The ripple effect of Silicon Valley Bank’s collapse has now struck another bank within days, the Federal Deposit Insurance Corporation (FDIC) officially announced that they are pulling the plug on Signature Bank in New York.

Signature held nearly $200 billion in assets.

According to the Motley Fool:

SVB’s collapse had to do with the fact that the bank was facing massive deposit outflows but had invested its deposits into longer-term bonds that were trading at huge losses because of soaring interest rates (bond yields and bond values have an inverse relationship). At the end of 2022, Signature had about $7.3 billion of tangible common equity and about $3.2 billion of unrealized losses in its available-for-sale (AFS) and held-to-maturity (HTM) bond portfolios. So, if the bank faced significant deposit outflows and had to sell these bonds to cover the outflows it could have wiped out a substantial amount of shareholder equity. Still, most of these losses were in the AFS book, which is marked to market and therefore already accounted for.

Signature had already been working to reduce its exposure to digital-asset-related clients that had come to the bank to use its real-time payment network, which better facilitated crypto trading. Silvergate saw an acceleration of crypto-related deposit outflows in the first few months of this year, so perhaps Signature did too, but as of Sunday night the specific reasons regulators closed the bank were not clear.

Just like all SVB, Signature also had holdings of cryptocurrencies, which will now put more pressure on that market.

In joint statement by the FDIC, the Federal Reserve, and U.S. Treasury department, the three entities stated:

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.

On top of that the Federal Reserve issued their own separate statement, and how they will be making additional funding to eligible depository institutions to try stabilize some of the chaos, by effectively releasing a new bail-out program they are calling Bank Term Funding Program (BTFP).

The Fed wrote:

To support American businesses and households, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy.

The Federal Reserve is prepared to address any liquidity pressures that may arise.

The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP. The Federal Reserve does not anticipate that it will be necessary to draw on these backstop funds.

After receiving a recommendation from the boards of the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve, Treasury Secretary Yellen, after consultation with the President, approved actions to enable the FDIC to complete its resolutions of Silicon Valley Bank and Signature Bank in a manner that fully protects all depositors, both insured and uninsured. These actions will reduce stress across the financial system, support financial stability and minimize any impact on businesses, households, taxpayers, and the broader economy.

The Board is carefully monitoring developments in financial markets. The capital and liquidity positions of the U.S. banking system are strong and the U.S. financial system is resilient.

Depository institutions may obtain liquidity against a wide range of collateral through the discount window, which remains open and available. In addition, the discount window will apply the same margins used for the securities eligible for the BTFP, further increasing lendable value at the window.

The Board is closely monitoring conditions across the financial system and is prepared to use its full range of tools to support households and businesses, and will take additional steps as appropriate.

To simplify what this will mean in the grand scale of it all, ZeroHedge fills in the blanks:

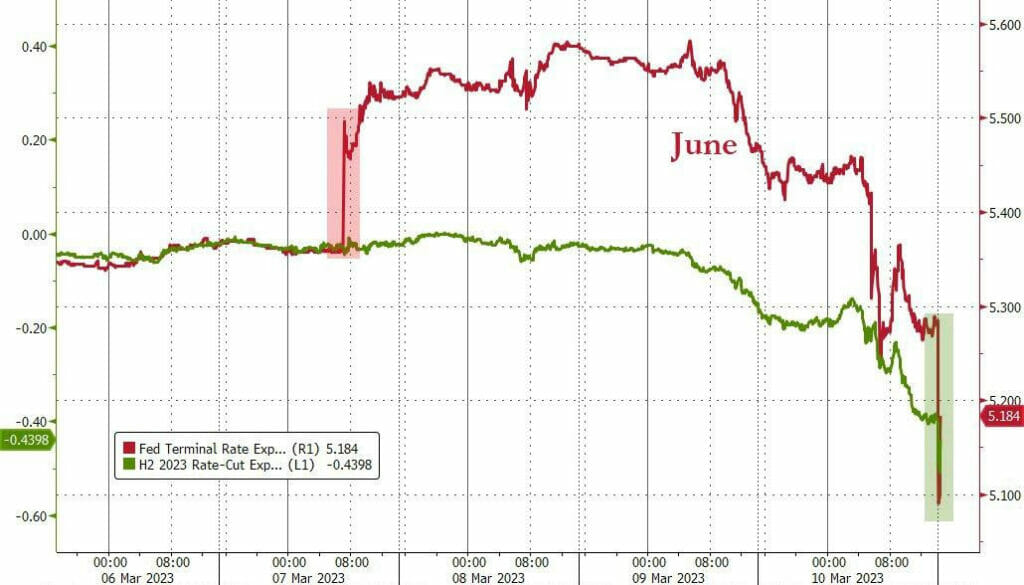

Translation: the Fed’s hiking cycle is dead and buried, and here comes the next round of massive liquidity injections. It also means that the Fed, Treasury and FDIC have just experienced the most devastating humiliation in recent history – just 4 days ago Powell was telling Congress he could hike 50bps and here we are now using taxpayer funds to bail out banks that have collapsed because they couldn’t even handle 4.75% and somehow the Fed has no idea!

What is more notable is that the BTFP […] facility, will pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!

Furthermore, to put this into perspective, the Federal Reserve’s emergency lending program is identical to what they did with the overnight funding rate, opening up the repo markets as collateral – which occurred in early 2009 as the financial markets continued to meltdown; and in September 2019, roughly two weeks before Covid-19 was purported discovered and first warned about in the media. We are now in the thick of it again with emergency bailouts and lending in an attempt to keep the ship afloat just enough.

For additional commentary on the collapse, what the media is saying, and what it all means, by the Economic Ninja.

AUTHOR COMMENTARY

[11] The rich man’s wealth is his strong city, and as an high wall in his own conceit. [12] Before destruction the heart of man is haughty, and before honour is humility. Proverbs 18:11-12

The statements speak for themselves. They are trying to whitewash this and make it sound so much better than it is. This is a collapse, and the Feds are now desperate to keep this sham going.

As ZeroHedge pointed out, we barely had had 5% interest rates and large and moderate banks can’t take the hit! That just shows you just how thin the ice really is.

The Federal Reserve will have their meeting this Wednesday and will announce the position on raising rates. Everyone seemed convinced that the Fed would increase rates another 50 points after the CPI was revised higher, and the [fake] jobs numbers were reported much higher than expected. But now it is looking like they may not even raise them at all, if not even perhaps go backwards.

As I noted in my last post about this banking collapse, this was all deliberate and they knew what was coming. This is a planned, coordinated act to consolidate and increase the power of the megabanks, and the Feds grip on the American people, as we enter a new feudal system of extreme-haves and extreme-have-notes.

I hope you had been listening and kept your money out of the banks.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.