Aired on January 19th, the segment titled “The Global Economic Outlook,” was described by the WEF; “With the global economy at a crossroads, policy-makers must balance the need for action on growth and inflation with structural imperatives on promoting human development and ensuring an orderly energy transition. What trade-offs and dilemmas will governments face as they seek to leverage the right economic tools and ensure sustainable, long-term growth?”

AUTHOR’S NOTE: A big part of the discussion involved implementing a global carbon tax, and subsidizing green energy. Read more about that here.

The talk featured a number of reputable figures to discuss the economy, including:

- Tharman Shanmugaratnam, President of Singapore, Office of the President of Singapore

- Ngozi Okonjo-Iweala, Director-General, World Trade Organization (WTO)

- Mohammed Al-Jadaan, Minister of Finance, Ministry of Finance of Saudi Arabia

- Francine Lacqua, Editor-at-Large and Presenter, Bloomberg Television

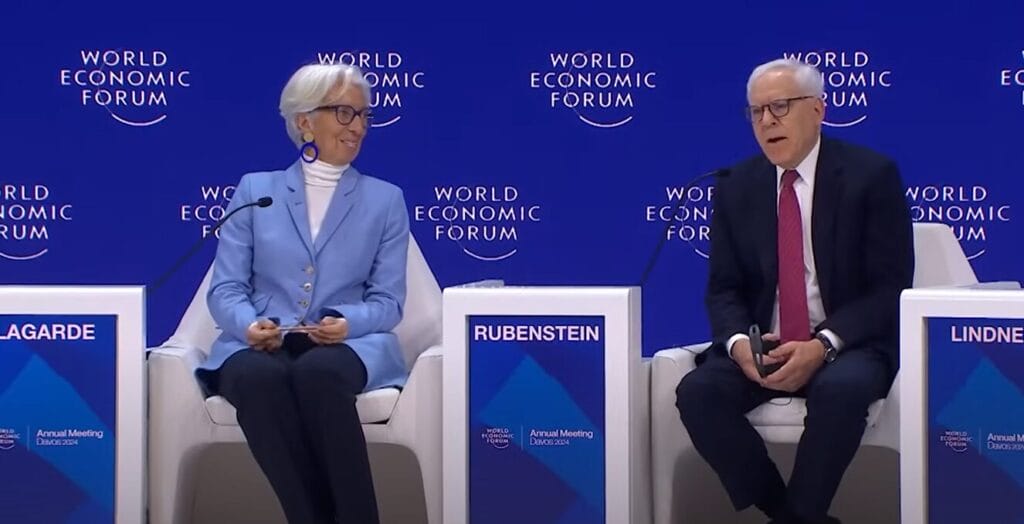

- David M. Rubenstein, Co-Founder and Co-Chairman, The Carlyle Group

- Christine Lagarde, President, European Central Bank

- Christian Lindner, Federal Minister of Finance, Federal Ministry of Finance of Germany

Early on during the discussion, though it was established that international economic conditions are by no means great, Ms. Ngozi said, “I think there are a lot of uncertainties that make forecasting difficult, however I’ll take a bit of a risk and say I think it will still it will be better than 2023.”

Lindner also displayed some positivity, saying “the last years the global economy has shown remarkable resilience, and the German economy has shown resilience as well.” However, the hard data would suggest a different story ongoing in Germany, along with the massive protests still going on that are protesting the economic disparities.

Lindner did say this off of Lagarde’s earlier remarks:

I would say we are witnessing a new normal and 2023 marks this new normal.

I think about the ways of artificial intelligence we all have [been] discussing here in Davos. Think about the geopolitical tension and the threat of fragmentation we will have to deal with over the next years. The higher debt levels after the pandemic and the energy price hikes which has shrunk our fiscal space to finance transformation, and given the very little growth perspective of the global economy, we have to answer the question, how we will be able in the future to finance transition by the private capital market and how to fight poverty around the world?

So for me it’s not normalization it is a new normal which we have to be prepared for.

And has 2023 given me hope, you asked, [and] I would put it this way: it was a call for action because we have to rearrange some policies, and probably we see a new need for structural reforms probably. We are at the beginning of an era of new structural reforms.

Rubenstein, however, would put the U.S on blast for its policies that have caused some of these distortions affecting themselves and the rest of the world. He explained that several interest rate cuts by the Federal Reserve are coming this year, and the risk of recession is low because it is a presidential election year and traditionally the U.S. economy does better during these cycles, because “Congress spends a lot of money and the Fed tends to be relatively easy on monetary policy during presidential election years,” he explained.

He went on to state:

The biggest risk for the U.S. economy is the usual risk that everybody has, are we going to be in a war somewhere, something like that. Is there going to be another pandemic.

But it’s really like we look at in the mirror and the enemy is us because the biggest risk we really have is the dysfunction of the U.S. government. Our inability to pass appropriation bills that fund the government on time, the inability of to deal with the debt limit issues on time. Those are the biggest things that worry me, whether it’s [at] some point the U.S government just can’t get these issues done because of the political problems we have in the country, and as a result I I worry more about that than other things in terms of the U.S. economy going forward.

We will have a presidential election year and almost everything every candidate will say will probably not be true about what will happen in the future, because they probably won’t be able to get done what they say they’re going to get done, but it’ll be interesting to watch.

Following that candid statement, Lacqua, the host for the chat, brought up the fact that Donald Trump could be elected again and would most likely, in their eyes, cause another rift in foreign policy. Lacqua asked him, “Is there any way that the rest of the world can Trump proof their economies?” Rubenstein jokingly responded, “If somebody has a way to do that I think they should patent it and probably sell it to somebody else.”

Rubenstein later interjected and commented that fiscal reform in the U.S. is going to be troublesome to say the least, building-off of the reasons he previous stated earlier, but issued a cryptic warning about the future of the U.S. dollar. Rubenstein explained:

Fiscal reform in the United States [is] very difficult to do. We know have $34 trillion of debt – the interest on it is approaching our defense budget, and if we don’t resolve this in the near future something’s going to happen to the dollar.

The dollar has been the only reserve currency for quite some time, but if the United States can’t get its fiscal act together, at some point people are going to do what they did to the British pound and the Dutch Gilder years ago when too much money was borrowed by those countries, and that their currency didn’t become as valuable and therefore lost its reserve status.

The U.S. doesn’t have any real challenger right now to reserve currency status for the dollar, but it will if it keeps doing what it’s doing. We have 122% of our GDP in debt and each year our budget deficit is probably about 25% of our our spending, and we just can’t keep doing that, but there is nobody in the United States government that I see [that] is really seriously addressing that problem, and it will be a big problem in the not too distant future.

AUTHOR COMMENTARY

As I noted earlier, if you want to read about the comments about the carbon taxes then check out my report and analysis here. I’m just going to address the comments concerning the U.S. and the dollar in particular.

Rubenstein was the lesser of all the gaslighters and liars on stage, though he obviously is no better, as he was the only one to actually state the obvious that the U.S. is coming apart at the hinges, and is holding on by a thread. But what he would not do is explain what’s coming and played dumb by saying “something’s going to happen to the dollar.”

Well, we that are awake and privy to what’s going on, understand that the dollar is dying and WILL be dethroned from its preeminent and world reserve currency status. The actions being taken by BRICS and nations seeking membership – which was never once addressed in this entire discussion – prove that, as they have explicitly said that they are trying to circumvent the dollar; and they will either trade in a basket of currencies, or may potential create a new collective BRICS currency to trade with. For that matter ASEAN has also postured that they will be decoupling from the dollar. That’s most of the world right there, and more will join as their economies collapse under the weight of the dollar, as more money printing occurs this year and in 2025.

Ultimately, when the dollar is finally removed as the world reserve currency (which is rapidly approaching, by sometime in 2025, if I had to guess), the U.S, will descend into the Weimer Republic overnight; and the loss of life that it will cause will be catastrophic.

These people on the stage are just playing dumb. They know where this is going.

And this talk of a “new normal” – the same language used during the Covid War – is just them admitting that all these distortions, high inflation, low wages, no opportunity, and deep penury is that way that it’ll be, ‘and that’s that, so get used to it,’ they basically said.

The real premise of this discussion were the carbon taxes, which has not gotten any real attention (for obvious reasons).

And shall receive the reward of unrighteousness, as they that count it pleasure to riot in the day time. Spots they are and blemishes, sporting themselves with their own deceivings while they feast with you;

2 Peter 2:13

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Discover Bragle: Looking for fashion that merges timeless elegance with modern design? Bragle has just that. With expertly crafted pieces, from chic outerwear to exquisite accessories, each item showcases style and quality. Bragle.com features an easy shopping experience, where you can find exclusive collections made with sustainable practices and attention to detail. It’s not just fashion – it’s an investment in your unique style. Visit Bragle.com today and boost your wardrobe with the best in exclusive fashion.