Yesterday the Federal Reserve raised federal interest rates another .50% percent, lower than the .75% they have been raising it by for the last several meetings.

The current rate is now at 4.5%

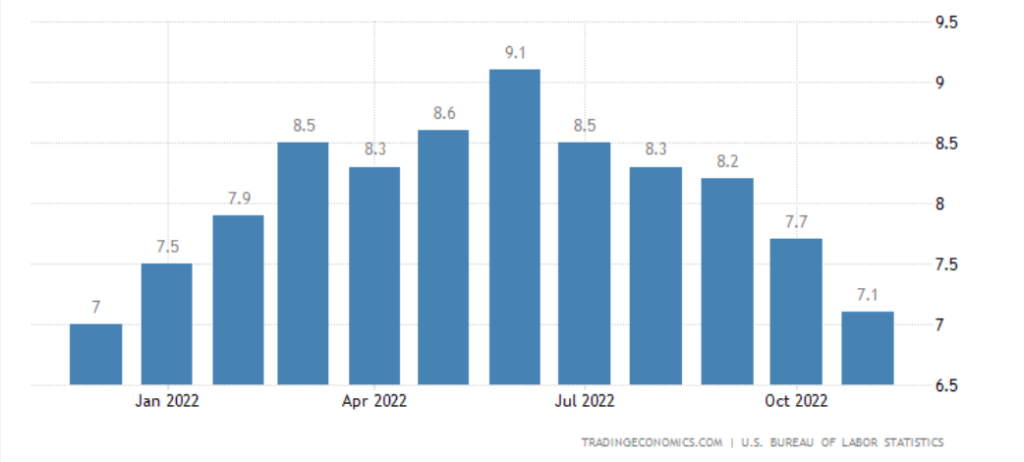

Federal statistics indicate that the rate of inflation has now fallen to 7.1% for the month of November, which is now right around where it was in January of last year. The peak this year was at 9.1% in June.

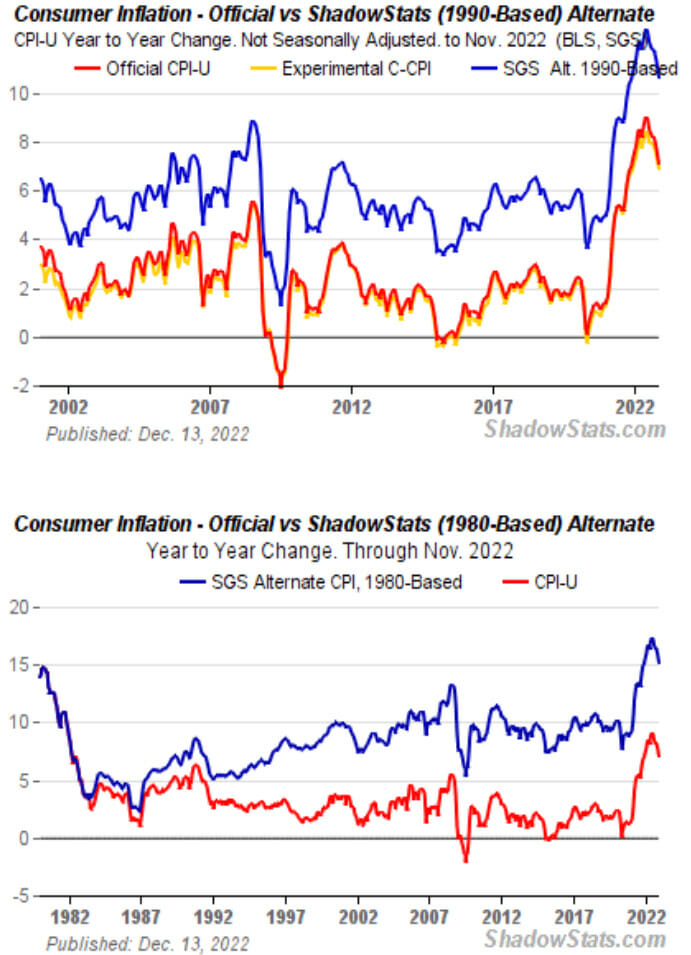

However alternative statistics that the government does include show that the rate of inflation is still much higher.

This move was highly expected by the Feds, but the real point of speculation is what they plan to do next year. The Feds reportedly have a target goal of 5% by early next year, and then it is speculated that they will then pause for a decent period of time if not for the remainder of the year.

Fed Chair Jerome Powell’s remarks were described by many as being “hawkish.” As he explained in his presentation, “It will take time, however, for the full effects of monetary restraint to be realized especially on inflation.” In other words, if you thought it was bad now, you have seen and felt nothing as of yet.

Many investors and speculators are already pricing in that the Feds will perhaps make too smaller increases both at .25% to reach this 5% target. Powell however noted that 17 out of 19 Federal Open Market Committee (FOMC) are expecting interest rates to rise to at least 5% or higher. “So that’s our best assessment today for what we think the peak rate will be,” Powell said

When asked if there would be any potential for rate cuts by mid-2023, Powell said there are no plans to do so.

Our focus right now is really on moving our policy stance to one that’s restrictive enough to assure a return of inflation to 2% goal over time. It’s not on rate cuts. And we think that we’ll have to maintain a restrictive stance of policy for some time. Historical experience caution strongly against prematurely loosening policy. I wouldn’t say we’re considering rate cuts and a sustained way so that’s — that’s the test I’d articulate and you’re correct, there are not rate cuts in the SEP for 2023.

Watch the video below for more of the highlights of Powell’s speech.

AUTHOR COMMENTARY

Just like the Great Recession, the damage was not so much felt when the markets collapsed in 2008, but during the tsunami wave of destruction that came through the following years. 2023 is going to be a year of pain and chaos, make no mistake about it.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Who knows, Lord only knows, 2023 will be when the US economy officially collapses! All the boastful millionaires and prominent well-to-do people and especially those living a debt based fake wealth are going to be rummaging through garbage and living in government cheese and assistance.