Silicon Valley Bank (SVB), the 16th largest bank in the United States, officially collapsed today and the Federal Deposit Insurance Corporation (FDIC) has stepped in to avert a much larger crisis, in what is being considered one of the largest bank failures since 2008. It’s stock has basically gone from $763 to 0 in the course of 16 months.

‘SVB had roughly $209 billion in total assets and $175.4 billion in total deposits,’ CNBC noted.

All assets held in SVB have now been frozen and can be accessed on Monday, March 13th, to insured depositors that is. Those that are uninsured will basically be gifted a coupon to get access to a part of their money within the next week. Essentially the FDIC has initiated a lukewarm bail-in of the bank.

Moreover, many employees whose companies ran a payroll through SVB will not be getting their paychecks anytime soon, needless to say.

According to a press release from the FDIC:

Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank.

All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

Silicon Valley Bank had 17 branches in California and Massachusetts. The main office and all branches of Silicon Valley Bank will reopen on Monday, March 13, 2023. The DINB will maintain Silicon Valley Bank’s normal business hours. Banking activities will resume no later than Monday, March 13, including on-line banking and other services. Silicon Valley Bank’s official checks will continue to clear. Under the Federal Deposit Insurance Act, the FDIC may create a DINB to ensure that customers have continued access to their insured funds.

As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined. The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.

Customers with accounts in excess of $250,000 should contact the FDIC toll–free at 1-866-799-0959.

The FDIC as receiver will retain all the assets from Silicon Valley Bank for later disposition. Loan customers should continue to make their payments as usual.

Silicon Valley Bank is the first FDIC–insured institution to fail this year. The last FDIC–insured institution to close was Almena State Bank, Almena, Kansas, on October 23, 2020.

But what the FDIC is not saying is that basically next to no one is insured. As a matter of fact, less than 3% meet the criteria to be backed-up by the FDIC. Over 93% are left holding the bag.

The signs of SVB’s collapse began to manifest themselves months before and some investors were able to pull out just in the nick of time, but others were not so lucky.

ZeroHedge compiled together an unofficial list of companies and investors who are getting tagged. ZeroHedge said, ‘there is a long line of depositors who are over the $250,000 FDIC insured limit (in fact only somewhere between 3 and 7% of total deposits are insured).’ The following list, while incomplete, is approximately sorted by size of exposure:

- USDC – Crypto Stablecoin run by Circle – Silicon Valley Bank is one of six banking partners Circle uses for managing the ~25% portion of USDC reserves held in cash. While we await clarity on how the FDIC receivership of SVB will impact its depositors, Circle & USDC continue to operate normally.

- ROKU – Roku had 26% of its cash, $487 million with Silicon Valley Bank

- BLOCKFI – BlockFi has $227 million in “unprotected” funds in Silicon Valley Bank, according to a bankruptcy document, and may be in violation of U.S. bankruptcy law.

- RBLX – Roblox said 5% of its $3b cash and securities balance is held at SVB.

- DNA – Gingko Bioworks: Only the cash balance of the company’s wholly-owned subsidiary Zymergen Inc. is held in deposit accounts at SVB, representing approximately $74M or 6% of the company’s cash and cash equivalents as of December 31, 2022

- RKLB – RocketLab USA had about $38 million in its accounts with the bank, representing about 7.9% of the startup’s cash and equivalents

- LC – Lending Club warned about potentially losing funds on deposit at SVB of $21 million, said amount isn’t material to its liquidity position or capital levels, and doesn’t pose a risk to the group’s business or operations.

- PAYO – Payoneer: Of the company’s approximately $6.4B in total cash balances as of December 31, 2022, less than $20M is held at SVB

- PTGX – Protagonist Therapeutics considers its exposure to any liquidity concern at SVB to be limited, given that cash held at SVB is approximately $13 million as of March 9, 2023.

- ACHR – Archer Aviation entered into a $20 million loan with SVB in 2021, $10 million of which is due for repayment in 2023

- COHU – Cohu announced that it has deposit accounts with SVB with an aggregate balance of approximately $12.3M, which is approximately 3.8% of the company’s total cash and investments.

- IGMS – IMG Biosciences: ‘As of March 10, 2023, the Company holds less than $5.0 million in deposits at SVB. Therefore, the Company believes it does not have any material exposure to any liquidity concerns at SVB.’

- RYTM – Rhythm Pharmaceuticals announced that it has deposit accounts with SVB with an aggregate balance of approximately $3.4 million, which is approximately 1.1% of the Company’s total cash and cash equivalents.’

- SYRS – Syros Pharmaceuticals discloses that, as of March 10, 2023, it has two deposit accounts at Silicon Valley Bank. One of these accounts has a balance of less than $250,000, and the other has a balance of approximately $3.1 million pursuant to a letter of credit that the Company was required to provide to its landlord in connection with the execution of the lease for its corporate headquarters…

- EYPT – EyePoint Pharmaceuticals currently maintains a de minimis amount of cash, in the single digit millions of U.S. dollars, with Silicon Valley Bank (SIVB)

- ATRA – Atara Biotherapeutics currently maintains an account at Silicon Valley Bank (“SVB”) holding cash deposits of approximately $2 million, which amount the Company considers to be immaterial to its liquidity.’

- ISEE – Iveric Bio currently maintains a de minimis amount of cash and cash equivalents, in the low single digit millions of U.S. dollars, with Silicon Valley Bank (“SVe”).’

- VERA – Vera Therapeutics currently holds approximately 1.2% of its cash and investments with SVB. Accordingly, the Company considers its risk exposure relating to SVB to be minimal.

- XFOR – X4 Pharmaceuticals had approximately 2.5% of its cash deposits with SVB.

- CTMX – CytomX Therapeutics does not consider its exposure to any liquidity concern at SVB to be significant. The cash held at SVB in CytomX’s operating CTMX account is at or near the FDIC-insured limit of $250,000. CytomX also maintains a deposit account at SVB under a standby letter of credit issued pursuant to its office lease for approximately $917,000.’

- AXSM – Axsome Therapeutics has material cash deposits with SVB.

- WVE – Wave Life Sciences aggregate amount of the company’s cash and restricted cash held at SVB is approximately $1.5M.

- JNPR – Juniper Networks maintains operating accounts at SVB with a minimal cash balance of less than 1% of the company’s total cash

- QS – QuantumScape has very limited exposure to SVB, with only a low single digit percentage exposure relative to both the Company’s total liquidity and total assets.

Before the FDIC stepped in today bank runs began yesterday, so much so that SVB was reporting the transactions and wirings were getting “backed up.”

Naturally, and the bigger fears surrounding this is bank failure contagion as this bleeds into other banks and industries. ‘The four largest US banks — JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup — saw their share prices plunge between 4% and 6%, wiping $52.3 billion from their collective market capitalizations for the day,’ Daily Mail wrote.

For more commentary and insights on this collapse, financial analysts and entrepreneurs Economic Ninja and iAllegedly, and stock market expert Gregory Mannarino discuss this and the greater implications of this, and how the much larger Wall Street megabanks will be closely eyeing this to seize the positive assets as this panic spreads to other smaller banks and institutions.

Smaller Banks Face Bank Runs

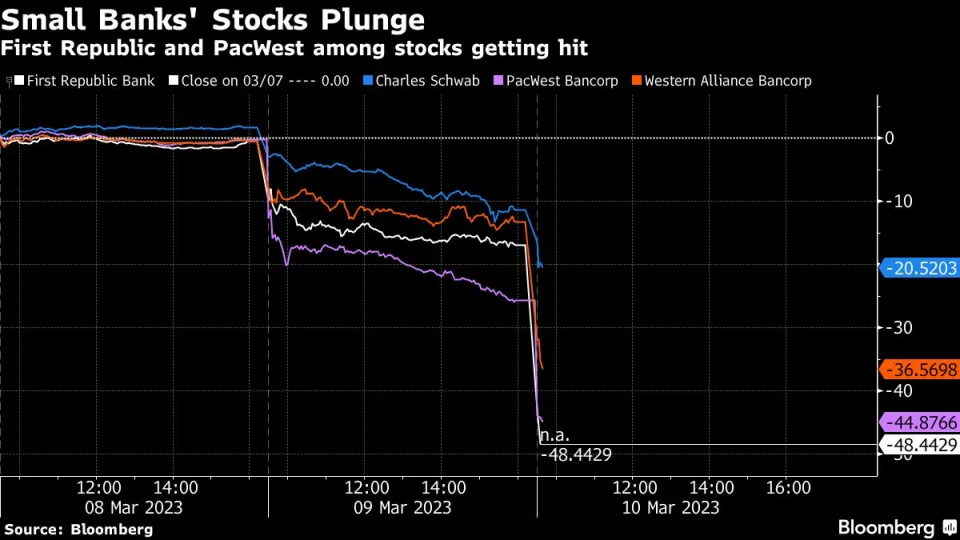

But the craziness does not stop there and the contagion has spread already. Bank runs have also struck First Republic Bank and PacWest Ban Corp.

Bloomberg reported, ‘Shares of First Republic tumbled 51% to $47.25 at 9:49 a.m. in New York, while PacWest dropped 37%, triggering trading halts for both.’ Others have been affected by this as their stocks get hammered.

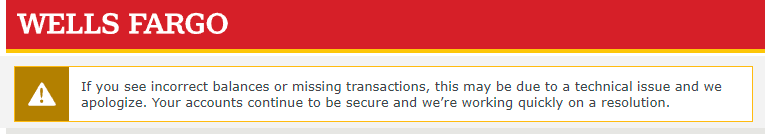

Wells Fargo Has ‘Incorrect Balances Or Missing Transactions’

But wait, there’s more! On the same day the fourth largest bank in the United States, Well Fargo, has had technical problems with customer’s accounts, preventing some from accessing their cash while others’ account balances were incorrect.

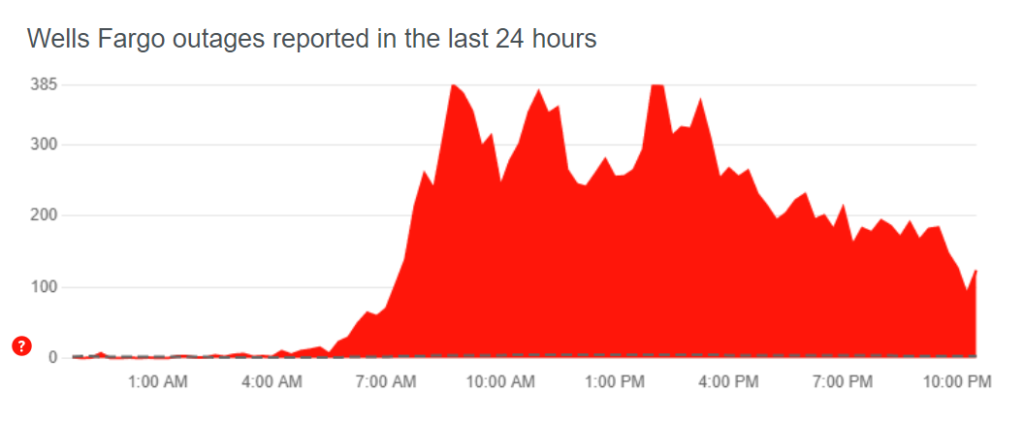

Down Detector has reported a large amount of outages within the last 24 hours.

ZeroHedge cited a collection Wells Fargo customers share their frustrations on Twitter.

AUTHOR COMMENTARY

He that is surety for a stranger shall smart for it: and he that hateth suretiship is sure.

Proverbs 11:15

I have repeatedly warned readers for years to keep their money out of the banks, only enough to meet the minimum requirements if there are any, to pay bills and make online transactions, and if you run a business; but otherwise there is no reason to have money in the banks at all. And now that this has happened I hope many of you who have not been listening will now finally get off your butt and do something.

For me, as bad as this is, I was not panicked. Even though my bank was not affected (though it might now come this Monday) – you see I follow my own advice and I keep very little in the bank, and the rest is locked away elsewhere.

The banks are not safe places to keep your money. And, now you get to see it come to pass, the FDIC is NOT there the bail people out and are basically performing a bail-in. The federal government could very well still get involved, however. Either way it is clearly not good. I hoped you listened to the commentary by the financial analysts and experts who are far more intelligent than me on this.

Oh, and surprise surprise: that little soulless gremlin Jim Cramer from CNBC – who always gets it wrong – told his viewers to buy into SVB one month ago. You think he and the network didn’t know what was going to happen? Think again.

The worst part about this too is that it happened on a Friday. When the markets and normal business hours begin on Monday, the CHAOS will commence. There is no question this contagion will spread to so many other banks and sectors.

To closeout 2022 and the Christmas season I told readers to bottle up that joy and mirth and save it, because I feared that would probably be the last ‘real’ Christmas and holiday season we’d have for a while, because 2023 is going to get rough. This bank collapse is just part of it, and it’s only going to get more hectic from here.

Stay calm but be vigilant, and take preemptive measures. Those are paying attention will reap plentifully if you prepare and get yourself in the best position that you can…

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Thank you sir, I just made a run to and fro.