Kristalina Georgieva, the head managing director of the International Monetary Fund (IMF), revealed the IMF very much wants governments to implement carbon taxes – a progressive tax that would charge civilians based on how much they pollute.

The IMF chief revealed this framework during an open forum in Dubai for COP28, with Ajay Banga, President of the World Bank Group, and hosted by Pilita Clark, a lead writer for the Financial Times.

The conversation began by discussing how $420 million had been raised for climate initiatives (by December 1st) for the World Bank’s climate Loss and Damage fund; and while that is a ton of money, Banga said “$420 million is not going to take us very far in a loss and damage situation.”

Clark then acknowledged a recent post from the IMF that claims that “by 2050, low carbon investments need to be rising to around $5 trillion a year,” asking Georgieva how the world gets to that point. The IMF head explained that progressive government carbon taxes on residents and businesses would have to accumulate the necessary funds. She stated:

The signal we are sending is that we do need to work together in a way that makes sure that what we achieve is bigger than we would have achieved each one of us on our own. Going to the money. Five trillion sounds like an impossible amount, but is it really? If you look at the world economy today, it is over $100 trillion economy. Of course, it will continue to grow. By the time we move in the decades, there should be better capacity to finance any activities.

The second question we have to ask ourselves is, is it really climate investment or is it climate and development in most cases? If this is the case, then, of course, we should not be scared of this amount because investments of that size are not necessarily that significant. But then comes the question, even if we are to be more comfortable that we are not talking about an impossible, it is still a mountain to climb.

The way we see the climb is to use all possible instruments we have at our disposal. We are a huge proponent of carbon price. We believe that carbon price has the potential of raising revenues in a way that is both equitable because the more you consume, the more you pollute, the more you pay. It is also an incentive to accelerate decarbonization. In other words, you would need less money because of consumption and production adapting to it.

Secondly, we are finally at the cusp of moving towards private, public money genuinely giving us the impact that is necessary. No more blended finance is a term, it is a reality. You would hear people talking about various instruments in that regard.

The third source of financing, frankly, is countries being more disciplined in collecting taxes from their businesses and their people. When we [signal cut off] at tax collection today, in many developing countries it is below 15% tax to GDP, which we think is the minimum you need to function. Even when it is 20%, 22%, 23%, our analysis shows that there is space by improving tax collection, especially put it on digital, nobody can hide, collect it, but also be more aggressive towards taxing those that today are avoiding taxation. It is a problem, but it is a solvable problem and our institutions would make our contribution to solving it. In our case, we have $40 billion in the Resilience and Sustainability Trust.

In 2022 the IMF published an official document simply titled “How to Cut Methane Emissions.” In it, the IMF references implementing a methane tax that would be applied to a myriad of spaces they claims are major emitters, and ways to decarbonize.

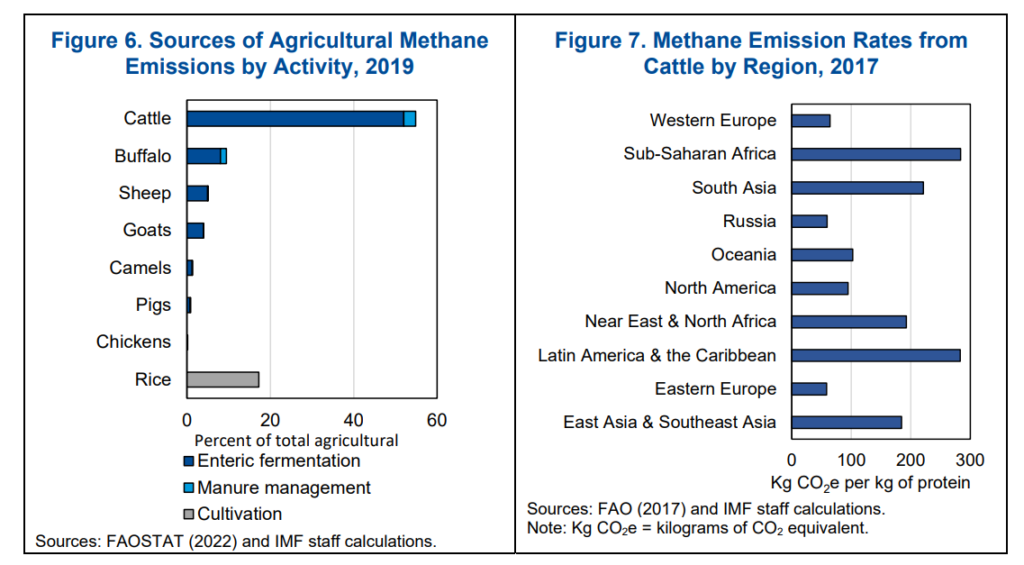

The document claims, “Globally, cattle accounted for 55 percent of agricultural methane emissions in 2019, other livestock (for example sheep, pigs) 22 percent, and rice cultivation 17 percent.” They later add that “incentives for decarbonizing food systems may be especially important for countries with large agricultural emissions and low or limited institutional capacity. This could include shifting from livestock to plant-based agriculture.”

The group also explains ways to decarbonize and reduce emissions:

There are various options for mitigating methane emissions through reductions in the emission intensity of production and of domestic (household and industrial) demand.

Reductions in emission intensity can be achieved through technological means, including flaring or capturing methane (for own use in power generation or for sale to the natural gas grid or mobile processing units) at extraction or manure sites, electrifying extraction processes and replacing natural gas pumps, improving leak detection and repair systems, upgrading distribution infrastructure, switching to higher-productivity livestock, and enhancing livestock feed through additives (for example, seaweed).

For cutting demand, responses include shifting from fossil fuel combustion to renewables and nuclear energy, from meat to crop-based diets, recycling, domestic composting of organic materials, and reducing packaging. However, demand responses generally play a minor role in efficient mitigation policy for extractives (given the modest product price increases from methane policies).

Moreover, the IMF explains how to properly enforce a carbon tax through different firms:

Methane taxes could be levied directly on emissions… In this case, firms might be required to develop their own emission-metering capacity and to remit taxes based on their reported emissions— facilities would be subject to random or periodic government inspections, with penalties for noncompliance with reporting requirements.

…or, in the interim, indirectly on production, scaled by default emission factors and allowing low emission-rate firms to petition for rebates. In this case, firms might be subject to proxy emission fees based on observable output and/or input and default emission factors.

To encourage reductions in emission intensity, firms would be permitted to monitor and report emission rates (based on their own, or third-party, certification) and petition for a lower tax (or partial rebate from a previously paid tax) if their emission rates are below the default. Rebates could also be linked to the use of observable technologies (for example, methane capture) or production methods (for example, more productive livestock herds). Default emission factors could be based on zero-mitigation scenarios or worst-performing firms to ensure that all firms have incentives to cut their emissions below the default rate.

[…] These fees may be feasible when the government already administers business taxes and/or support programs, at least for large producers in the sector. In countries with limited capacity for agriculture, however, strategies may need to focus on farm- and consumer-level incentives, for example, for more productive livestock and shifting from livestock to plant-based food.

Getting back to the conversation, the trio then got into carbon credits as a way of reducing methane emissions from a number of sectors, without having to pour trillions into it to reach these climate goals. Investopedia says, ‘Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gases. One credit permits the emission of one ton of carbon dioxide or the equivalent in other greenhouse gases.’

Speaking of these credits, Banga explained: “If we can get going with 125 odd million credits we think from 15 countries over the coming few years, and if we can be good at certifying those credits both for environmental quality but also social quality, meaning the majority of the money from those credits should go into going back to the communities which are relying upon that habitat.”

Clark, circling back to Georgieva, said “we, at the FT, are huge supporters of the carbon price.” However, the average price for a carbon credit around $5-6, though the IMF says they want the price to be at $85 by 2030. Clark questioned if this was even possible, but the IMF head assured her that we can unless “we give up,” she said.

We have to persevere and we also have to work with countries so they can make their choice of carbon price. Is it tax? Is it trade? Or is it standards and regulatory compliance that implicitly leads to an increase of carbon price? I think we should be less ideological and more focused on what is in for me.

Georgieva said

During the Q&A portion, Banga interjected at one point and brought up the idea of “subsidies on fossil fuel and on agriculture and fisheries may well be justified in certain circumstances in countries. If you’re getting somebody cooking gas at a cheaper price than what they would use otherwise to burn wood or coal, I would do that every day.”

AUTHOR COMMENTARY

Some things never change:

And Jehoiakim gave the silver and the gold to Pharaoh; but he taxed the land to give the money according to the commandment of Pharaoh: he exacted the silver and the gold of the people of the land, of every one according to his taxation, to give it unto Pharaoh-nechoh.

2 Kings 23:35

Needless to say, carbon and meat taxes are coming. “They” are going to manufacture some kind of a crisis to justify implementing these taxes. Hardly no one is abiding by these ridiculous climate demands voluntarily, so the bankster gangsters and global elites will have to create reasons for the obey. This is a big reason why they are all pushing for CBDCs, digital IDs, social credit scores, and omni-AI that monitors everything in real time.

Indeed, the masses and believers who fall away will, for example, accept not eating meat. Count on it. Don’t be one of them. Stick to your guns.

[1] Now the Spirit speaketh expressly, that in the latter times some shall depart from the faith, giving heed to seducing spirits, and doctrines of devils; [2] Speaking lies in hypocrisy; having their conscience seared with a hot iron; [3] Forbidding to marry, and commanding to abstain from meats, which God hath created to be received with thanksgiving of them which believe and know the truth. 1 Timothy 4:1-3

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

And there it is…….the Roman Catholic Carbon Tax……..what they have wanted all along. They never were concerned for the evironment. It is just another gimmick in their plans to make sure they rob the world right down to everyone’s underwear…….or worse.

They will also find an excuse to tax us for every breath we take……just like the song……..they’ll be watching you.

That woman(demon) needs to go to Canada and go visit MAiD for a nice quite conversation.

Fight this, eat meat and don’t back down

Wonder if anyone has told her that climate change don’t exist, insanity on display.

“…especially put it on digital, nobody can hide”

The feudal lord hypocrites “bankster gangsters and global elites” are the biggest carbon emitters; let’s start with China/India via population alone.

The carbon tax plan will not work and is a total fraud to make the feudal lords richer/take land/lock us in cities; the serfs will own nothing and be happy. It didn’t work for Sri Lanka and it will not work anywhere else.

Listen to planet panic at 1:07 mark https://thehighwire.com/watch/

Listen to what Marlo Oaks says about ESG, Climate carbon tax etc. The states are banding together.

That’s why 1 Timothy 4:1-3 is worded the way that it is. “Speaking lies in hypocrisy, having their conscience seared with a hot iron;”

The taxing of everything will put a lot of people out of their own homes that they have been paying on for many years, due to the taxes being so high they won’t be able to afford to pay them and will be evicted.

Come Lord Jesus.

They’ll probably get tokenized as a digital asset, bought and sold as a debt slave on a blockchain and traded like a stock or bond, in a new form of slavery.

This really answered my downside, thanks!

Hi there! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be fantastic if you could point me in the direction of a good platform.