ANZ Bank, one of the largest banks in Australia, has decided to no longer allow tellers at some locations to give cash withdrawals, in a bid to slowly adjust to a cashless society.

Since January 2020 ANZ had already begun to shutter many of their locations – 146 of them, according to Mirage News, with 15 closing in different states in April of 2021. Because of the various Covid-19 restrictions and lockdown measures in place, ANZ took the opportunity to further expand their digital presence and reduce their in-person locations.

Bank staff have been pressured by the use of ‘targets’ to move customers online and in each of the banks, limits have been imposed on the number of over-the-counter transactions.

Shutting branches in regional areas does not reflect the true needs of bank customers.

They need to be able to transact the full range of banking and financial services in branches close to where they live.

We don’t believe the community is ready for the changes to banking that are being pushed by the likes of the ANZ.

And we know the community is not ready for managing their finances online because one third of bank customers either don’t have a computer, do not have sufficient skills or are not interested in taking up online banking.

Finance Sector Union (FSU) National secretary Julia Angrisano, said at the time

But now in Spring 2023 ANZ are taking things to the next step with some tellers unable to provide physical cash withdrawals at a “small number” of branches across the country, according to Daily Mail Australia.

And according a broadcaster from 7 News Australia, this represents “another step towards a cashless society.”

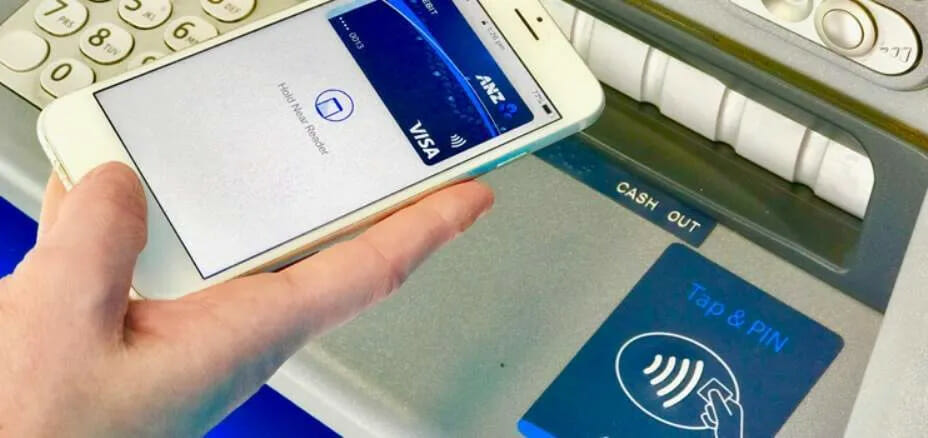

Because of this move ANZ are directing some customers to their smart ATMs to process these tangible transactions.

Cash and cheque deposits and cash withdrawals can continue to be made by using our Smart ATM and coin deposit machines.

We have staff on hand to help customers who might be using (smart ATMs) for the first time.

ANZ told 7 News, referring to the elderly, disabled, and migrants who would typically need a living person to help them

The smart ATMs courtesy of ANZ allow customers to perform contactless payments with their phones or smart watches.

However, ANZ’s closure of many branches and near-total transition to digital services have been ongoing since 2017, along with the three other Australian megabanks: Commonwealth Bank, Nab, and Westpac. Reportedly to date, only 8% of ANZ customers rely on physical branches for their transactions, and only a tiny 3% at Nab.

Normal ATMs have also more than halved across the country from around 1,400 since 2017, to now roughly 600ish.

SEE: Australia Debuts New Cashless Fuel Stations That Use QR Codes To Pay

In a statement to News 9, ANZ again acknowledged the reduced number of customers relying on in-person transactions.

Our customers are changing how they bank with more than a 50% decline in in-branch transactions across ANZ over the past four years.

Today, many customers visit our branches to discuss more complex and big financial decisions, like borrowing for a new home or establishing business accounts for a new business.

There are a small number of branches where we no longer handle cash at a counter.

At these branches, cash and cheque deposits and cash withdrawals can continue to be made by using our Smart ATM and coin deposit machines and we have staff on hand to help customers that might be using them for the first time.”

Only eight percent of our customers solely rely on branches for their everyday banking needs.

The spokesperson told News 9

7 News notes how this will also vastly impact more rural Australians who rely on physical branches and in-person transactions more frequently.

Because of this ‘shocking’ move some speculate and wonder if the three other megabanks are primed to do something similar.

News 9 concluded: ‘Cash transactions around the country are on the decline, with Australians ditching the payment method at the fastest rate in history. With the rise of contactless payments and the boom of buy-now-pay-later schemes, the use of physical money has also drastically reduced around the world.’

SEE: Australia Is Now Offering “Buy Now Pay Later” Apps For Bread, Milk, And Gas, At A Max Of $500

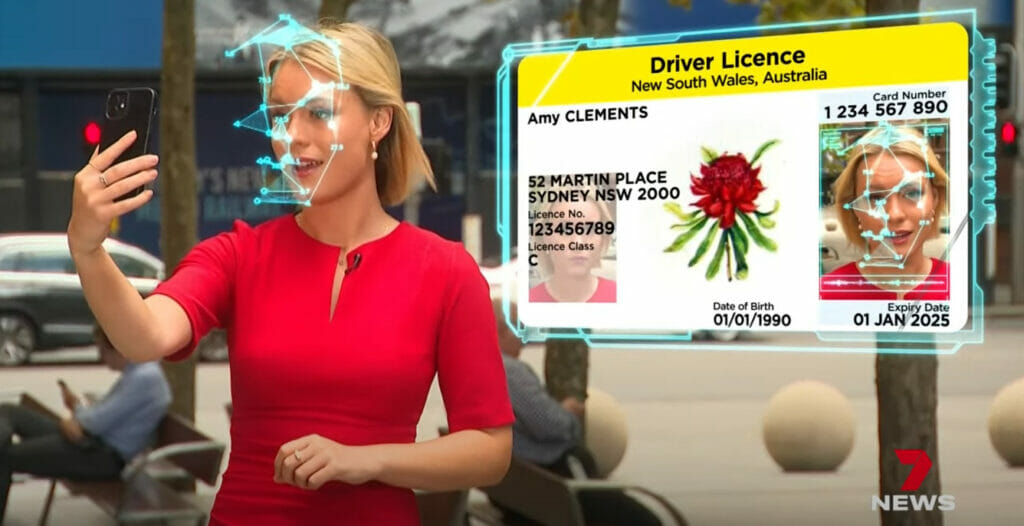

Australia has been marching towards implementing digital currencies and IDs like the rest of the world, and arguably is ahead of many of them.

In October 2022 The WinePress reported that Commonwealth Bank began to track carbon footprinting in the form of a proto-social credit score, while offering many different climate and green loans and deals for being more eco-friendly, so-called.

In December the country then launched the MyGov app, an all-in-one digital ID that would allow Aussies to store their important documents, IDs, licenses, medical information, insurance, vaccine passport, virtual banking, and more.

Moreover, early this month New South Wales released a “world leading” biometric digital ID – separate from the MyGov app, and touted as being better – to fully replace all physical documentation and IDs.

AUTHOR COMMENTARY

It’s unfortunate, but the Australians, by and large, simply go along with all the globalist agendas it seems; always so quick to adopt the latest and greatest “innovation” (though Americans are just as simple). They are farther ahead than most when it comes to accepting biometrics and CBDCs.

And that is of course where all of this is leading: CBDCs; and the Aussies will surely accept it down the road, sad to say. But, seeing just how draconian their lockdowns were this is not surprising to me.

Ultimately we know where this is all eventually leading towards:

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.