The new interest rate is at 2.5%.

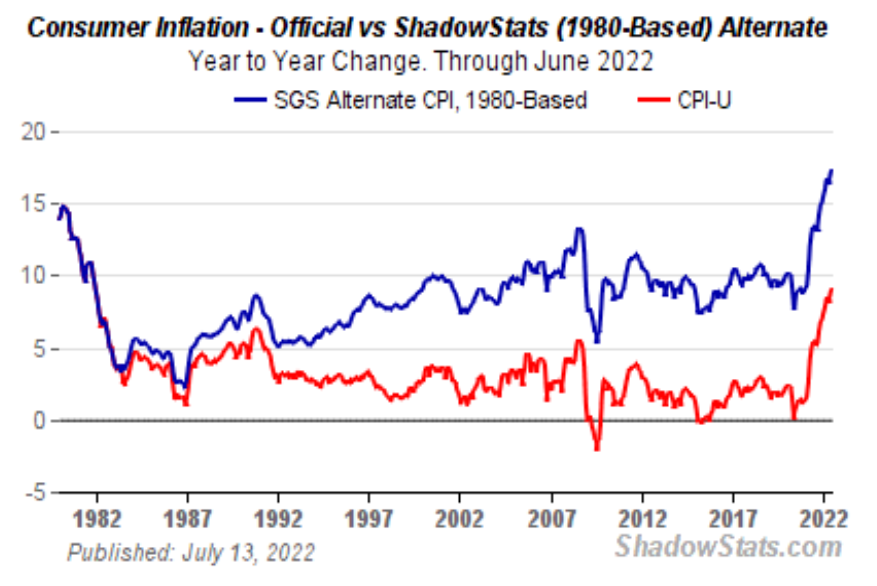

But as I have noted so many times over when covering these rate hikes in previous articles, in order to even attempt to curtail inflation, the interest rate must be higher than the inflation rate. But you are not supposed to know that. Moreover, the official inflation metrics are not the accurate ones, as they remove other key data points.

According to Shadow Stats, an alternative economics website that factors in other data points that previous administrations no longer analyze, the real inflation are approximately in the 18% range.

Even so, increased interest rates in this abysmal and non-existent economy will exacerbate the problem, because producers will include these higher costs off loans into their final price.

Even CNBC admits this:

Rate hikes increase the costs of borrowing money, which can help slow inflation. But they also result in added costs for consumers already dealing with elevated prices for goods and services.

Here’s a look five things that will become more expensive:

1. Credit Cards

With the Federal Reserve raising interest rates, your credit card’s annual percentage rate will likely increase within a couple of billing cycles. That means you’ll be paying more on any outstanding credit card debt that isn’t paid off by the end of the month.

A 2.25% year-to-date rate increase means that for a cardholder making the minimum payment on a $5,000 credit card balance, it will take an additional five months and $868 in interest to pay the card off completely, according to calculations provided by Bankrate.com.

2. Car Loans

Auto loan lenders use the Fed’s benchmark rate to determine the interest rate you’ll pay on financing. This won’t affect borrowers already locked into fixed-rate financing, but new car loans or those with variable-rate financing will likely go up in cost.

A 2.25% year-to-date rate increase means that for a $35,000, 5-year new car loan, the monthly payment would be $36 higher now compared to a loan taken out at the beginning of the year, per calculations provided by Bankrate.com.

3. Adjustable-Rate Mortgages

The Fed’s benchmark indirectly affects rates on variable-rate mortgages, also known as adjustable-rate mortgages, or ARMs. Most homeowners are locked into fixed-rate mortgages, so they are unaffected by rate hikes unless they are refinancing or signing up for a new loan.

Borrowers with ARMs can expect a bump in the interest rate on their home loans, although it will vary based on the lender, the mortgage size and their credit score. That said, the average interest rate for five-year ARMs have nearly doubled since the beginning of the year, which coincides with four Fed rate hikes in that time.

4. Private Student Loans

Borrowers with federal student loans will be unaffected by the rate hike as interest rates for these loans are set by Congress, based on 10-year Treasury note yields. Plus, there is a payment and interest freeze on federal student loans still in effect through Aug. 31, which might be extended even further.

However, borrowers with private, variable-rate student loans could see an increase in how much they pay in interest charges, usually within a month of the rate hike. This would also apply to new borrowers signing up for private, fixed-term student loans after the rate hike kicks in. The rates for these types of loans tend to rise with the federal funds rate — though technically, they aren’t directly linked.

Interest rates and terms on private student loans can vary depending on your financial situation, credit history and the lender you choose.

5. Other Variable-Rate Loans

Expect increased costs for variable-rate loans like personal loans and home equity lines of credit (HELOC).

Lenders for these types of loans set their prime rate — the lowest rate offered for the most qualified buyers — based on the Fed’s benchmark rate. That means that the interest you pay will increase, although what you will pay will vary based on your lender, the size of the loan and your credit score.

The Federal Reserve is only guaranteeing the problem will persist, laying the groundwork for a colossal collapse in the future.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Five things to avoid, lost or saved. About the decrease in the price level of general goods and services (between 2007 and 2012, within the span of 1997 to 2022, ShadowStats’ CPI), what contributed to that, I wonder?