On the backing of this news oil prices have expectedly surged higher.

‘OPEC+ on Sunday surprised oil markets with an announcement that it will reduce its output further, by some 1.66 million barrels daily,’ OilPrice.com explained. ‘Russia, meanwhile, said it would extend the production cuts of 500,000 bpd it announced earlier this year until the end of 2023,’ the outlet added.

Naturally the United States was displeased to hear this news:

We don’t think cuts are advisable at this moment given market uncertainty — and we’ve made that clear.

But we’re focused on prices for American consumers, not barrels, and prices have come down significantly since last year, more than $1.50 per gallon from their peak last summer.

An anonymous spokesperson for the National Security Council, said

Moreover, the White House reaffirmed their commitment to green energy this morning, per the U.S.-EU Task Force on Energy Security.

Recognizing that clean energy as well as energy efficiency, and demand flexibility measures are essential to enhancing energy security and accelerating the energy transition, the Task Force has exchanged information on policy and market solutions to accelerate the deployment of energy efficiency technology, heat pumps, smart thermostats and related awareness raising activities among consumers and relevant stakeholders.

The Task Force also discussed solutions for reducing gas and electricity use and costs through flexible demand response mechanisms that reward customers for reducing or shifting their energy usage.

During 2023, the Task Force will continue to focus on the energy market shocks and high energy prices caused by Putin’s war of aggression against Ukraine. Russia uses energy as a weapon to undermine European security. Task Force priorities for 2023 will include: 1) continuous assessments of LNG markets and ensuring U.S. LNG deliveries to Europe of 50 bcm in 2023, 2) reduction of methane emissions, and 3) energy savings and efficiency measures.

In the coming months, the Task Force will continue to work on keeping a high level of U.S. LNG supplies to Europe in 2023 of at least 50 bcm. This is necessary given the challenging supply situation and the need to ensure storage filling for the next winter 2023-24.

Furthermore, today the Joint Ministerial Monitoring Committee for OPEC met for the 48th time, discussing the voluntary production output adjustments.

The Meeting noted the following voluntarily production adjustment announced on 2 April 2023 by Saudi Arabia (500 thousand b/d); Iraq (211 thousand b/d); United Arab Emirates (144 thousand b/d); Kuwait (128 thousand b/d); Kazakhstan (78 thousand b/d); Algeria (48 thousand b/d); Oman (40 thousand b/d); and Gabon (8 thousand b/d) starting May until the end of 2023. These will be in addition to the production adjustments decided at the 33rd OPEC and non-OPEC Ministerial Meeting,

The above will be in addition to the announced voluntary adjustment by the Russian Federation of 500 thousand barrels per day until the end of 2023, which will be from the average production levels as assessed by the secondary sources for the month of February 2023.

Accordingly, this will bring the total additional voluntary production adjustments by the above-mentioned countries to 1.66 million b/d.

OPEC said in a press release

All of this will force inflation higher again. Graham Summers, MBA, of Phoenix Capital Research wrote in a short piece:

[…] OPEC is cutting production at the same time that the Biden administration is set to STOP dumping oil on the market.What does this mean?

Energy prices are about to erupt higher, pushing inflation to new highs.

Oil is already back at $80 a barrel, up from $66 per barrel a few weeks ago.

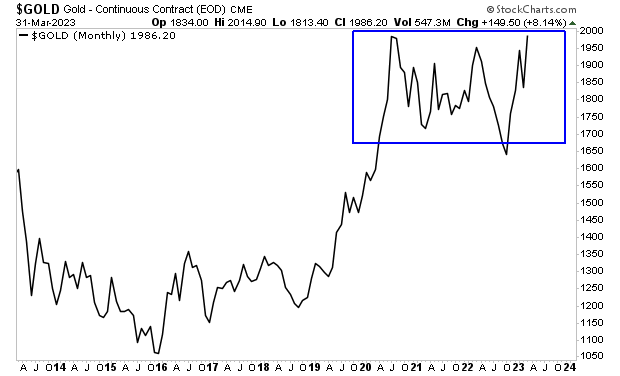

Gold has figured out what’s coming already. It’s rocketed from $1,600 an ounce to $2,000 an ounce and is about to break out to new all-time highs.

Lena Petrova, CPA, also explains the ramifications of this move by OPEC is a short video briefing.

Interestingly enough, Kenyan President William Ruto told investors to dump their holdings of the U.S. dollar, because of a new oil and gas deal that was about to take effect in cooperation with their central bank.

We just concluded a market-driven arrangement in our fuel sector that will see Kenya access all our fuel needs on a deferred six-month credit that will eliminate a demand of USD 500 million dollars every month from this market.

I am giving you free advice that those of you who are hoarding dollars you shortly might go into losses. You better do what you must do because this market is going to be different in a couple of weeks.

Ruto said

AUTHOR COMMENTARY

As Gerald Celente of the Trends Journal often says, “When all else fails they take you to war.” All modern wars are banker wars, namely over commodities and energy. And now that OPEC is once again back-handing the U.S. and making moves to undercut the petrodollars – at a time when more and more nations are looking to dump the dollar – you can accept the military industrial complex to respond to this at some point…

This move is why I have talked about perhaps stocking up on some extra gas and fuel reserves in times past. Energy is being purposefully drained in this country to bring people to their knees and get them begging for bread, even more dependent on the system (i.e. CBDC, social credit score, meat consumption, metaverse/smart city). And, it it should be remembered that the States’ diesel supply is severely low and on a razor’s edge.

In order to get food and commodities transported, it takes energy. Therefore, food inflation will go higher and stay higher.

Furthermore, this lends into the death of the dollar. The East is fighting back with their own backdoor restrictions and measures to squeeze the U.S. and the West, and it is working; and with more such detrimental restrictions coming soon.

India To Trade In Their Rupee With Countries Facing Currency Crunch Or Looking To Dump The Dollar

Therefore prepare and ready yourself, and do not be idle.

[6] Go to the ant, thou sluggard; consider her ways, and be wise: [7] Which having no guide, overseer, or ruler, [8] Provideth her meat in the summer, and gathereth her food in the harvest. [9] How long wilt thou sleep, O sluggard? when wilt thou arise out of thy sleep? [10]Yet a little sleep, a little slumber, a little folding of the hands to sleep: [11] So shall thy poverty come as one that travelleth, and thy want as an armed man. Proverbs 6:6-11

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I am not capable of storing gasoline anywhere so when it all goes down, thats that. We do have a decent amount of food stored however.

Any little bit that you do is better than nothing, brother, in any aspect. So many have zero clue what’s coming.

Proverbs 21:31 The horse is prepared against the day of battle: but safety is of the LORD.

amen, most are clueless.

I’m considering turning the storm cellar my Great Grandfather built into an off-grid emergency cabin for long term grid down scenarios. All it really needs is the rood redone, a better door, a wood floor, a 400 watt solar panel system and a small wood stove for the winter and it’d be pretty nice for a back-up living quarters.

Only thing is that it’s a one room building and it utterly fails for tornado protection, but it’d be nice to make it usable. Right now it’s just sitting there unused.

Sounds like a plan.