In April OPEC turned some heads when they suddenly announced they would begin productions cuts of oil by hundreds of millions of barrels a day.

Now Saudi Arabia, the juggernaut of OPEC, recently announced that these productions will extend all the way into the end of 2024, along with Russia jointly announcing productions cuts as well. CNBC reported:

Fellow heavyweight oil producer Russia — which leads the contingent that joins OPEC nations in the OPEC+ coalition — also pledged to voluntarily reduce exports by 500,000 barrels per day in August and by 300,000 barrels per day in September. Russian Deputy Prime Minister Alexander Novak on Tuesday said that it will extend its 300,000 barrels per day reduction of exports until the end of December 2023 and will likewise review the measure on a monthly basis, according to the Kremlin.

This past Friday, September 1st, oil prices reached a new high for 2023 at $85. Brent crude oil reached $87.88 that same day, yet another record on the year.

Julianne Geiger for OIlPrice.com explained why prices are rising, writing:

A big factor in the rising price of crude oil are the falling inventories in the United States, which dipped another 10.6 million barrels according to the Energy Information Administration for the week ending August 25.

Another contributing factor to strong oil prices is the OPEC+ alliance, which includes heavyweights Saudi Arabia and Russia. The duo has reached a deal concerning production cuts, for which Russia has said it will provide details next week. The market is weighing the likelihood that Saudi Arabia or Russia could extend or deepen their current production cuts. More analysts than not expect that Saudi Arabia will extend its 1 million bpd production cut into October.

A third support under oil prices is the weakening dollar, which makes crude oil more affordable for non-dollar holders, thereby stimulating demand.

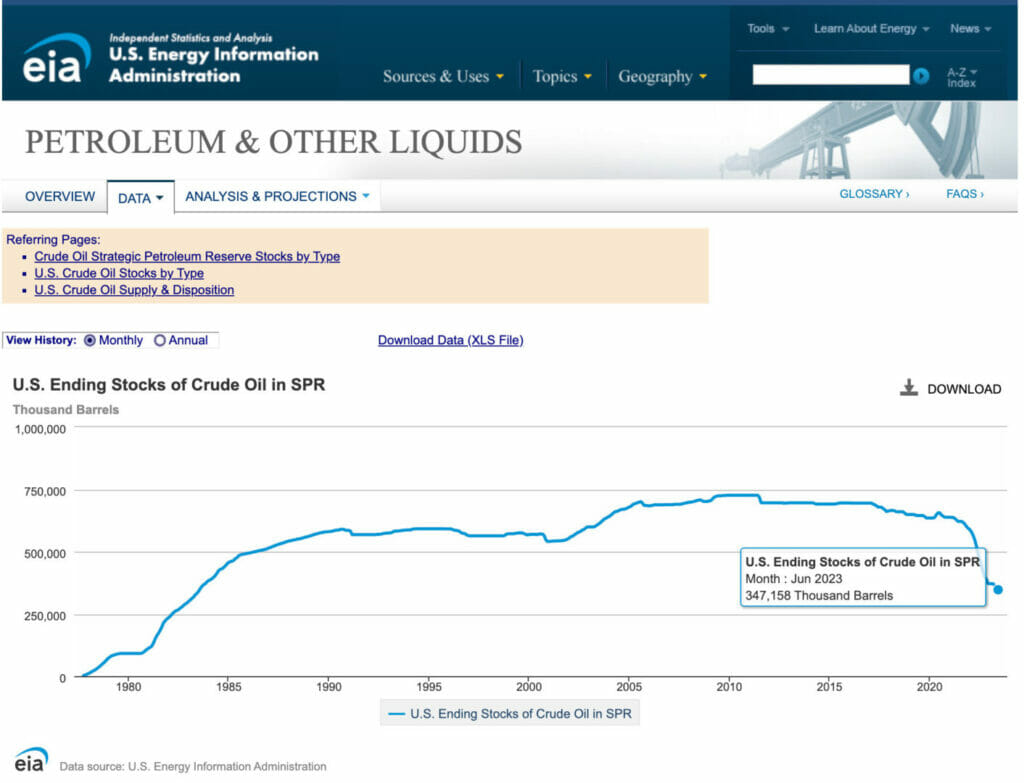

The price rise will make it more difficult for the Biden Administration to continue the painstakingly slow process of refilling the nation’s Strategic Petroleum Reserve, which has grown by an average of 600,000 barrels per week for the last few weeks, after draining 300 million barrels out of the SPR over the last few years.

Despite the 300 million barrels leaving the SPR and going into commercial inventories, crude oil inventories—excluding that in the SPR—are more than 100 million barrels shy of July 2020 levels.

Currently, at the time of publishing this report, WTI Crude is trading at $87.11 and Brent Crude at $90.27.

Back in April, a week after OPEC made their controversial announcement, the U.S. Senate voted unanimously 100-0 to ban Russian oil experts and further trade with them. It then only took a few months later for the U.S. to discover the oil they were purchasing from India contained Russia crude in it. Because of the waves of restrictions levied against Russia, Russian increased their relations with other Eastern nations such as India, which purchased Russia’s oil at better rates and then India hiked up the prices when exporting to the U.S.

SEE: De-Dollarization: India Dumps Dollar And Buys Oil From UAE In Rupees

Fast forward to now, as OPEC has indicated that production cuts will persist, the United State’s strategic reserves continued to be rapidly depleted with no intentions to restock as the federal government is only concerned with funding green energies.

Lena Petrova, CPA, noted in a post: ‘As the result of multiple drawdowns, the U.S. Strategic Petroleum Reserve is now at the lowest level it’s been in four decades since 1983. Over the course of just two years, petroleum inventory decreased by 43%, falling to 347 million barrels.’

With the recent OPEC oil production cuts, led by Saudi Arabia and Russia, followed by a lack of any appropriate response domestically, the American consumer has no choice but to start paying more. Expect to spend more at the pump as well as at a grocery store, since rising oil prices drive up farming and transportation costs.

Without replenishing the reserve, or even with its current depleted levels, we may have only two options. The first option is to focus on domestic exploration and oil production in order to replenish the reserve and to be in control of our own supply chain. In an increasingly unstable world, with growing geopolitical tensions it appears to be a reasonable course.

However, it is as much reasonable as it is unlikely. The focus is on green energy; fossil fuels don’t attract major investments. The alternative is to accept that oil costs, and the well being of a U.S. consumer who is heavily dependent on the price of gasoline, will be dictated by a coalition of foreign countries.

Petrova added

AUTHOR COMMENTARY

Back in October of last year when I wrote about America running woefully low of diesel supply and reserves, I also addressed Biden’s touted release of strategic oil reserves to curb rising fuel costs at the time. What people do not realize is that the U.S. burns through nearly 20 million barrels a day. So if you recall Biden was talking about releasing 15 million barrels or so over a year ago, that did not even fully cover a day! It was more media antics and political fanfare.

Simply put, as Lena explained it, prices will be forced to rise, and the cost of everything will rise once more.

He that passeth by, and meddleth with strife belonging not to him, is like one that taketh a dog by the ears.

Proverbs 26:17

If only Americans could figure that out…

Furthermore, this plays into the globalist agenda of slowing down the velocity of travel. They want people to be isolated and restricted in their movement so they can be more easily controlled; things like car-free Sundays may come to remembrance…

SEE: International Energy Agency Calls For ‘Car-Free Sundays’ And Other Ways To Reduce Oil Use

British Paper Calls To Ban All Driving On Sundays Lowering Speed Limits To Reduce Oil Usage

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

USA has plenty of oil, but it’s a sin to the green nutjobs to use it

Exactly