This morning the Labor Department released the latest set of jobless claims, which saw an unexpected rise from last week.

In the week ending in July 3rd, the U.S. saw another 373,000 new claims filed, reports MarketWatch. The previous week was 364K.

As of last week, on July 2nd, John Williams of ShadowStats updated his unemployment numbers to 25.8%, versus the official government numbers which is currently slightly below 6%.

And, amidst the slight rise in weekly claims, the International Monetary Fund (IMF) is now also admitting that not only is there inflation, it is surging – which, along with other groups, institutions, and the mainstream media, are now starting switch their tone, as The WinePress has noted severally times months ago these groups stated that inflation was only “transitory.”

Subleasing Office Space Leads To Savings

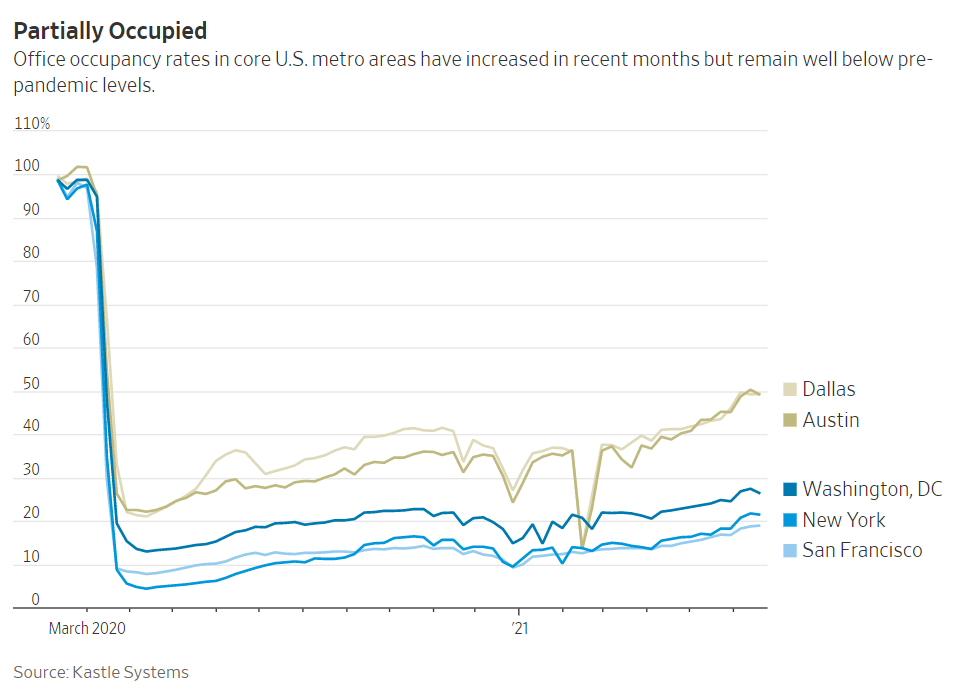

According to a recent Wall Street Journal report, companies are now making the moves to cut office space and buildings, which will save them millions of dollars annually.

‘Online listings company Yelp Inc., consumer loan provider Affirm Holdings Inc. and drug distributor McKesson Corp. in recent weeks have disclosed one-time charges related to plans to shrink their real-estate footprint. They are among many businesses that are subletting office space, choosing not to renew leases or taking other steps to slim down after giving employees more flexibility to work from home,’ according to the report.

Some other large companies such as Facebook are allowing some of their employees to work from home permanently, others such as Alphabet are requiring employees to come to the office a few times a week.

Affirm, the San Francisco-based company, has now evolved into a remote-first company, with its roughly 1,340 employees given the choice to come back to the office or stay at home.

Covid changed everything, and we became a remote-first company.

Michael Linford, the company’s chief financial officer.

Yelp ‘expects to book an $11 million impairment charge in the second quarter in connection with the agreements. Over time, however, Yelp expects to save an estimated $10 million to $12 million a year through 2024.’

Read more about it here:

Wells Fargo To Shut Down All Personal Credit Lines

The following report is from the International Business Times:

Wells Fargo on Thursday gave customers a 60-day notice that it is shutting down all existing personal lines of credit and will also no longer be offering its popular lending product, according to a CNBC report.

The $3,000 to $100,000 in revolving credit lines were a way for customers to consolidate higher-interest credit-card debt, pay for home renovations or avoid overdraft fees on linked checking accounts, CNBC noted.

In an effort to simplify our product offerings, we’ve made the decision to no longer offer personal lines of credit as we feel we can better meet the borrowing needs of our customers through credit card and personal loan products.

The bank said in the emailed statement.

Wells Fargo, which is the third-biggest bank with nearly $1.8 trillion in total assets, also warned customers that the account closures “may have an impact on your credit score.” The San Francisco-based financial services company did not disclose how many credit lines customers it is eliminating.

According to its most recent Quarterly Supplement report, Wells Fargo had $24.9 billion in loans in a category called “other consumer” as of March, which was 26% lower than the year-earlier period.

The move comes more than a year after the bank suspended home equity loans, given the economic uncertainty of the pandemic, Reuters noted.

We apologize for the inconvenience this Line of Credit closure will cause. The account closure is final.

AUTHOR COMMENTARY

Not too much more to add here: it’s the same old song and dance I have said in all these reports. And now we are seeing banks cutting off credit, which will help the banks and hurt the people that are reliant on living the quick money extended to them.

Plus, with more office work fading out, this helps with the new communal living arrangements that the WEF has planned for Agenda 2030.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.