Commonwealth Bank (CBA), one of the largest banks in Australia, has begun to start monitoring user’s carbon footprint tied to their spending habits, in a bid to help customers voluntarily mitigate and adapt their lifestyles.

An October ago CBA announced that they would trialing this new system by partnering with fintech group CoGo. The pilot program allowed a select group of 250,000 people to monitor their carbon footprint with the CommBank app, and “offset their previous month’s transactions by purchasing carbon credits,” CBA said in a press release at the time. Eventually the bank said that they later expand to small businesses, allowing them to “see a breakdown of their emissions by month and category, and eventually at an individual transaction level.”

By combining our rich customer data and CoGo’s industry-leading capability in measuring carbon outputs, we will be able to provide greater transparency for customers so that they can take actionable steps to reduce their environmental footprint.

Our data capability will provide greater personalisation for customers overtime, including more granular information about their carbon footprint with the option to offset individual transactions.

Angus Sullivan, Commonwealth Bank Group Executive, said in a statement

In separate post, CoGo explained what this carbon footprint is and why it needs to be checked:

Whenever we go places, eat things, use and buy new stuff, we’re contributing to the growing amount of greenhouse gases in the atmosphere. While we don’t actually see or feel these gases around us, almost every consumption choice we make creates greenhouse gases. This is your carbon footprint and it is measured in kilograms of carbon dioxide equivalent (CO2e).

Where we choose to spend our money has a huge environmental price tag too. Every time we spend money and consume things from our morning coffee to our Netflix subscription, our ‘consumption’ has an impact, and this adds to our carbon footprint.

A carbon footprint tracker tracks your carbon emissions and is therefore your own personal impact on the planet. Think of it like a fitness tracker counting your steps, except this tracker counts the carbon associated with your spending. Through our partnership with CBA, you will soon be able to see how your everyday purchases, like when you purchase an item of clothing from a retailer, generates carbon emissions.

To give you an idea of the quantity of emissions, every $2 spent at an Australian fashion retailer creates on average 1kg CO2e, and 1kg of CO2e is generated by driving an average car 4 kilometres. Certain industries and companies that are more sustainable would perform much better than others when calculating emissions and their carbon impact – renewable energy providers and second-hand fashion retailers for example would have a much lower impact on your footprint.

By helping people understand how their spending contributes to their carbon footprint, we can help them lower emissions through their spending choices. Actions such as choosing to cut down your meat consumption, home composting or buying second hand goods all make a big difference.

CBA provides some of the ways customers can reduce their carbon footprints:

The first is to buy second-hand clothing and furniture, and resell those items.

Secondly, CBA says “driving your car less (unless it’s electric) and opting for public transport” will lower the footprint score, and also use a bicycle instead.

Thirdly, cutdown on how many times a person flies.

Fourthly, stop eating meat and dairy products, adopt a plant-based diet if not convert to outright veganism. “Start by going meat-free 1-2 days a week. You can find easy plant-based recipes online and most supermarkets have delicious vegan alternatives, including meats, yoghurts, milk, and cheeses,” CBA advises.

SEE: St. Louis Federal Reserve Says To Eat Plants Instead Of Turkey This Thanksgiving

CBA also says to recycle and reuse packaging and other assorted items, especially by buying items that are more ‘sustainable’ and longer lasting.

And the final way the CBA says to reduce your carbon footprint is to start composting.

Banks are ideally positioned to take on the role of champion in supporting their customers to lower their carbon footprint. In a highly competitive market in which it’s hard to differentiate, banks cannot ignore this opportunity to stand out and establish themselves as a lifestyle partner to the conscious consumer.

There’s never been a more important time in history to reduce our carbon footprint and climate friendly actions like reducing flights, taking public transport or going vegan for one meal a week can all have an impact on that. We’re proud to be the go-to solution for change for the world’s largest banks, and we’re excited about expanding this change throughout Australia, in partnership with CommBank.

Ben Gleisner, Cogo Founder, said

The app was launched in August of this year and is now beginning to get traction.

The combination of customer data and Cogo’s capabilities, means we can now provide personalised and granular information to customers about how their spending translates to a carbon footprint.

A customer’s carbon footprint is an estimate that considers things such as personalised spending data and transaction behaviours using select CommBank products, such as an Everyday account, credit cards and BPAY. We can then assign each transaction emissions factor data per industry type (ie fashion, grocery, etc.), which is provided to us by Cogo to calculate their carbon footprint.

Ben Morgan, General Manager Strategy Investments and Transformation, said

On top of this, coupled with the release of the new app and program, CBA will also be offering green-based home loans and reduced mortgage rates if homeowners buy verified products that qualify them for reduced rates. Going solar and removing all gas appliances will also help customers get better rates.

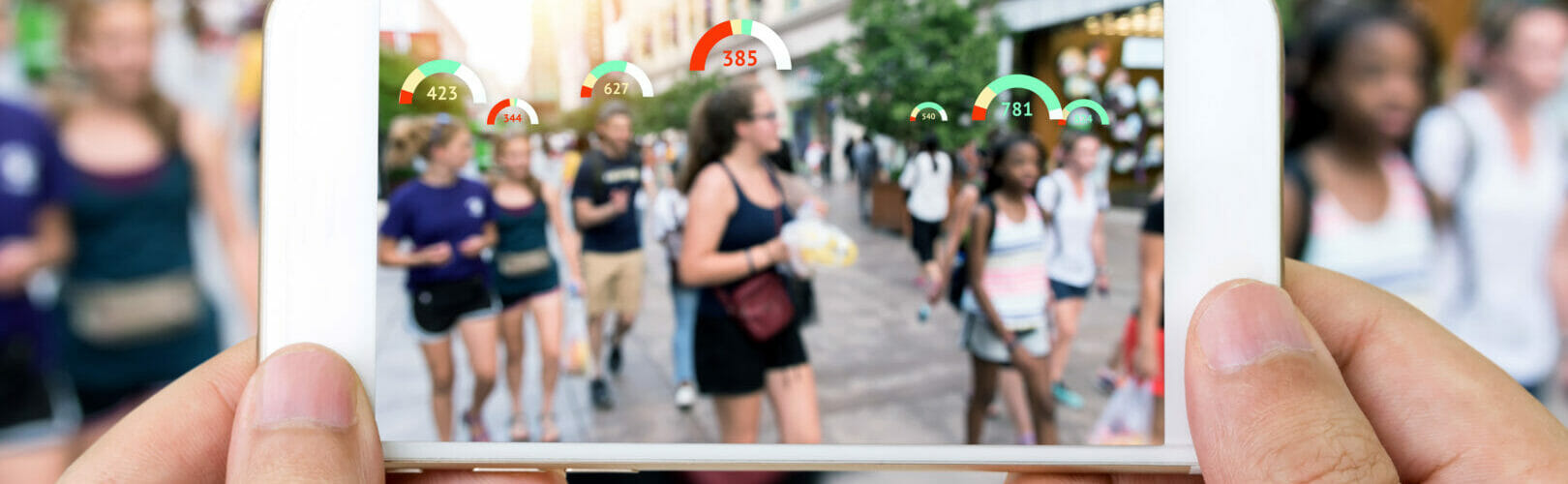

Over two weeks ago The WinePress reported that the U.S. Federal Reserve is partnering with 6 other major American banks, to trial a new carbon-based social credit score system and green-based loan opportunities, identical to what CBA is now already providing.

Moreover, The WP also noted a month ago that the World Economic Forum has openly stated that the billions of people who submitted themselves to a slew of invasive Covid-restrictions and lifestyle changes, will also accept carbon-based social credit scores.

AUTHOR COMMENTARY

If you have not read my reports “Agenda 2030: You’ll Own Nothing And Be Happy,” and “Agenda Absolute Zero: You’ll Be Enslaved And Be Happy,” then you need to; because what the CBA is tracking people for are the very same things these elitists want to have happen, and prognosticate will happen by 2030.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

But, as I have said before, per the WEF’s sobering statements, what they say is true: the sheeple will willingly accept these coming systems. Perhaps not at first, but when the Western economies finally break apart and the people cry out for help due to the utter chaos, then these banks and governments will come offering and enforcing their “solution:” which the public will gladly accept.

[1] Now the Spirit speaketh expressly, that in the latter times some shall depart from the faith, giving heed to seducing spirits, and doctrines of devils; [2] Speaking lies in hypocrisy; having their conscience seared with a hot iron; [3] Forbidding to marry, and commanding to abstain from meats, which God hath created to be received with thanksgiving of them which believe and know the truth.1 Timothy 4:1-3

As I said, because both saved and lost are so broke, indebted, covetous, and so forth, they will readily comply with this façade of an economy finally implodes in the soon time to come. Meanwhile, you got conservative shills and sellouts like Candace Owens trying to peddle a social credit score platform of her own.

Ignite The Right: Candace Owens Endorses Social Credit Score App Marketed For “Patriots”

The soul of the sluggard desireth, and hath nothing: but the soul of the diligent shall be made fat.

Proverbs 13:4

That’s the problem here: laziness, and these elitists and puppet string pullers at the WEF or UN, and ultimately the Vatican, know how to pull the strings of envy. Therefore, the masses will run to these enslavement mechanisms.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Jacob, thanks for the effort and hard work for the Lord Jesus Christ and the brethren with these articles. They are a great help to those that search for and love the truth.

Glad to be of service!

Inflation is destroying a lot of people. It seems impossible to get ahead

Someone necessarily assist to make severely posts I’d state. That is the first time I frequented your web page and so far? I amazed with the research you made to make this actual publish incredible. Great task!

What i do not realize is in truth how you are not really a lot more neatly-preferred than you might be right now. You’re so intelligent. You recognize thus significantly with regards to this topic, produced me for my part consider it from numerous varied angles. Its like women and men are not fascinated except it’s something to do with Lady gaga! Your own stuffs outstanding. All the time handle it up!

What i don’t realize is in truth how you’re now not actually a lot more well-appreciated than you may be right now. You’re very intelligent. You know therefore significantly in terms of this topic, produced me individually consider it from a lot of numerous angles. Its like women and men don’t seem to be fascinated except it is one thing to accomplish with Girl gaga! Your individual stuffs great. All the time care for it up!

magnificent points altogether, you simply gained a brand new reader. What would you suggest in regards to your post that you made some days ago? Any positive?

I truly appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again!

Hello, i think that i saw you visited my site so i came to “return the favor”.I’m trying to find things to enhance my site!I suppose its ok to use some of your ideas!!