The Independent Grocers of Australia (IGA), Foodworks, and United Petroleum, are now the first chains in the country to allow consumers to purchase basic essential goods like bread, milk, fuel, via short-term loans, otherwise known as “Buy now, Pay later.”

American media company CNBC has been documenting the rise of these credit apps on most e-commerce sites, as you may have been starting to notice them appear more and more in 2021. And CNBC reported in December of last year they show no signs of slowing down. These apps allow consumers to purchase items without paying full-price up front, and pay for the items over the course of an allotted time per varying interest rates.

Now these payment apps are reaching the most basic of commodities, and not just online either.

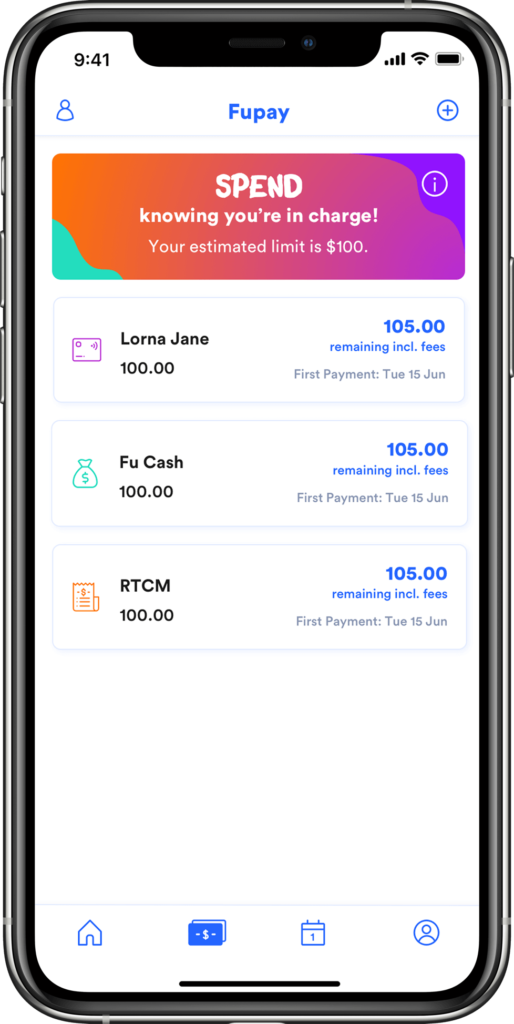

The Daily Mail reports that Fupay, Australian credit app company – who currently have roughly 200,000 users and plan to expand into Europe this year – have struck a deal with IGA, Foodworks, and United Petroleum to offer their “Buy now, pay later” services.

Michael Fredericks, managing director at Fupay, told Australian press that their service would help struggling consumers afford essential goods.

Our focus is on the everyday spending categories – relative to that our data shows that’s where the greatest need is in terms of our transactions.

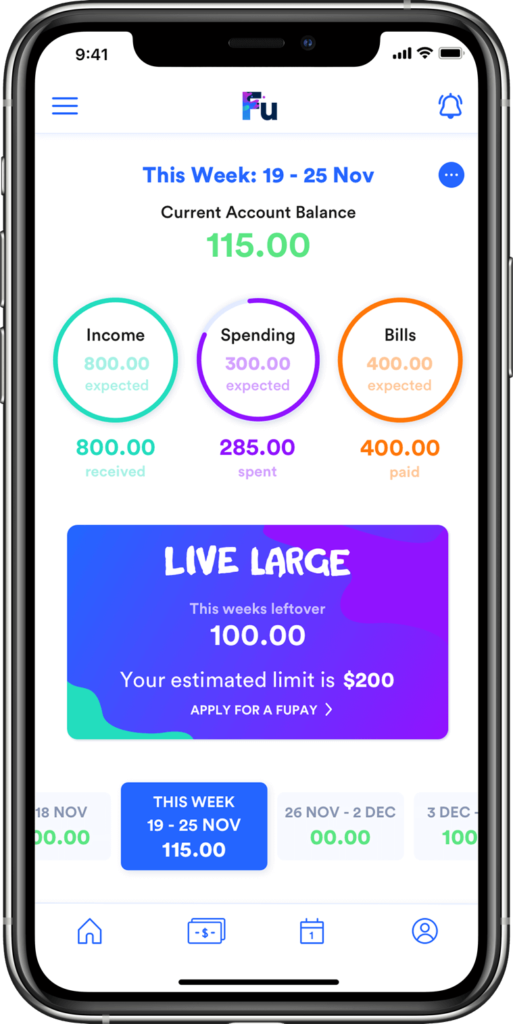

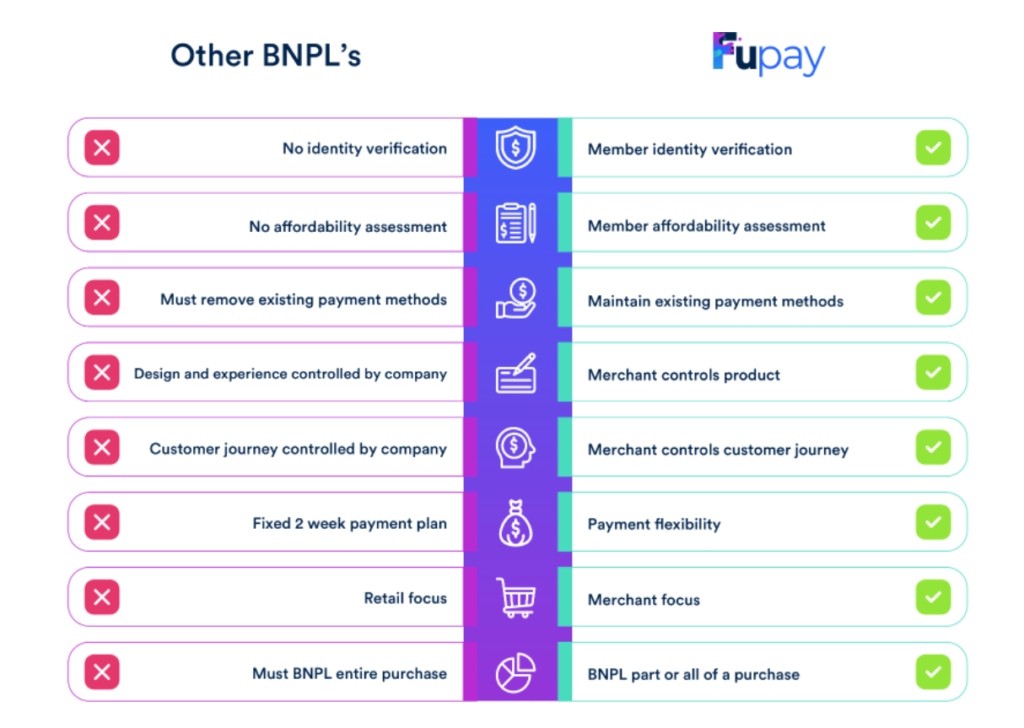

‘The feature work by linking the user’s bank account to Fupay, where an algorithm analyses their income, outgoing payments, and upcoming bills,’ the Daily Mail wrote. Users will be notified if their credit application has been approved. Those applying for the app most provide proof that they work for a recognized company.

Fredricks additionally noted that Fupay offers “smart spend” that analyzes the user’s financial situation and on rare occasions do they offer a $500 limit. Facial recognition is also required for use, per their identity checks.

In reality, not many people can pay back that amount or a lot of people struggle to pay back $500 in that buy now pay later eight week window.

He also admitted that 20% of people how use these buy now pay later services should not be given credit in the first place, and all these apps should be using filters to determine whether the consumer can repay the loan.

Even though Fupay has struck a deal with these grocery and gas chains, the company also provides services for payment deferral for all types of bills and expenses, rent, and other items, according to their website.

“Simply pay us back over 8 weeks with personalized repayments based on when and how much you can afford to pay. It’s that easy,” Fupay claims.

We aren’t here to Fu you over. We help you understand what you can afford, so you can spend knowing you’re in charge.

We don’t do the big stuff (🚗 🏠💍). We provide just enough help to spread out the costs of your everyday life.

Set your own personalised repayment schedule based on your affordability.

Defer all or just part of your bill, or get a bit of cash to tie you over.

Get the lowdown on your cashflow in real-time.

The company also explains

AUTHOR COMMENTARY

[7] The rich ruleth over the poor, and the borrower is servant to the lender. [26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee?Proverbs 22:7, 26-27

Last year, right around the time Biden’s $1,400 stimmie came out, I remember I was looking online for some new athletic attire for purchase (I had lost a ton of weight so I needed new clothes), and I remember I saw a pair of shorts that cost $28 (not including tax and shipping); and next to the checkout button there was a new credit app called Klarna, and the message read, “Or 4 payments of $6.99.” That speaks volumes: we now have people that are so broke and so covetous, they can’t even afford to pay for a pair of shorts upfront!

And now in Australia, the consumer is so broke they cannot even afford to buy basic items like food and fuel. That’s where we are at, folks. And how much longer before this comes to America, Canada, Europe, etc.?

Not only is this making habitual debt slaves in the most literal sense, this is conditioning people to accept the mentality of, “You’ll own nothing and be happy:” allowing people to flip burgers for the rest of their lives and get their weekly allowance for new toys. And since Fupay and others have to verify a lot of details for the user to make sure they can pay back the loans, it is creating the prelude to a social credit score, that determines what you can buy, how much, when, and so on.

Agenda 2030: You’ll Own Nothing And Be Happy

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Very similar to how credit cards work.

Yes it is.

Credit cards are evil, Thomas. Think of the credit card as “the debt ticket” and all the people here in Land of the Free and Home of the SLAVE America, people charge everything on credit cards from cars to houses to fishing rods and hunting rifles from takeout meals to a box of milk duds and a sprite, it’s no wonder debt in America is below the boiling point.