This week was a big week for the Federal Reserve as economists and financial forecasters awaited to hear what the Federal Reserve would do with interest rates this week. After a wild month of banking turmoil, bank runs, and bailouts; and with inflation still higher than the ‘experts’ had predicted, and reported jobs numbers coming in higher these past two months – a lot were unsure as to what the Fed was going to do: play it safe and raise rates by .25%, be aggressive and go for another .50%, pause rates to wait and see how things pan out, or pivot and mull rates.

In the end, the Feds went with .25%.

This now brings the total federal interest rate to 5%.

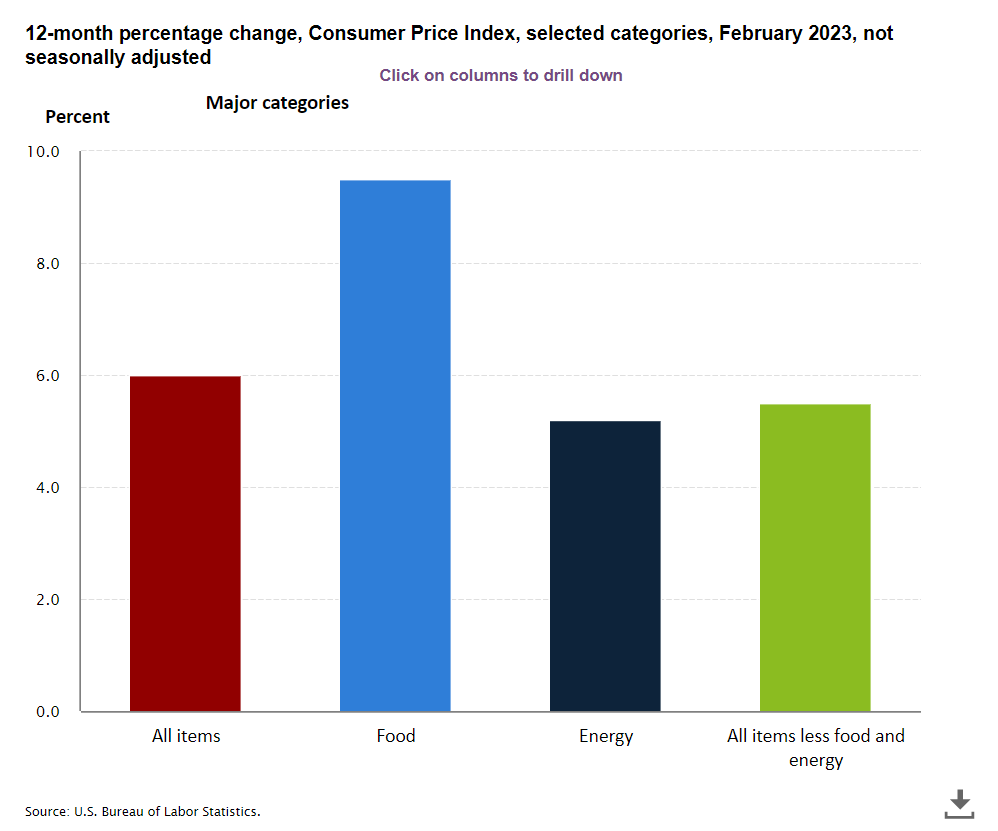

The Federal CPI inflation numbers are currently reported to be at 6%.

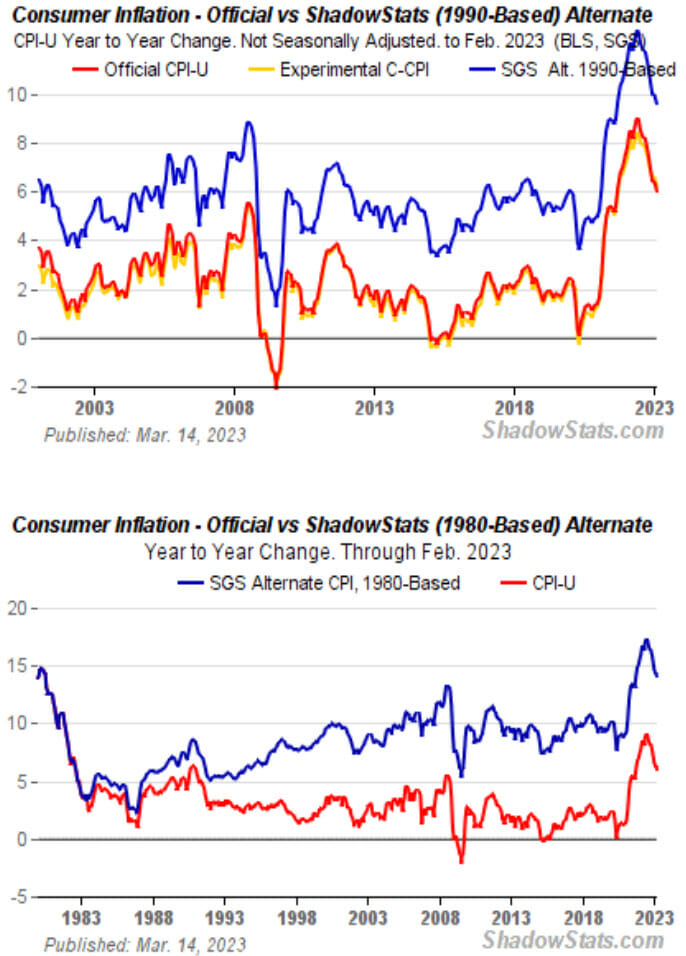

However, alternative statistics that the federal government and Federal Reserve do not print, show that inflation is more like 10-15% when factoring in more data points.

The sentiment from Fed Chair Jerome Powell today indicated that he and his constituents have left the door open for future rate hikes, but intend to stay locked at this number for most of the year. This is what Powell indicated at the last FOMC meeting in February.

Powell said that the Fed’s are still committed to fighting inflation and bringing it back down to 2%. Because of the instability with credit as of recent brought upon by this banking turmoil, more rates could be needed, but ruled out rate cuts.

In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.

The FOMC said

Powell added:

[T]he events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses and, thereby, weigh on demand on the labor market and on inflation. Such a tightening in financial conditions would work in the same direction as rate tightening.In principle, as a matter of fact, you can think of it as being the equivalent of a rate hike, or perhaps more than that. Of course, it’s not possible to make that assessment today with any precision whatsoever.

For purposes of our monetary policy tool, we’re looking at what’s happening among the banks and asking is there going to be some tightening of credit conditions. Then we’re thinking about that as effectively doing the same thing rate hikes do.

In a way, that substitutes for rate hikes.

So, the key is we have to have — policies have to be tight enough to bring inflation down to 2% over time. It doesn’t all have to come from rate hikes. It can come from, you know, from tighter credit conditions. So, we’re looking at — it’s highly uncertain how long the situation will be sustained or how significant any of those effects would be. So we’re just going to have to watch.

[…]No, absolutely not. No. If we need to raise rates higher, we will.

I think for now, though, we, as I mentioned, we see the likelihood of credit tightening. We know that that can have … an effect on the macro-economy, on demand, on labor market, on inflation. And we’re going to be watching to see what that is. And we’ll also be watching what’s happening with inflation. And in the labor market.

So, we’ll be watching all those things, and, of course, we will eventually get to tight enough policy to bring inflation down to 2%.

We’ll find ourselves at that place.

The Fed Chair said

The full transcript of Powell’s speech and Q&A can be read here.

SEE: Red Alert: Federal Reserve Set To Launch “FedNow” Digital Payment System To Usher In CBDC

AUTHOR COMMENTARY

Notice the word choice: they did not say “safe,” they said “resilient.” In other words, it’s broken and under great duress, and on borrowed time.

This banking crisis – that has now been completely forgotten about in the mainstream and the masses already – was fueled because of the interest rates. These banks, big and small, are insolvent. They are holding onto bonds, treasuries, securities, that they can no longer afford because the rates went up when they bought them at near-zero for years on end. And so when investors got spooked at Silicon Valley Bank, it started this chain-reaction and bank runs.

As rates hold at 5%, or grow later this year, more problems with the banks WILL emerge. Do not get complacent.

Also, what Powell and mainstream economists will not say is that their little magic tricks they just pulled fly in the face of fighting inflation. Raising rates were never meant to fix that, but all the money the Fed is now printing and bailing-out, and their daily credit swaps, will be MASSIVELY inflationary.

Federal Reserve To Pump $2 Trillion Of Liquidity Into Economy To Keep The Ship Barely Afloat

Do not be surprised if they lower rates near and before this year’s election.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.