ASEAN comprises 10 different Asian nations, which include: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam; with Australia and New Zealand also working closely with this association via new a free trade agreement pact established in November, 2022. Subtract Australia and New Zealand, and ASEAN affects over 600 million people and is one of the world’s largest economies.

In April The WinePress reported that ASEAN had announced they will begin the process of diluting their shares of the dollar and their dependency on it, including the euro, Yen, and British pound rather would begin to really start prioritizing trade in their local currencies.

Moreover, in May The WP reported that Malaysia’s Prime Minister Anwar Ibrahim said, “There is no reason for Malaysia to continue depending on the dollar.”

Now these nations are working to implement their own instant transfer payment systems, similarly to the Federal Reserve’s FedNow system; a rapid transaction that wires money in seconds, and is operable 24/7/365, and lays the foundation for a programmable and tokenized central bank digital currency (CBDC).

In a blog post published on November 17th, the World Economic Forum highlighted the financial bloc’s push instant transfer payment rails. The WEF wrote:

Thailand and Singapore have been at the forefront of linking domestic fast payment systems across borders. Their PromptPay and PayNow systems now enable instant, low-cost mobile transfers between the countries using just a recipient’s phone number.

This first-of-its-kind ASEAN cross-border linkage provides a blueprint for connecting real-time payment infrastructure across the region. The value of gross digital payments across the six largest ASEAN economies reached $806 billion in 2022, up 14% year on year, and is forecast to rise to close to $1.2 trillion by 2025.

The availability of smartphones and increased internet penetration have played central roles in the widespread adoption of online banking services, mobile money and e-wallets.

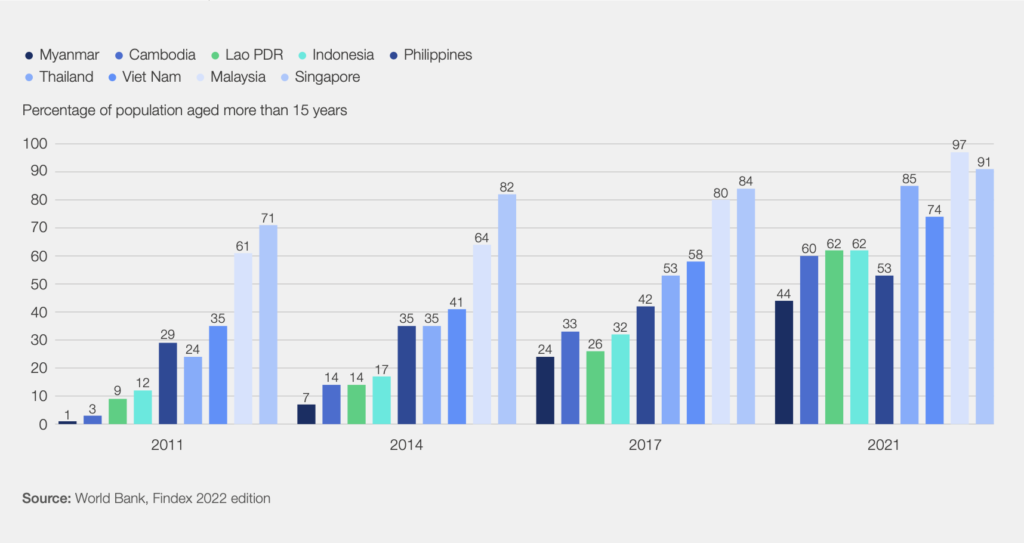

As illustrated below, account ownership within financial institutions has also taken a leap forward across ASEAN countries over the past decade. Account ownership or access to mobile money is now higher than 60% in seven out of the nine countries covered by the World Bank Findex, compared with only two countries in 2011.

The number of people holding a bank account or signing up with a mobile money provider in that time has grown from 3% to 60% in Cambodia; from 9% to 62% in Lao People’s Democratic Republic; and from 12% to 62% in Indonesia.

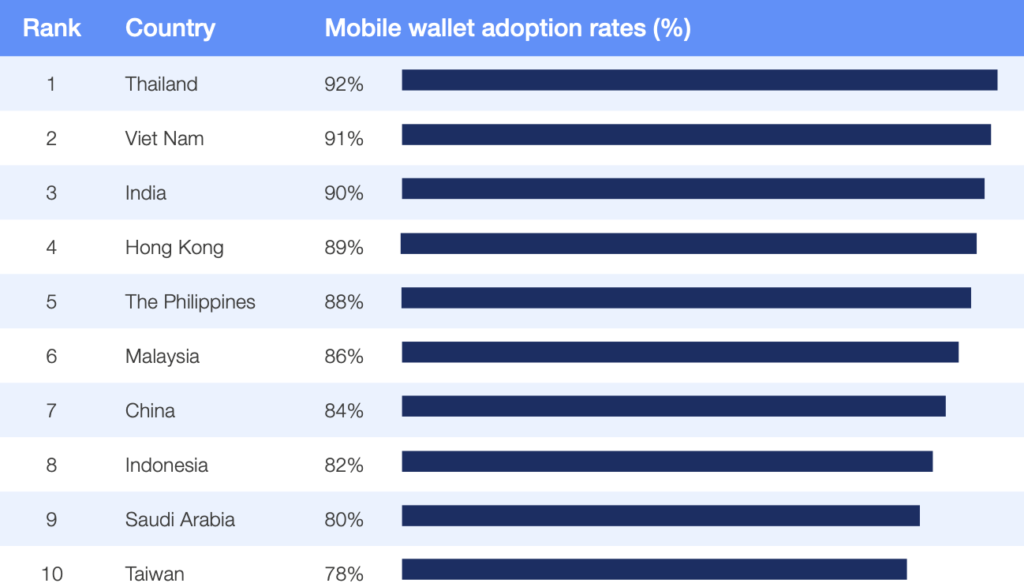

The use of e-wallets is also rapidly gaining traction across ASEAN countries. As illustrated below, half of the top 10 countries in the world in terms of e-wallet penetration are Southeast Asian countries (Thailand, Viet Nam, the Philippines, Malaysia and Indonesia).

The World Economic Forum’s recent briefing paper Shaping The Future of Cross-Border Fast Payment Systems, released in collaboration with the Bank of Thailand, examines the rise of fast payment systems in Southeast Asia and the momentum towards expanded cross-border connectivity.

Using the landmark PromptPay-PayNow linkage between Thailand and Singapore as a case study, it highlights lessons learned to guide future cross-border payments linkages and make the vision of a unified seamless real-time payments infrastructure across Southeast Asia a reality.

Promptpay-Paynow Cross-Border Linkage

Thailand and Singapore connected their PromptPay and PayNow fast payment systems in 2021. This pioneering linkage now allows individuals to make real-time, low-cost mobile payments using just the recipient’s phone number.

Transfers that once took days now complete in minutes. The linkage enables individuals to make real-time and low-cost transfers of up to SGD 1,000/THB 25,000 (about $735/$695) daily between Thailand and Singapore using just the recipient’s mobile number.

As of mid-2022, the linkage was processing more than 65,000 cross-border transactions monthly, with transaction size averaging $150–200 per transfer. The fixed cost per transaction is currently THB 150 (+/- $4) in Thailand and is currently free to use in Singapore, although it includes a small foreign exchange markup defined by the participating bank issuing the transfer.

Before the establishment of the PromptPay-PayNow linkage, senders had to pay up to 10% of the amount sent to transmit money between the two countries, and it might take several working days for the money to arrive.

Moves Towards Regional Integration On Digital Payments

As central banks across Southeast Asia lead the way to connect fast payment systems and improve interoperability, the realization of full regional digital integration is being fast-tracked.

In September 2023, ASEAN launched negotiations for a Digital Economy Framework Agreement during the latest ASEAN Summit in Jakarta, which will enhance how the region cooperates on digital trade, cross-border e-commerce, and digital payments among other key priorities.

AUTHOR’S NOTE: Citing that blog post from ASEAN, a snippet from that press release reads:

The launch of ASEAN DEFA negotiations comes after the endorsement of the ASEAN DEFA study at the 55th ASEAN Economic Ministers (AEM) meeting in Semarang, Indonesia last 19 August. The study identified nine core elements, including digital trade, cross-border e-commerce, cybersecurity, digital ID, digital payments, cross-border data flows, and emerging topics that are expected to be covered in the negotiations of DEFA.

Indonesia’s Coordinating Minister for Economic Affairs Airlangga Hartarto said that the region will work towards the completion of the ASEAN DEFA negotiations in 2025 and is committed to create a sustainable and inclusive digital ecosystem. “It is an honor to experience this milestone with all of you and I look forward to working closely with each of ASEAN Member States,” he said.

ASEAN countries are also working with the Bank for International Settlements’ on Project Nexus, a platform with provides a model for regional payments integration. By establishing common standards and a shared platform, domestic systems gain reach to all participants, avoiding the need for custom bilateral links. Thailand, Malaysia, Singapore, Indonesia and the Philippines aim to connect their fast payment systems with Nexus.

Integrating real-time payments regionally is challenging but achievable with collaboration, vision and sustained commitment from stakeholders of payments ecosystems. Cross-border real-time connectivity has immense potential to accelerate financial access, empower societies and improve lives across ASEAN.

AUTHOR COMMENTARY

I mention this because it again demonstrates that digital trap system is continuing to form underneath everyone’s noses, though hardly no one even notices it yet. As I always like to say, convenience is a killer; and these instant transfer payment rails are not to be trusted and warned of, as they are a big foundation for the CBDCs and loss of all remaining freedoms we have left.

Thorns and snares are in the way of the froward: he that doth keep his soul shall be far from them.

Proverbs 22:5

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Isn’t that nice, holding hands. Put height markings on the wall behind and you’ve got a police line up.

Proverbs 11:21

Though hand join in hand, the wicked shall not be unpunished: but the seed of the righteous shall be delivered.

Hmmm…. the land of Pol Pot’s enforced ignorance, lots of Roman Catholics & attached in spiritual fornication Eastern antichrist cults, and lots of Muslims…..with a few Bible & Gospel resistant headhunters & spiritists mixed in. Thailand’s creepy pagan godman & goddess royalty thing & the betrayed Christian Karen allies who got thrown under the bus after WWII. I’d say same spirit. Same deal. Same end, reading the Book and living through a lot of that history wondering at the hypocrisy and senselessness of much of it.

I do not know if it’s just me or if perhaps everybody else encountering problems with your website.

It seems like some of the written text on your posts are running off the screen. Can someone

else please comment and let me know if this is happening to them too?

This could be a issue with my browser because I’ve had this happen previously.

Many thanks seraphina.top