While mainstream financial outlets, President Joe Biden, Treasurer Janet Yellen, Fed Chair Jerome Powell, and FDIC, are trying to sell the general public that the banking industry is “safe,” some researchers are not buying it.

The economists in their study – Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs? – wrote the following in their abstract.

We analyze U.S. banks’ asset exposure to a recent rise in the interest rates with implications for financial stability.

The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity. Marked-to-market bank assets have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%. We illustrate that uninsured leverage (i.e., Uninsured Debt/Assets) is the key to understanding whether these losses would lead to some banks in the U.S. becoming insolvent– unlike insured depositors, uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run.

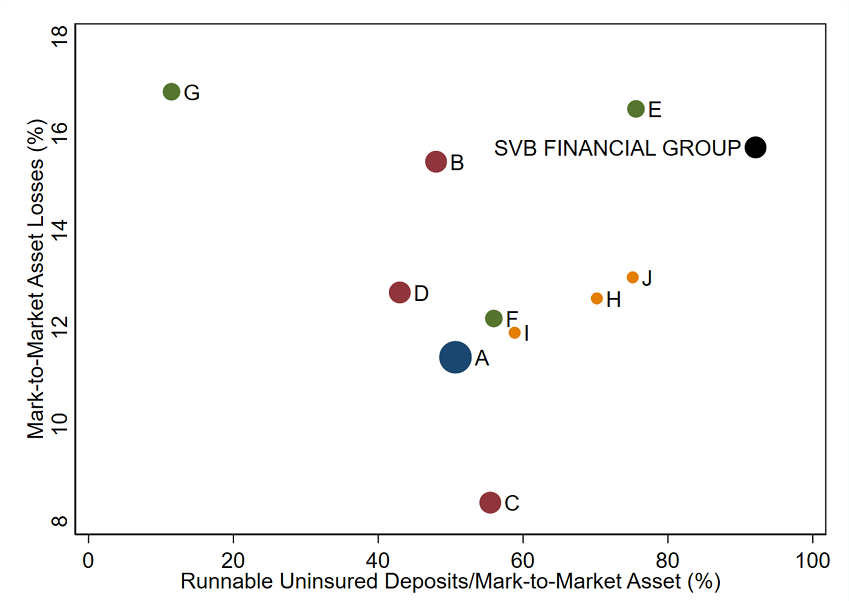

A case study of the recently failed Silicon Valley Bank (SVB) is illustrative. 10 percent of banks have larger unrecognized losses than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent of banks having lower capitalization than SVB. On the other hand, SVB had a disproportional share of uninsured funding: only 1 percent of banks had higher uninsured leverage. Combined, losses and uninsured leverage provide incentives for an SVB uninsured depositor run.

We compute similar incentives for the sample of all U.S. banks. Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk.

Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs.

The financial researchers wrote

The full paper can be read/downloaded here.

This study would have likely gone more unnoticed than it already has, relatively speaking, but USA Today are one of the few that referenced this study that highlights the precarious nature of the banking system.

But as Treasurer Janet Yellen indicated during a Senate Financial Committee last week, she made it clear that much larger institutions and other groups they deem important will receive bailout money from the government, but the smaller median banks and below will be left out to dry. Therefore the scenario these economists have detailed in their paper is quite plausible.

AUTHOR COMMENTARY

He that is surety for a stranger shall smart for it: and he that hateth suretiship is sure.

Proverbs 11:15

WinePress readers know that I have been warning about the banks being insolvent and the system collapsing, basically since this platform was launched, and that people needed to get their money out of the banks and limit their exposure to them.

Now, as I have been warning about, with the rise in interest rates, these banks – who thought that the easy money party would last forever, as we’ve been at near-0% interest rates before 2008 – and now that we are at 5% the banks cannot take the hit.

This is only the beginning. More banks will collapse and will be forced to consolidate, swallowed up by the much larger “too-big-to-fails,” granted immunity from failure if they face collapse by the Feds and the government; that WE get to pay for as they print more money, as out smaller banks are left to die.

The FDIC does not have enough money to insure everyone. That is the great lie the public is not supposed to know. Yes, they insure up to $250,000, but it only assumes one or two banks would collapse in a ‘perfect’ scenario. But when you have tens of millions of Americans pulling their money all at once and the banks collapse, the FDIC cannot and will not bailout the people left holding the bag.

But hey, according to false prophet Dave Ramsey, he says your bank is “safe,” and you should run out to get a new mortgage. The insanity!

SEE: Charlatan Dave Ramsey Says The Banks Are Safe And You Need To Buy A House Now

He that putteth not out his money to usury, nor taketh reward against the innocent. He that doeth these things shall never be moved.

Psalm 15:5

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.