Megabanks in Australia are abruptly clamping down on cash, catching many residents off guard, furthering the push to allow Australia to become a cashless society.

In late-March The WinePress reported that one of these banks, ANZ Bank, one of the largest in Australia, announced that they would be ending cash withdrawals at a “small number” of locations, and are instead directing customers to their modern smart ATMs. A broadcaster for Australia’s 7 News said this is another large step towards a “cashless society.”

Channel News 9 added: ‘Cash transactions around the country are on the decline, with Australians ditching the payment method at the fastest rate in history. With the rise of contactless payments and the boom of buy-now-pay-later schemes, the use of physical money has also drastically reduced around the world.’

Because ANZ took this bold step many analysts and economists wondered if this would influence the other three megabanks – Commonwealth Bank, NAB, and Westpac – to do something similar.

It appears that they have.

Last week Commonwealth Bank announced that they will no longer be providing cash withdrawals at a variety of locations in Brisbane, Sidney, and Melbourne. Customers can deposit and withdrawal cash at ATMs minus the handful of locations that still will allow cash transactions.

Instead these many of these physical branches are being replaced with “Specialist Centres” that geared more towards “complex banking needs.” ‘The new centres offer general customer assistance and help with home loans, business loans and saving goals,’ News 7 confirmed.

Customers can also withdraw and deposit through the bank’s app using “Cardless Cash,” allowing customers to withdraw cash without their physical card, or dispose someone else to retrieve the funds for them. Users can withdraw up to $500 daily using Cardless Cash. ‘An eight-digit Cash Code and Cash PIN, provided through the app, must be used within 30 minutes or the money is returned to their account,’ the outlet added.

Commonwealth Bank has created a very small number of Specialist Centres in major metropolitan areas, which are designed to support personal and business customers with more complex banking needs.

These Specialist Centres provide customers with face-to-face access to specialist home and business lenders, and also offer the latest self-service technologies. All of our Specialist Centres are in major metropolitan locations and very nearby to full-service branches.

We continue to maintain Australia’s largest branch network for customers.

The bank said in statement

News 7 added that this move is part of the growing “cashless trend.”

Earlier this month an Australian mom, Taryn Comptyn of Brisbane, lashed-out against ANZ and is no longer doing business with them, after the bank refused to let her withdrawal $3,500 from her local branch, she revealed in a viral rant on TikTok.

Comptyn realized she forgot her bank card so she went inside to get the lump sum from the teller with her ID, but was turned down when she was told she could only get her money from the ATM. The teller then sent her up with temporary ID to use the ATM, but that was rejected and was given an error message. The teller then told Comptyn, “I am really sorry, there is nothing we can do.” Comptyn then said “I need to get my money out of my bank account,” to which the teller apologetically answered, “We don’t carry cash here.”

Comptyn would then later get every cent out of that bank and has closed all accounts with ANZ.

She later said in a statement to Australia’s Today morning show: “If you can’t get your own money from a branch, what’s the point of a bank?”

A spokesperson for ANZ responded:

At ANZ we have seen in-branch transactions fall 50 per cent over the past five years, with just one per cent of transactions now done over the counter and 96 percent conducted digitally.

Some ANZ branches no longer handle cash at the counter, but continue to have cash available through our onsite Smart ATMs.

At these branches, cash and cheque deposits and cash withdrawals can continue to be made by using our Smart ATM and coin deposit machines, and we have staff on hand to help customers using them for the first time.

But the restrictions on cash don’t stop there.

Crispin Rovere, an Australian poker player and author, sounded-off on his frustrations with Westpac after bank froze his accounts without any explanation.

Casino.org reported: ‘Rovere explained that he deposited winnings from a poker game into his Westpac account, emphasizing that the amount was essentially insignificant. He said it was “way, way under” the $10K threshold that financial regulators have established as the trigger for suspicious transactions.’

The issue arose when he tried to pay a bill at a hotel with his bank card but was denied. ‘The only reason the bank gave for having flagged the account was because the deposit was made in a different state from where Rovere opened it. In other words, Westpac doesn’t believe that its verified customers deserve the flexibility to make deposits anywhere there’s a bank branch,’ the outlet noted.

He took to social media to warn that the use of cash is now “stigmatized” and could soon be “criminalized.”

Eventually, even valuing the concept of personal privacy will be viewed as seditious.

He added

Many comments across his many social media accounts pitched in their own experiences, with one questioning, “Is this a push for electronic, controllable currency only?”

Furthermore, Sky News Australia discussed how larger banks in Australia are no longer apt to lend cash these days. “There are stories abounding today that you can’t get cash from banks anymore,” host Peta Credlin said.

Reporter Caroline Marcus said that the banks are treating people with “absolute disdain” following the reports customers are being denied their money.

They’ve got to remember it isn’t their money. It belongs to the customers.

It kind of leaves you feeling that you might be better off stashing your cash under the bed.

Marcus said

Commenting on these recent moves by the banks to move away from physical tender, cyber security expert Ben Britton, who works as a chief information security officer, explained to Daily Mail Australia the risks and insecurities with going mostly or totally digital:

If there’s no internet, there’s no transactions, there’s no access to your money.

But if you have your money in your hand, or in your pocket, there could be no electricity and you’ll still be able to make payments to people.

The huge weakness to the system is that it’s dependent on the internet, internet security and individual device security.

Whereas no one can remotely access the cash in your pocket.

If you look at cyber criminal organisation or individuals that are cyber criminals who wish to rob a large amount of people, they can rob millions of dollars from tens of thousands of people in one day.

That would not be possible to go and do that on the street, robbing individual citizens of their cash money.

The old system, coins and physical cash, has worked for thousands of years. It’s undoubtedly got its problems but we know what they are.

But if you look at the digital world, there’s so many unknown problems that we haven’t even encountered yet.

He said

But the underlying reason behind this major effort to phase-out cash was because the last several years of the Covid pandemonium, National Seniors Australia Chief Advocate Ian Henschke told Daily Mail, that “no doubt [this was] accelerated by Covid-19.”

While we understand the move to a more cashless society – and closely related – the phasing out of cheques, ATM and bank closures, are a part of progress, these decisions should be made with seniors in mind.

Some seniors may not be comfortable banking or doing business online because they’re not tech savvy, they’re fearful of potential online scams, cash is what they’ve always known, and they have no other way to make financial transactions.

Cash is still a valid form of currency. And, as we’ve seen many times before, online banking or doing any business online can come with problems and risks.

He explained

Many Australians have complained and warned about these cash restrictions and what removing physical tender will result in.

Nevertheless, if the data is to be believed, so very few in Australia even use cash entirely anymore.

In May Australia’s SBS News floated out a headline that read: “Is Australia on its way to becoming a cashless society?” The site wrote: “With cash becoming less common in everyday life, it may not be too far into the future that the question is asked if it’s worth keeping cash or switching to an all-digital currency.”

They report, according to date from financial technology company FIS global, the total value of cash payments made in Australia comprised a miniscule 6% of all point-of-sale transactions in 2022.

Cash usage has curtailed so much it is reported that over a billion dollars worth of notes have disappeared from circulation, Australian media says; talking about how the “pain of paying” is disappearing along with the physical money supply.

Commenting on the statistics, UNSW Professor of Economics Richard Holden said:

It’s become harder to get cash out and banks are literally taking ATMs out of service, so it’s kind of an effort to go get cash.

The other thing that’s been really important is the development of the New Payments Platform (NPP) which was developed by the RBA (Reserve Bank of Australia) in 2018, this is what you might know as Osko or PayID.

The professor noted

Holden referenced how Sweden has basically become cashless already, sitting at just a mere 2% of cash transactions according to recent estimates.

SEE: Sweden To Rollout Digital ID With BankID, Scanning QR Codes For Clearance

Norway is in the same boat, quietly ready to dump cash entirely and embrace their CBDC.

China is not far behind either, and Holden believes China can actually become cashless before they do. “China is basically moving towards a digital currency, so there just won’t ever be physical currency in China and it might only be a few years,” he said.

The professor then tried to explain the benefits of going cashless. From a business perspective, dumping dollars decreased the risk of theft and stickups and thusly could have a ;flow-on effect on business insurance premiums but also reduced workload,’ he explained.

Somebody’s got to count it up, bundle it up, take it to night drop safe and all this kind of stuff, that’s a bunch of staff time, it’s a hassle and it’s not very safe.

It’s good for consumers and it’s good for business and it really makes sense for a central bank to say we’re going to help coordinate so that they’re just getting rid of this stuff.

He added

He also pointed out that going cashless creates a paper trail of all transactions, for which he speculates is why Sweden’s national bank is looking to scrap cash.

I can’t speak to the motives of the Riksbank, but I wouldn’t be surprised if part of the motivation was the underground economy.

He added that going cashless would crack down on the small side hustles and small givings, and therefore would increase tax revenue. The professor did concede that this would take time for people to adjust, but said people will eventually adapt and have a digital ID to do it with.

Whether it’s babysitters, nannies, tradies, even people buying cars and things like that, it’s this sort of sort of cash-only transaction recorded off the books kind of stuff that leads to a real loss of tax revenue.

That might be in the order of six to eight billion dollars in tax revenue.

Give people time to adjust, put in place plans for some of those vulnerable seniors and make sure everyone’s got pay ID and things like that.

Holden explained

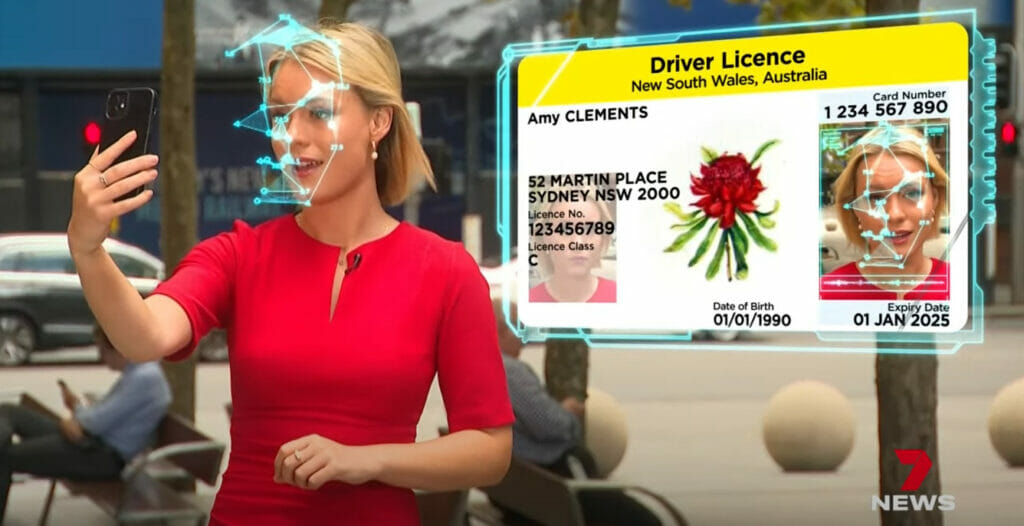

Speaking of IDs, Australia and some of its provinces are rolling out rapidly rolling out digital IDs. The WinePress has reported on these many instances already. Late last year the federal government debuted the MyGov ID app that is a pseudo-all-in-one app, that, within reason, can facilitate (or will eventually) things likes driver’s licenses, documents, vaccine passports, digital banking, and managing private and public services. The government has considered mandating them to view pornographic and mature content sites.

The province of Victoria announced that they will be rolling out their own by 2024

In March New South Wales debuted their own, touted as being one of the most advanced and effective in the world thus far, essentially forging the path ahead:

Biometric Update recently reported that NSW’s rollout of their digital ID is happening fairly “swiftly.”

Andrew Garner, the government digital and technology lead for EY Oceania, said,

Australia’s digital identity initiative presents a unique opportunity to shape a more inclusive Australia. [It can deliver] improved service delivery for all citizens, not just the majority.

Shadow Minister for Government Services, Paul Fletcher, said in a statement published on Liberal New South Wales’ website, said,

Digital ID has the potential to be a game changer for citizens and industry by saving time and making it easier to complete various transactions. Further delays only serve to undermine confidence in the Government’s technology and innovation agenda.

‘The NSW Digital ID program is a significant step towards a more equitable, inclusive, and accessible government. By providing a safe and secure way to prove one’s identity, the program aims to streamline digital processes and reduce barriers faced by its citizens. With a focus on privacy, trust, and adherence to global standards, the NSW Digital ID and Digital Wallet offer a convenient and private solution for individuals across NSW,’ Biometric Update added.

The website concluded: ‘Future government plans include a newly-approved National Strategy for Identity Resilience, making biometrically anchored digital identity credentials that work across state boundaries the norm in Australia. The government is also consulting on associated reforms to statutory declarations and deeds to allow Australians to use a digital identity to witness documents online without needing to visit a Justice of the Peace.’

AUTHOR COMMENTARY

The Australians have dug their own graves with this one. Instead of resisting the takeover they have embraced. But that is not surprising when consider – if the data is to be believed and taken at face value – that around or over 9/10ths of the country got vaccinated in this last go around. They are slaves of their own oppression.

[5] The righteousness of the perfect shall direct his way: but the wicked shall fall by his own wickedness. [6] The righteousness of the upright shall deliver them: but transgressors shall be taken in their own naughtiness. Proverbs 11:5-6

Now the banks are taking advantage of this and the people are enthralled with it, and the few that notice it or are upset are drowned out.

While a few more things need to fall into place, this is obviously another step closer towards to laying the foundation for the coming mark of the beast.

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

There is no hiding it, their doing it right in front of your nose, lousy bastards!

This article brings me to a topic my wife and I have been struggling with that maybe someone more in the know might help me with. About two years ago, we surrendered a life changing decision to GOD. It resulted in selling everything and moving to some land and living off grid, living very humble. We paid cash for that and have no debt, and now have some Davy it not much.,We are thinking about taking some of our savings and turn it into some Gold and Silver. Our thought is that when the US Dollar does collapse, maybe having some Gold n Silver will prevent us losing a lot of value. My challenge is two things: 1. How much Gold n Silver? 2. Once our GOVT goes totally digital… turn our Gold and Silver into the Digital. I feel the Digital Era coming, is Evil and is the start of things towards The Mark Of The Beast. I am not sure what direction to go other than Daily Surrender and Prayer to GOD.