Last night the United States lost the coveted “AAA” credit rating courtesy of financial outlook group Fitch, which they provided in detail as to why on their website. Fitch wrote (excerpts):

Ratings Downgrade: The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Erosion of Governance: In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.

Economy to Slip into Recession: Tighter credit conditions, weakening business investment, and a slowdown in consumption will push the U.S. economy into a mild recession in 4Q23 and 1Q24, according to Fitch projections.

Because of that stocks were in a pan-selloff today across the board as economists lambasted the news, trying to continuously convince Americans the situation is not as bad as it would seem.

The Treasury Goes Nuts

On top of this news the U.S. Treasury department is now forecasting they will need to borrow another $1 trillion dollars to function for the rest of the year, even though the U.S. just got down raising the debt limit once again with promises of cutting spending. It’s hardly been two months and the U.S. government supposedly needs even more money to remain operable.

SEE: The US Debt Ceiling Crisis Is A Big Fat Joke, Lie, And Scare Tactic

MarketWatch wrote: ‘On Monday, Treasury officials said the department also expects to borrow $852 billion in privately-held net marketable debt during the fourth quarter, assuming an end-of-December cash balance of $750 billion.’

The outlet added in a follow-up report yesterday:

In a Tuesday note title “Treasury tsunami,” rates strategists at Barclays said “Treasury’s latest financing estimates point to a worsening fiscal profile” and “the fiscal picture has worsened significantly since last year.” They point to the likelihood of “a sharp increase in the supply of notes and bonds over the coming quarters,” and cautioned investors against expecting “a typical end-of-cycle bond market rally.”

We have noted that the Treasury will soon need to increase auction sizes meaningfully across the curve, potentially to levels beyond the COVID peak, and that the rates market was too complacent. But based on the Treasury’s latest financing estimates, released earlier this week, we may have been too conservative.

We would not be surprised if net issuance of notes/bonds to investors were to be close to $2 trillion” for the 2024 calendar year.

Strategists Anshul Pradhan and Andres Mok wrote.

According to Simons, who the most likely buyers will be at Treasury’s upcoming auctions will depend on where the department decides to focus its issuances. If the focus is on bills, then money-market mutual funds could “move some cash over,” he said. And if it’s on long-duration coupons, it would be “real money” players such as insurers, pension funds, hedge funds and bond funds — though much will rely on inflows from clients “before demand would pick up.”

This amount of treasury notes the Treasury would be offloading totals $103 billion.

But at the same time the Treasury also announced that they could potentially decide to buyback debt.

In essence, the Treasury would be borrowing to payoff debts that have lower interest rates in order to borrow at a higher interest.

Lynnette Zang of ITM Trading blasted the move that she referred to as “schizophrenia” because the United States is losing control of its bond market, also known as the the debt/credit market. She contends that the banks have run out of options and are just throwing things out there and hoping something lands.

We are at the end. If you have not executed your strategy, get it done!

She warned

AUTHOR COMMENTARY

As I have documented before, right when there is some really bad economic events and critical deals, the media floats out and parades more Trump soap opera drama in our faces to distract us with. Don’t fall for it and look deeper. Politics in the media are used to divide and distract. Real, important news never gets an honest shakedown.

The truth is what Ms. Zang said is absolutely true: we are at the end, and the banks and governments are out of options, it’s too late. The problems are too numerous to count and nothing can be done at this point to fix them. All we can do is recognize it, don’t hide from it, but accept it, adjust to it, and figure out how we can make it work for us. It’s that simple. People say, ‘Oh, this is just doom and gloom.’ You bet it is, but I say, ‘How can we make it work for us?’ I’m just one man and I cannot cover everything. Pray about it and do your own research, and figure out what you need to do to prepare, because this collapse will be MONUMENTAL and it will come sooner than you most of you realize.

Furthermore, I have discussed the issue with the bond/credit/debt market before, and when it does crash, the tsunami wave will be massive. I’m not just blowing smoke, as you just heard another actual honest economist warn about this debt market losing massive stability.

If you don’t know what the debt market is and how it works in its simplest form, read this article for more information:

SEE: “What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty”

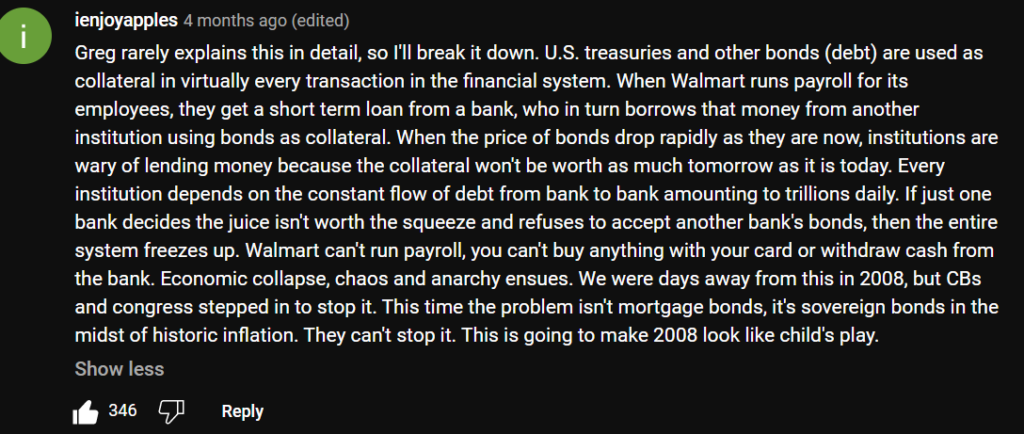

Stock market analyst and Trends Journal contributor Gregory Mannarino has harped on this for years, and now that debt market is REALLY becoming unstable around the world as interest rates continued to terrorize consumers, businesses, banks, and the markets. This comment really summarizes just how bad things will get:

I know people are going to whine and write to me that I am “scaring” them and peddling hysteria. Whatever. Get over it or go find a different outlet. I’m here to help and warn, not powder your butt and whisper sweets nothings to you. Go join a “good local church” if that’s what you want.

The simple believeth every word: but the prudent man looketh well to his going.

A prudent man foreseeth the evil, and hideth himself; but the simple pass on, and are punished.

Proverbs 14:15, 27:12

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Nobody likes the idea of this coming doom, but ya have to tell them the truth, which always hurts.

Kept up the good work Jacob!!!

Thanks David.