Even though President Joe Biden wants Americans to believe the banking system is safe, smaller and regional banks are getting crushed, as predicted by most economists and analysts, specially by independents.

SEE: Sleepy Joe Biden Blows Smoke And Says The Banking System Is ‘Safe’ Amidst Bank Runs

As The WinePress has previously discussed in the wake of these banking collapses (i.e. Silicon Valley Bank, Signature Bank, and more to come), this is a clear consolidation of power of consumers transferring assets out of their small banks and into the so-called “too-big-to-fail” institutions, while the megabanks begin to snap-up the good assets from these failing banks, thereby increasing their stranglehold and monopolization of the banking industry.

From that article, according to stock market expert and analyst Greggory Mannarino:

The collapse of SBV, and there will be others, creates a “fire sale” opportunity for the major banks. Not a single major bank stepped in to save SVB because now this collapse presents them with a MAJOR opportunity to now be able to acquire assets from this collapse for next to nothing, pennies on the dollar. Moreover, the big banks by design will now become even larger as more regional bank collapses occur, allowing for more fire sales.

I fully expect that the overnight collapse of SVB will be followed by more, smaller/regional bank failures, AND THAT MEANS MORE FIRE SALES of assets and opportunities for the major banks.

In my opinion, we are about to see a consolidation of the entire banking system accelerate, with more power, and more assets concentrated in the Wall Street Super Banks. ANY “contagion” regarding regional/smaller bank failures will of course allow for the Too Big To Fail institutions to get MUCH bigger.

He wrote

And already that is starting to happen. Americans are beginning to transfer their money to much larger banks:

The WinePress has long warned as well that the banks were in trouble and were beginning to seriously shutter as far back as January, 2021, and months after that where even the “too-big-to-fails” were shutting a number of their branches across the country.

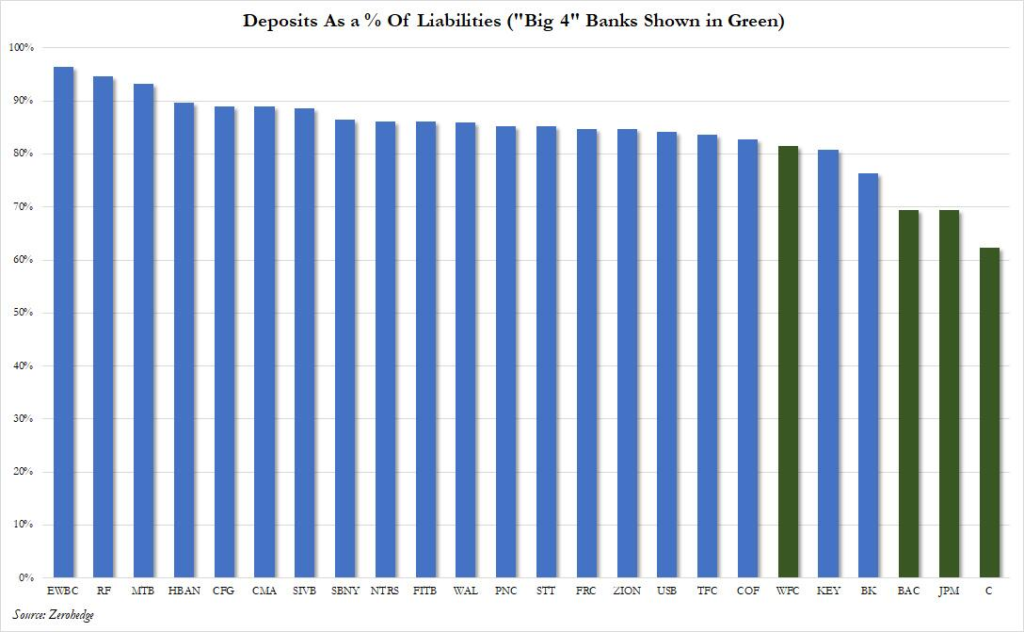

For more on this pall on the smaller banks ZeroHedge provided some of the early data not long after Biden’s speech.

Over the weekend, when parsing through the carnage sweeping the US banking sector, we analyzed which banks are facing the highest deposit-run risk in the aftermath of the SIVB – and now SBNY – failures, and focused on a handful of names who have the bulk of their funding in the form of deposits – deposits which are now suddenly at risk amid what seems to be a major bank run.

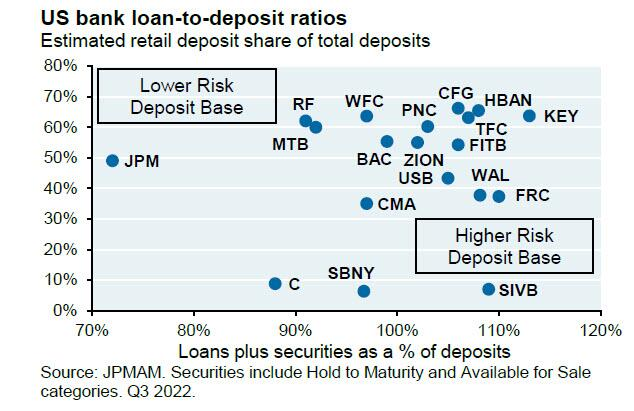

JPM’s Michael Cembalest – whose bank is poised to benefit the most from the ongoing carnage – chimed in with the following chart, which added an additional axis looking at loans plus securities as a % of total deposits, but which after the new BTFP bailout facility is irrelevant since the Fed and TSY are effectively backstopping unrealized losses on securities.

So we are really down to which banks have the most bank run risk, which as we explained, are primarily America’s small, regional banks.

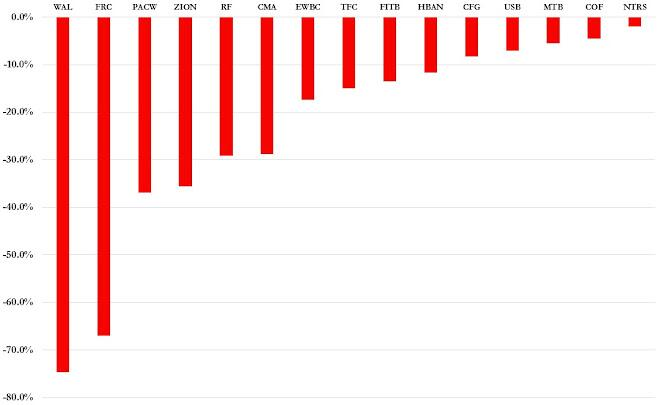

How are they holding up today? Well, not good: here is the KRE index…

… while its consttiuent members are having a very bad day as the following headlines reveal:

- *FIRST REPUBLIC BANK HALTED FOR VOLATILITY, DOWN 65%

- *PACWEST HALTED FOR VOLATILITY; DROPPED 41% TO LOWEST ON RECORD

- *REGIONS HALTED FOR VOLATILITY AFTER PARING 31% DROP TO 20%

- *WESTERN ALLIANCE SINKS A RECORD 76%; HALTED FOR VOLATILITY

And this is how the various small banks are doing today.

The take home here is that, unfortunately, Joe Biden’s 9am pep talk did little to boost confidence in small US banks.

Or, as we put it earlier, “”It would be the Savings and Loan 2.0 Crisis but we regret to inform you there are no savings.” Meanwhile, all hail JPMorgan, pardon, JPMega, which is about to have some $18 trillion in deposits.

AUTHOR COMMENTARY

He that oppresseth the poor to increase his riches, and he that giveth to the rich, shall surely come to want.

Proverbs 22:16

As we have been covering, all the evidence of the SVB collapse points to a controlled demolition. The banks are insolvent and are running on empty, and will be bailed-out just like they always do; and SVB, while it had its own set of problems, drew the short end of the stick to therefore initiate an consolidation of power and control, which is now playing out.

In the end, it will be a temporary fix as they too will collapse when the economy is allowed to finally fail completely; but when that happens, we the American tax cattle, and our European friends will too have to bail them out for their greed and arrogance.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Did you see my mail with the 666 reference?

https://www.aftonbladet.se/minekonomi/a/JQpqoX/sjunde-ap-fonden-ager-666-miljoner-i-krisbankerna

Cant make this stuff up.

CBDC might come now.

Yes. I am working on it.