Earlier this week the European Central Bank (ECB) announced that they have commenced the next stage in developing and releasing their central bank digital currency (CBDC), the Digital Euro, closing in on its eventual retail use.

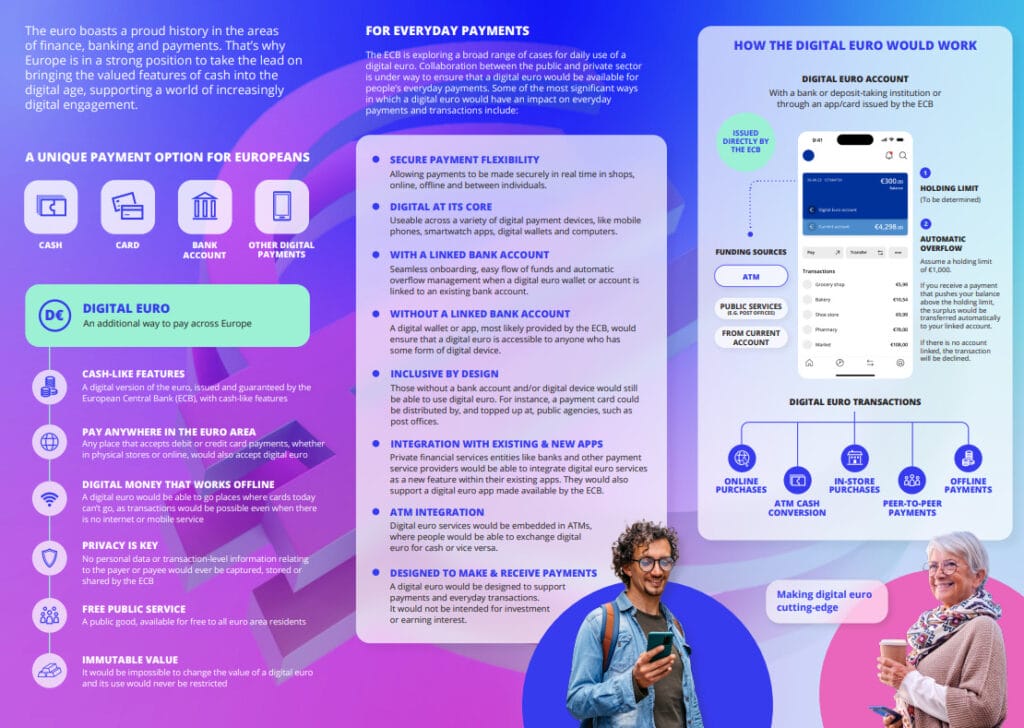

The ECB says that the digital euro is simply just a digitized form of cash, saying “it would offer another way to pay in stores or online shops, or to send money to friends and family.” The ECB adds, “a digital euro would be backed by the same institution that backs your cash – us, the European Central Bank. And just like cash, it would always be worth its face value.”

In a press release published on October 18th, the ECB says its Governing Council has decided to move into the “preparation phase” of the digital euro project. This latest phase will commence starting November1st and will initially last two years.

“It will involve finalising the digital euro rulebook and selecting providers that could develop a digital euro platform and infrastructure. It will also include testing and experimentation to develop a digital euro that meets both the Eurosystem’s requirements and user needs, for example in terms of user experience, privacy, financial inclusion and environmental footprint,” the ECB says.

After this phase is expired, the ECB, after communicating this process to the public and stakeholders involved, will decide “whether to move to the next stage of preparations, to pave the way for the possible future issuance and roll-out of a digital euro.”

We need to prepare our currency for the future. We envisage a digital euro as a digital form of cash that can be used for all digital payments, free of charge, and that meets the highest privacy standards. It would coexist alongside physical cash, which will always be available, leaving no one behind.

Christine Lagarde, President of the ECB, said

In a video published on social media platforms, Lagarde said that “the digital euro is on the move.” She made sure to note that “cash is here to stay.”

Fabio Panetta, ECB Executive Board member and Chair of the High-Level Task Force on a digital euro, also stated in the press release, “As people increasingly choose to pay digitally, we should be ready to issue a digital euro alongside cash. A digital euro would increase the efficiency of European payments and contribute to Europe’s strategic autonomy.”

The ECB published a detailed 44-page report that covers their findings during their investigation phase.

In the introduction of the report, the ECB claims it is not designed to control and mitigate people’s lives’ but they do say that “a digital euro [will] “simplify life.””

With a digital euro, people would have more choice in how to pay and a secure solution that fully respects their privacy. The central bank has no interest in monitoring peoples’ payment patterns and no commercial aspirations. It would not have access to or store any personal data that would directly identify end users.

The digital euro is also intended to achieve a cash-like level of privacy for offline payments, as it would require no third-party validation and would rely simply on the direct transfer from the payer to the payee.

The ECB also claims that a “digital euro would also address risks stemming from geopolitical tensions. The fragility of global supply chains exposed by the coronavirus (COVID-19) pandemic and Russia’s war of aggression in Ukraine has painfully demonstrated the risks of relying exclusively on external suppliers for basic needs.”

Moreover, in order to facilitate the transference of the CBDC a new app would need to be created. “The Eurosystem would make available a digital euro app which would act as a uniform point of entry with a homogeneous look and feel for any end user to access digital euro services.” Furthermore, the ECB explains, “providing this app would ensure that basic functionalities are available, as identified by consumer’s associations and market surveys, as well as features supporting digital inclusion and the needs of people with disabilities and low digital skills.”

And even though Lagarde and the ECB claims cash is not going away, their reports asserts that “a digital euro would be a standardised means of payment, covering all retail payment needs across all euro area countries and providing a pan-European platform for innovative payment services, thereby marking a further advance in European integration.”

A digital euro would provide, for the first time in history, direct access for people to digital central bank money issued and backed by the ECB. It would respect people’s privacy, without infringing on public policy objectives such as combatting money laundering.

The introduction of a digital euro would be a logical next step in the natural evolution of our currency. It would ensure the same levels of trust and stability that our money and payments enjoy today, while also adding a new, digital option that addresses the limitations of cash inherent in its physical nature. A digital euro would make the euro future-proof.

The European Union (EU) has already been laying the groundwork for introducing a CBDC in advance. Earlier this year The WinePress reported that the EU passed a law that bans cash and crypto transactions of “up to €7000 for cash payments and €1000 for crypto-asset transfers, where the customer cannot be identified,” the EU parliament ruled. Even Lagarde admitted in an interview that this amount could eventually go as low as €300 or €400. This revelation was made when Lagarde was, apparently, pranked into thinking she was having a private chat with Ukrainian President Volodymyr Zelensky.

AUTHOR COMMENTARY

If they’re saying cash is going nowhere, then we know that the availability of cash is nearly at an end. This is typical, brazen, stone-cold lying as usual from a central banker, obviously. We already know that the world is rapidly transitioning to digitized money and CBDCS; and yet all these gaslighters keep seeing, ‘oh, we’re just weighing our options, we’re not even sure if we’re going to implement one.’ But then you actually read their whitepapers, as I did and highlighted some of the salient points, and it plainly says something else.

Australia, for example, is a shining example of nation going cashless rapidly and replacing it with digital IDs and CBDCs. They don’t even try to hide it. They brag about it.

As far as I am concerned, feel free to call me a “conspiracist theorist,” but I think most major central banks already have a CBDC ready to go, but it’s a matter of waiting for the right moment to introduce and then enforce them.

Clearly we are yet again one step closer to the coming mark of the beast system, slowly but surely.

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.