The U.S. Supreme Court recently made a ruling that could force 70,000 Californian truckers out of the business, greatly inducing more supply chain and shortage woes.

Gasoline has been poured on the fire that is our ongoing supply-chain crisis.

In addition to the direct impact on California’s 70,000 owner-operators who have seven days to cease long-standing independent businesses, the impact of taking tens of thousands of truck drivers off the road will have devastating repercussions on an already fragile supply chain, increasing costs and worsening runaway inflation.

The California Trucking Association

CTA asked the Supreme Court for a review of a case challenging California’s Assembly Bill 5 (AB5), ‘a law that sets out three tests to determine whether a worker is an employee entitled to job benefits or an independent contractor who isn’t. The trucking industry relies on contractors, and has fought to be exempt from state regulations for years because of federal law,’ Bloomberg explains.

The ruling was first made by a 9th Circuit Appellee Court June of 2021, but stayed their verdict until the Supreme Court gave their official ruling on the course. However the Supreme Court rejected to even look at or comment on the 9th Circuit’s ruling, which therefore causes the 9th Circuit’s original verdict to stand and take effect soon.

According to Freight Waves: “The Nerve Center of the Global Supply Chain,” wrote that AB5 presumes that a worker is an employee (and not an independent contractor) unless the hiring entity can prove that the worker:

- (A) Is free from the control and direction of the employer in performing work, both practically and in any contractual agreement.

- (B) Performs work that is outside the usual course of the employer’s business.

- (C) Is usually engaged in an independently established trade, occupation or business of the same nature as the work performed for the employer.

Freight Waves points out that many independent drivers are worried that the second criteria listed will effectively force them out of the business, or at least in California.

To avoid the risks of a misclassification suit, a motor carrier, under the B prong, must prove that its independent contractor drivers perform work that is outside the usual course of the motor carrier’s business — a seemingly impossible task in the context of drivers and motor carriers.

In its briefing before the Supreme Court, the state of California went to great lengths to downplay the impact AB5 will have on motor carriers and transportation at large, but the consequences have a significant chance of being highly impactful and disruptive to motor carriers operating in California.

Freight Waves wrote

California Cuts Off Water Supply To Rice Farmers To Protect Fish

For more details on this quiet yet important development, read more about it in Freight Waves’ recent articles dealing with the subject: “Is AB5 Armageddon for 70,000+ independent truckers?” & “California trucking prepares for shake-up under independent contractor law AB5.”

The Purge

The trucking industry is falling off of a cliff, adding to the ever-growing logistical nightmares and delays.

On top of California dealing a blow to independent trucking, the rest of the nation is witnessing a culling of the trucking industry as a whole.

Over a week ago Freight Waves detailed this “great purge” and looming recession of trucking in the United States:

Chris Tucker needed to move some hot tubs. It seemed like a good gig for his network of small truckers.

The Winchester, Kentucky-based owner of Full Coverage Freight, a truck brokerage, recently advertised to truck drivers on a load board that it had a shipment of hot tubs headed from Seattle to a small town in the middle of Wisconsin. The rate came out to under $2 a mile, which Tucker thought was low. He expected drivers to haggle with his company to get paid at least $2.50 a mile, or about $1,000 more for the gig.

Instead, his office was slammed with dozens of phone calls and hundreds of texts clamoring for the hot tub job — exactly at the rate advertised.

It’s not an ideal situation for America’s 2 million truck drivers. Too many truck drivers for the amount of work available means lower and lower pay. During the last major trucking recession in 2019, hundreds of trucking companies declared bankruptcy, unable to cover the costs of running a trucking company with deflating rates.

The last few months have made Tucker believe trucking is about to enter the “Great Purge,” or another spate of major bankruptcies. He predicted in a June 10 Facebook post on the Rate Per Miles Masters group, which hosts about 33,000 trucking professionals, that the many truck drivers who flooded the industry amid unprecedented truck volumes would have to shut down their operations. Ill-prepared brokers would also face the same doom, he wrote.

I don’t think there’s enough freight out there to justify their existence anymore.

Tucker told FreightWaves this week

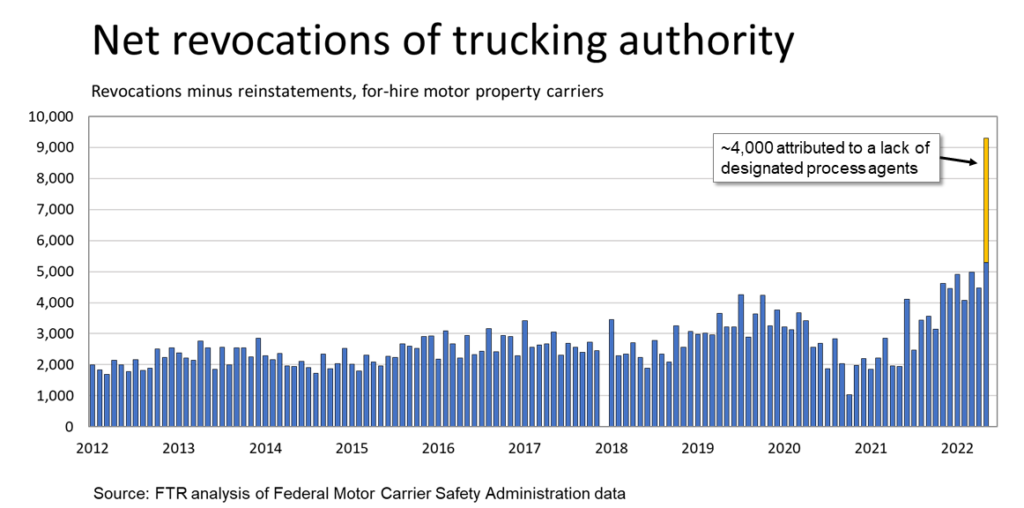

The Great Purge appears to be underway already. In May, net motor carrier revocations hit a record high, according to an analysis of federal data by FTR Transportation Intelligence. January and March of this year were the previous records.

As the above FTR graph shows, revocations of trucking authorities reached a record high in May, hitting nearly 9,300. The yellow bar represents some 4,000 revocations from entities that failed to file a required form and may be considered aberrations in the data. Even counting that out, though, the net revocations peaked.

Small fleets as tiny as one driver comprise the bulk of these shuttering trucking companies. Avery Vise, who is the vice president of trucking at FTR, said many of these drivers will join larger fleets rather than get flushed out of the market completely.

The following months will likely break May’s record, representing more fleets fleeing the market. The revocations represented above were likely filed before this spring’s diesel surge and spot rate decline, Vise said.

It’s an about-face from just a few months ago, when small truckers were still bringing in major cash. Here’s what happened:

2020-2022: All The Cool Kids Are Becoming Owner-Operators

In March 2020, retailers and manufacturers expected a long-term economic meltdown to result from the coronavirus. Instead, consumers bought more and more.

Retailers were caught flat-footed with empty warehouses and had to quickly scale up to meet consumer demand for exercise equipment, computer monitors and, yes, toilet paper.

New trucking fleets poured into the market to profit from these sky-high rates. From July 2020 to now, almost 195,000 new carriers have entered the market, according to Vise of FTR. About 70% of these new carriers were just one truck. The previous record 23-month period saw just 86,000 new carriers.

The flood of new carriers was felt around the industry.

Tucker of Full Coverage Freight, which is an independent agency with GlobalTranz, confirmed that through his own experiences. His office was flooded with calls from small truckers who had set up their authority only a few days prior.

We saw this developing 18 months ago. We could support this artificial introduction of all these carriers just because of all this activity going on.

Tucker said

The unusual marker of the last two years isn’t just that rates and volumes skyrocketed but where they skyrocketed: the spot market.

The spot market usually accounts for 10-20% of the overall trucking market. Vise said that share may have climbed to as high as 50% in the height of COVID-buying craziness.

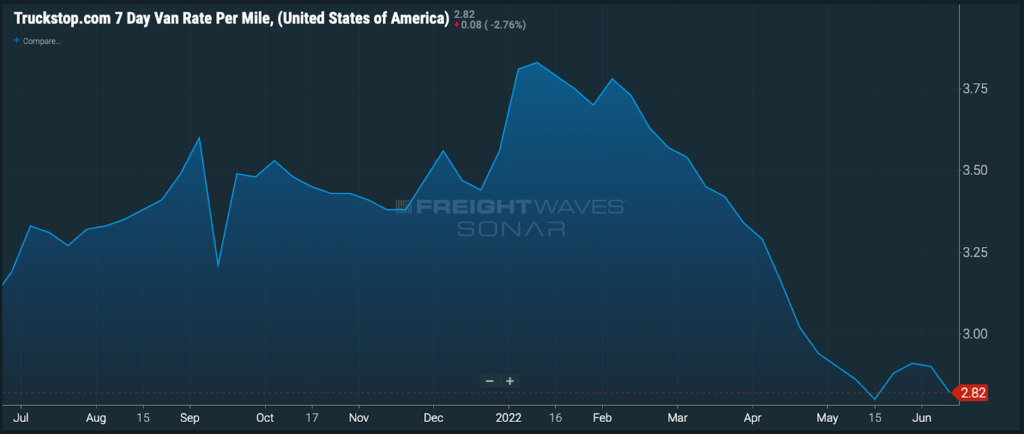

The rate to move a load on the spot market soared. Each month of 2021 seemed to break a new record in the rate to move a dry van, with the peak hitting in January 2022. It was a fantastic time to be a small trucker, who can pick up spot jobs easily.

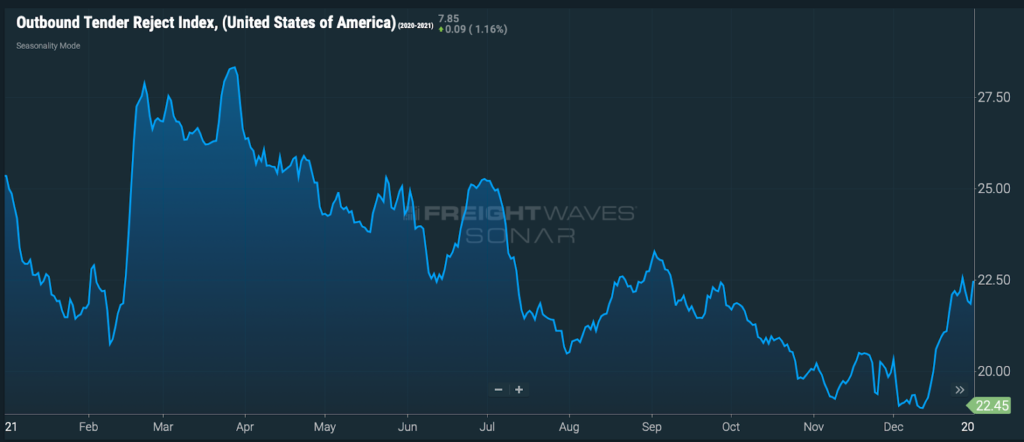

Contract rates didn’t climb at the same pace. That’s best measured by the Outbound Tender Reject Index, which shows how much contract freight is getting rejected.

Unlike, well, every other industry, you don’t need to honor your trucking contracts. If you’re a fleet that can make more money moving spot loads, you’re free to go do that. (Of course, keep in mind that your customer might not be so happy to give you a fair rate when spot rates inevitably crash again — and you’re struggling to make ends meet.)

Around 27% of all contract freight was getting rejected last spring. Even in late December 2021 and early January 2022, the rejection rate was more than 20%.

The spike in spot rates meant more capacity on the small trucker side. Trucking companies with more than 100 trucks didn’t grow at nearly the same pace as the part of the market with one-man bands. Vise estimated around 6-7% of capacity shifted from those fleets of 100-plus drivers to those under 100 in the past two years.

Spring 2022: A Collapse In Spot Rates Meets A Surge In Diesel

As you can safely expect in trucking, the good times ran out. In March, spot rates began a freefall at a stunning rate.

Mazen Danaf, who is the senior economist at Uber Freight, compared the month-over-month drop in spot rates excluding fuel. In March and April, rates dropped by 30 cents compared to the months prior. Rates dropped another 20 cents in May.

Those declines outpace the previous record decline: 15 cents.

Meanwhile, the contract side of the market is regaining territory. The rejection rate for contract rate, which loomed at more than 20% earlier this year, is now sitting at 7.7%.

Danaf said freight contracts that were negotiated in early 2022 took into account high spot rates. That allowed big trucking companies, which aren’t as active in the spot market as smaller ones, to secure higher rates from their customers. The new, small truckers that flooded the market in the last few years were less likely to have those sort of long-term relationships with big retailers and manufacturers. They lost out on any bump in contract rates earlier this year.

Now, Vise said spot accounts for about 30% of the market. Danaf estimated that number was 18%. Both indicate a trucking economy that’s shifting back from the volatile spot world to steadier contracts — even though it means that some smaller trucking companies will get shuttered in the process.

What we’re seeing is a shift of the market back to a traditional split. It could take a long time however.

Vise said.

Even more challenging to small trucking companies is the soaring cost of doing business. According to a report from loadboard Truckstop.com, it’s now 51% more expensive to run a trucking company in 2022 than last year. Smaller carriers are more likely to shoulder than burden.

The staggering cost of diesel is the most marked cost increase, with the smallest fleets struggling to keep up. Some truck drivers have shut down simply because they couldn’t afford diesel anymore.

David Guzman of San Antonio is one of them.

The way the rates are, you have to run twice as hard to make ends meet. I can’t help but feel for my fellow truck drivers.

He told FreightWaves in April.

Equipment has also become more expensive. Truck drivers who bought their trucks in 2021 are paying off loans on trucks that might be two or three times higher than normal. The cost of repairs is also pricier — up nearly 9% in late 2021 from late 2020. Such expenses aren’t getting subsidized by ultra-high spot rates anymore.

Others believe that this winnowing out of small truckers resembles something spookier than a mere shift from spot to contract. This week, FreightWaves CEO Craig Fuller wrote that the issues plaguing trucking may resemble a larger economic recession. Ocean volumes are beginning to collapse, reflecting record inflation and big-box retailers that are already full-up on inventory. What consumer spending is still growing is on the travel and entertainment side, which doesn’t move as much freight.

What’s going to happen is going to be tough. It’s going to be painful for a lot of people. Very few people will be left standing.

Tucker, the freight broker, said

There’s One Way Out For Small Truckers, But That Opportunity Is Closing

Vise said many of the small truckers who gave up their authority rejoined a big fleet as company drivers. Others leased their truck back to one of those mega-carriers, where they can benefit from fuel surcharges to underwrite big diesel payments

Those drivers might be the lucky ones. Those who already sold their trucks were still able to take advantage of high used truck prices, which are now quickly declining.

What’s more, there may not be many more jobs available at big carriers. Nonsupervisory trucking employment hit a record high in April, the latest available data from the Bureau of Labor Statistics. Vise said he’s closely monitoring these numbers to see if trucking fleets decide themselves they have too many drivers.

Vise is still positive on the current market, saying that trucking is shifting from spot freight dominated by small truckers back to contract loads dominated by big carriers. Pointing to pent-up manufacturing demand and signs of resiliency on the consumer side, he said he’s “fairly optimistic we will muddle through this year without a recession.”

Not all are feeling so chipper. Thom Albrecht, chief financial officer of transportation insurance agency Reliance Partners, said current rates can’t match the new cost structure of running a trucking company. Fuel, equipment and labor have become too expensive — and these problems are matching a slowdown in job creation and the Federal Reserve’s struggle to tame inflation.

The party’s over.

Albrecht said

AUTHOR COMMENTARY

The robbery of the wicked shall destroy them; because they refuse to do judgment.

Proverbs 21:7

The destruction of this country is deliberate for all eyes to see, and yet the masses’ eyes have been blinded because they have chosen to remain steadfast in their wickedness; as the media continually points the figure at everything else under the sun as to why supply chains are in ruins.

“It’s Pootin! It’s Pootin!,” they say.

Shipping MUST decline and be destroyed: it is spelled out in these globalist think-tank manifestos:

[By 2030] Development of petrol/diesel engines ends; Any new vehicle introduced from now on must be compatible with Absolute Zero. [Afterwards] All new vehicles electric, average size of cars reduces to ~1000kg. [By 2030] Growth in domestic and international rail as substitute for flights and low-occupancy car travel. [Afterwards] Further growth with expanded network and all electric trains; rail becomes dominant mode for freight as shipping declines.[By 2030] All airports except Heathrow, Glasgow and Belfast close with transfers by rail. [Afterwards] All remaining airports close.[By 2030] There are currently no freight ships operating without emissions, so shipping must contract. [Afterwards] All shipping declines to zero.[By 2030] National consumption of beef and lamb drops by 50%, along with reduction in frozen ready meals and air-freighted food imports. [Afterwards] Beef and lamb phased out, along with all imports not transported by train; fertilizer use greatly reduced.[By 2030] Rapid reduction in supply and use of all fossil fuels, except for oil for plastic production. [Afterwords] Fossil fuels completed phased out.

The famine in this nation is going to rapidly increase, as the dead masses will continue argue over something they know nothing of.

These two things are come unto thee; who shall be sorry for thee? desolation, and destruction, and the famine, and the sword: by whom shall I comfort thee?

Isaiah 51:19

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

As America is being destroyed and rightfully so, if it were to be state-by-state, California will definitely be one of the first. They’ve been so vile, heathen, Christ-rejecting, and anti-King James Bible for far too long.

Hollywood (HELLywood) San Francisco (San FranSICKO) San Diego (SIN Diego) Beverly Hills (Beverly HELLS) Los Angeles (Los ANIMALES) and so on. It’s virtually a socialist state already! If some college recruiter from one of those California universities came up to me I wouldn’t be able to hold myself in – I’d shout “take a hike, Bud,” and chase him off!

I pray that first innocent men, women, children, pets, stray animals, homeless people, businesses, sentimental value items, and belongings are moved out first…then a gigantic category five hurricane STRIKES California and its three times worse than Katrina!

Thank you for another excellent article!

I’m just as thankful as you are, ABC. We have a true believer who edifies us and we are permanently separated from the cult buildings – those dens of thieves who give weak insipid talks of sin but mostly watered down wishy washy gospels because the hirelings are more motivated by the tithe money, and they gotta tread lightly with the tithers lest they lose their income and can’t afford their new Mercedes Benz or send the youth group to their incognito vacation falsely called missions trips to Mexico and Jamaica.

“ [Afterwards] All shipping declines to zero.”

How will that even work??

It won’t. There’s no doubt it will reduce and shipping will be greatly stymied for a time, but it will not be erased. Some of these goals will never be achieved.

Revelation 8: [8] And the second angel sounded, and as it were a great mountain burning with fire was cast into the sea: and the third part of the sea became blood; [9 ]And the third part of the creatures which were in the sea, and had life, died; and the third part of the ships were destroyed.

Revelation 18: [17]For in one hour so great riches is come to nought. And every shipmaster, and all the company in ships, and sailors, and as many as trade by sea, stood afar off, [18] And cried when they saw the smoke of her burning, saying, What city is like unto this great city!

It is just a dream out of their own imagination. Lol

You will see a massive rise in black markets. Funny, when I was a kid you purchased pot on the street and food in the stores, now it’s going to be the opposite. Crazy world we live it. Psst, hey buddy, know anyplace I can score a pork chop?

Mitch – The hardest part of “two weeks to flatten the curve”, is the first two years.

I didn’t think it was possible to make me laugh with such a serious topic! And I’ve known a lot of independents. A LOT of Christians were out there driving truck & working as independents when the colleges & political correctness went nuts….all over the country. Used to be preachers would work the truckstops & always find enough for a service or Bible study. They avoided being sucked into it & raised families, & a remnant of the middle management college educated who got the boot when they started off-shoring who ended up out there, disillusioned with the American dream got saved ….but gradualism & craft like Disney’s, like Lot’s 20 years in Sodom, take their toll : – (.

–

But you succeeded in bringing a smile…. pot’s legal & state regulated (nothing of Rome in THAT…lol), & food’s going black market & barter. The happening markets for the unprincipled ambitious recently have been: pot & tattoo parlors. (Or vaccines) America’s been ailing for a long time, but there were still niches for the peculiar. The niches are going away.