For the fourth time in a row the Federal Reserve has raised the federal interest rate another .75%, bringing the total to 4%, which is higher than what it was in 2008 which kicked-off the official start of the Great Recession.

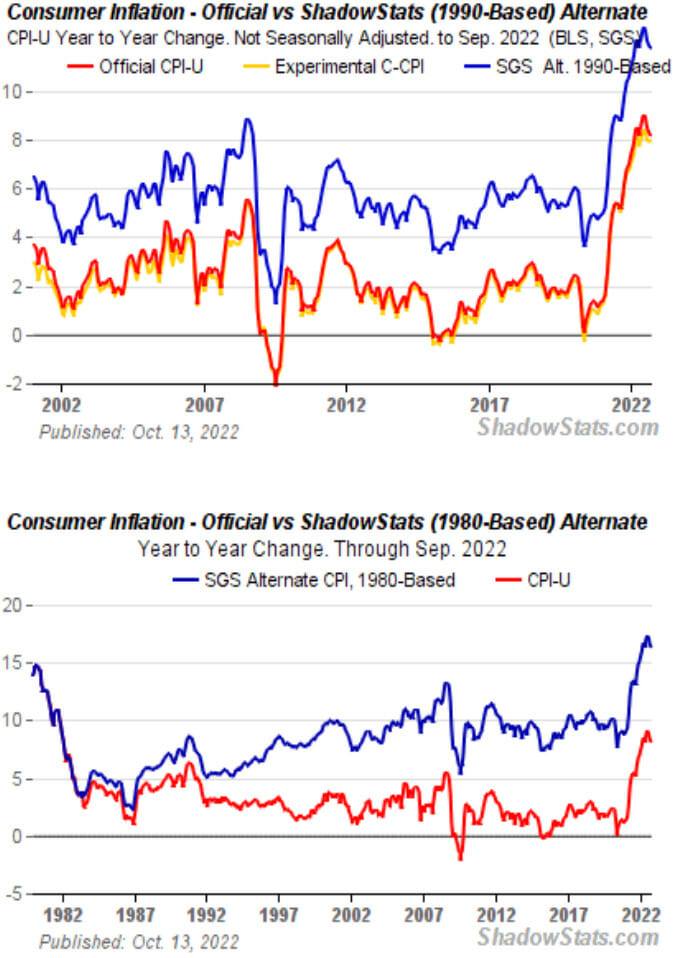

However, the current federal inflation rate is at 8.2%. Moreover, the real inflation numbers, when factoring in other data points the feds do not, the ravine even widens and deepens, according to ShadowStats.

This rise in rates was expected to happen, but the news that gripped the markets today was Fed Chairman Jerome Powell’s remarks that more rate hikes are possibly coming, but they might not be as high and as frequent.

It’s very premature in my view to be thinking about or talking about pausing our rate hike. We have a ways to go. We need ongoing rate hikes to get to that level of restrictive. We don’t know where that exactly is. We have a sense. We’ll write down in the December meeting a new summary of economic projections which updates that. I would expect us to continue to update it based on what we’re seeing with incoming data.

Remember, though, that we still think there’s a need for ongoing rate increases. We have some ground left to cover here. And cover it we will.

Powell said during a Q&A after the rate hike was announced

Mace News reported, ‘Asked repeatedly about plans for slowing and eventually halting rate hikes, he avoided giving precise signals. As he’s done before, he said that “at some point it will become appropriate to slow the pace of increases,” but did not say when that will be.’

Powell did say “that time is coming, and it may come as soon as the next meeting (Dec. 13-14) or the one after that (Jan. 31-Feb. 1).”

No decision has been made. It is likely we’ll have a discussion about this at the next meeting — a discussion.

To be clear, let me say again, the question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive which will be our principle focus.

Powell added

The WinePress has repeatedly noted that by keeping rates below the inflation rates will not stop inflation, rather, only guaranteeing that inflation will persist.

However, someone finally asked Mr. Powell why the Federal Reserve has not decided to raise rates higher than inflation. Powell had this to say:

So this is the question of does the policy rate need to get above the inflation rate. I would say there are a range of views on it. That’s the classic Taylor principle view. I think you would look at a more forward looking measure of inflation to look at that.

But I think the answer is we’ll want to get the policy rate to a level where it is — where the real interest rate is positive.’ We will want to do that. I do not think of it as a single and only touchstone, though.

We haven’t seen inflation coming down. The implication of inflation not coming down — what we would expect by now to have seen is that really as the supply side problems had resolved themselves, we would have expected goods inflation to come down by now, long since by now. It really hasn’t.

Actually it has come down, but not to the extent we had hoped. At the same time now you see services inflation, core services inflation moving up. I think the inflation picture has become more and more challenging over the course of this year, without question.

AUTHOR COMMENTARY

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

Only now do we finally get someone calling out Powell for not raising rates above the rate of inflation; but better late than never I guess. Obviously Powell’s answer are just a pack of lies as usual, but what he will also not tell you is that by raising rates at a huge pace, especially above the current rate of inflation, will implode the economy. It is lose-lose situation.

Moreover, what no one will tell you is the issue is not a rate issue, it’s a CURRENCY issue. You cannot print money ’til the cows the come home and expect inflation to get better, especially with the velocity of money at all-time record lows, and a government that cannot stop funding wars and other endless crises.

The United States Does Not Have An Economy

The Quickest Way To Know The Economy Is Broken Beyond Repair

The Federal Reserve Is Guaranteeing Inflation Will Persist: Ignore The Media’s Rhetoric

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.