Today the Federal Reserve announced that they have elected to not raise interest rates, which have been the predominant word on the street going into this anticipated week of announcements from the Fed. This announcement comes after a historical 10-in-a-row times of raising rates.

The federal interest rates still remain at 5.25%.

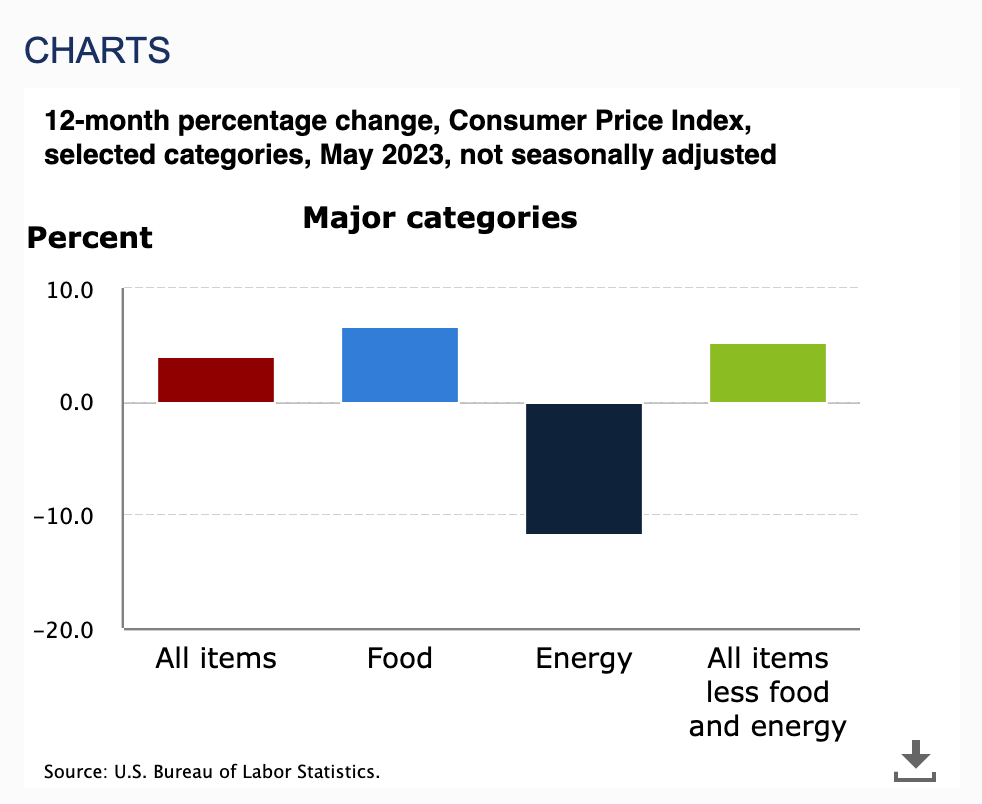

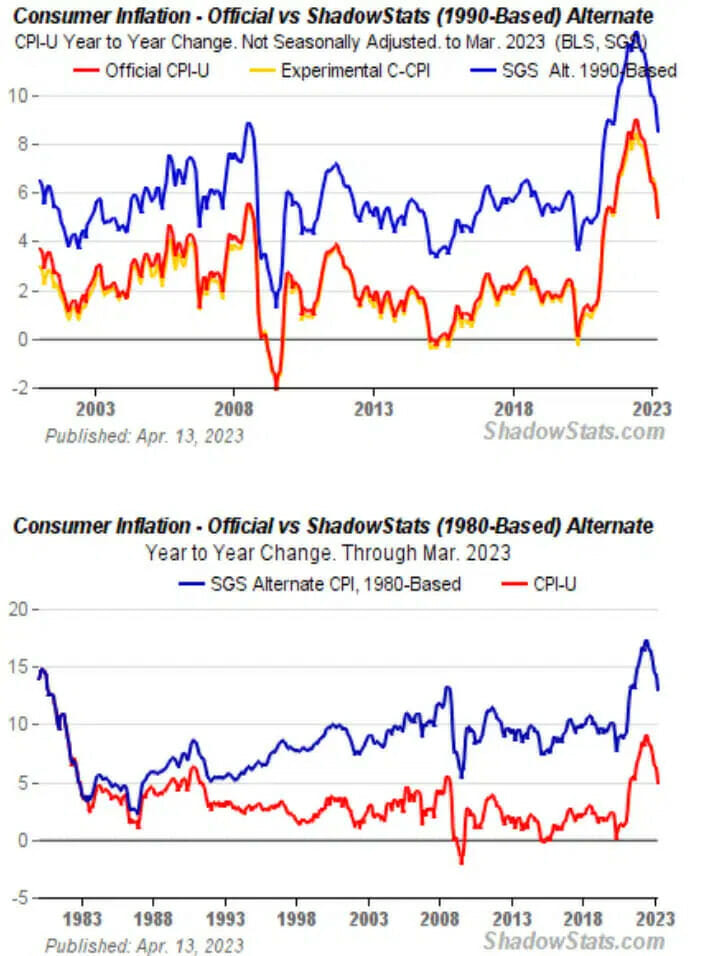

The Labor Department is now saying that the rate of inflation has lowered to 4%, as the Federal Reserve continues to tout their goal of reaching 2% inflation.

But once again real inflation rates are much higher than reported, when factoring other important data points the government disregards.

While interest rates were left unchanged today, Chair Jerome Powell strongly hinted that more rate hikes could be coming in the future. Powell told reporters “nearly all” Fed officials think the funds rate “will need to go higher.”

We have raised our policy interest rate by five percentage points and continued to reduce our securities holdings at a brisk base. We’ve covered a lot of ground.

The full effects have yet to be felt.

It will take time, however, for the full effects of monetary redistribute to be realized — restraint to be realized, especially on inflation. The economy is facing headwinds from tighter credit conditions for household and businesses, which are likely to weigh on economic activity, hiring, and inflation.

Nearly all committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year, but at this meeting, considering how far and how fast we’ve moved, we judged it prudent to hold the target range steady to allow the committee to assess additional information and its implications for monetary policy.

Powell said

AUTHOR COMMENTARY

Indeed, “The full effects have yet to be felt.” What Powell means that the slowly drowning consumer and dead economy is going to have suffer even more.

Inflation will not stop, and as a matter of fact I’d be willing to bet that it will go higher again at some point in the near future.

Powell just shot more bull at this press release. The data is all fake and manipulated, along with the markets and financial sectors.

Take heed to my warnings: things are going to get a lot worse economically in the near future, sharply. I will be coming out with more reports that go over the data and reports soon.

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

OPT OUT , BOYCOTT , RUN THESE DEVILS DRY OUT OF MONEY AND CUT THEM OFF FINANCIALLY.