Sustained Unemployment

This morning the Labor Department released the jobless claims for the week ending in June 26th. The jobless claims fell to 364,000 people filing for unemployment – a 51K decrease from the week previous – which MarketWatch says is a ‘new pandemic low.’

Additionally, 115,267 applications for benefits were filed through a temporary federal-relief program were announced by the government,’ according to the MarketWatch report.

As Jobless claims for the week have fallen, continuing claims, however, have risen to 3.4 million, a 56,000 increase according to the New York Post.

The WinePress reported two weeks ago that two dozen states by now have already, or are about to, cut many of their Covid-related benefits earlier than the end date in September, amidst a reported labor shortage.

Just yesterday, June 30th, The WinePress also noted that hundreds of thousands of retail workers are quitting their jobs, which, according to the reported findings, is because of a multitude of issues, such as: low pay, long hours, understaffed stores, rude customers, and so on; while many of these workers are turning to government jobs, fitness centers, agencies, going back to school, or dabbling in the art world.

“Skills Canyon”

Citing a recently published Pulse of the American Worker Survey courtesy of Prudential, Yahoo Finance reports that their is growing skills gap that, as anchor Seana Smith said, ‘is a threat to the economic recovery and Americans are worried their financial security may be in jeopardy as a result.’

Roughly 50% workers replied that they will need to learn new skills within the next year to continue working their current jobs, resulting in many on edge that they will be unprepared to seize on potential job opportunities.

Before the pandemic… there was a skills gap. Post-pandemic, we may be saying there’s a skills canyon. You’re not going to be able to hire your way out of that problem. … You’re well-served to be investing in the skills of your employees.

It’s employees who are looking to their employers to provide the opportunity for upskilling, reskilling, and training. Employers need to invest in training their workforce… They need to do it for their own purposes because they’re not going to find the skills in the marketplace.

[It previously was] about every decade or so you had to reinvent yourself to be relevant in the workforce, but that’s accelerated to a four-year period of time with the rapid adoption of technology, AI, automation. You need to stay on the leading edge of the evolution of the necessary skills to be creating value in an organization, and that means you have to constantly be reinvesting in an education process.Rob Falzon. Prudential Financial Vice Chair

Citing a recent McKinsey Global Survey, almost 90% of executives acknowledge a skills definite skills gap or expect one to arise in the next few years, however, less than half of these executives plan to reskill and educate their employees.

‘Nearly half of workers and 30% of managers responding to Prudential’s survey believe problem solving skills and adaptability will be valuable in the years to come, while computer technology and remote work capabilities topped the list for skills most needed in the near-term,’ according to the Yahoo report.

Living On A Prayer

Citing evidence from a news service PYMNTS.com and LendingClub, an online financial services firm, the Trends Journal, reports that 54% of Americans and 70% of Millennials are living paycheck to paycheck, according to a large survey of 28,000 households.

The survey found that Baby Boomers (57-75 years old) barely have any savings, or none at all.

Millennials — especially older ones — are collectively at important stages of their lives.

They may be starting families or taking on their first major purchases, such as homes and new vehicles, but they may also be less advanced in their careers than their older counterparts, [due to having lived through the Great Recession, 2020’s economic meltdown, and two housing crises.]The survey report says

From rising costs of housing to even things such as pet food, a lot of Millennials are chained to student debt.

Living paycheck to paycheck sometimes carries connotations of barely scraping by and of poverty. The reality of a paycheck-to-paycheck lifestyle in the U.S. today is more complex.

To demonstrate, 6 out of 10 of the Millennials are earning six-figure salaries are also reported to live paycheck to paycheck, because of the potential for what is called “lifestyle creep,” which means that, as the salaries grow so does the lifestyle it can buy.

The data reveals that those living paycheck to paycheck are greatly responsible, ‘if not frugal, in their financial lives.’

Gerald Celente, founder of the Trends Journal gives his commentary:

TREND FORECAST: This is not news to Trends Journal readers (“Buddy, Can you Spare a Dime?,” 18 February, 2020), but the ongoing financial crisis is making the situation worse.

Inflation, rising housing costs, the rising cost of advanced education, and a job market demanding increasingly specialized and sophisticated skills will leave more and more Americans falling behind financially.

Also, as we reported, the Pew Research Center found that 52% of young adults lived with one or both of their parents, a rate that the U.S. Census Bureau data notes is higher than any previous measurement.

As a result, Millennials – already leaning socialist politically – will turn up pressure for a more expansive social safety net and sharing of costs in education, health care, and other areas.

Money Printer Goes Brrr

The following is written by Trends Journal writer and stock market expert, Gregory Mannarino:

Before I proceed with this article, keep this in mind: the current environment IS NOT what it seems, and NOTHING is happening by accident.

Every single week the economic news continues to be bad, more like abysmal, and although the mainstream narrative is attempting to desperately convince you otherwise, debts and deficits are hyper-ballooning. Moreover, as a percent of debt to GDP, the US Economy is CONTRACTING. Meanwhile, just in the last week the NASDAQ and the S&P 500 have hit new all-time record highs. The fact that this market continues to rise should be of no surprise to you IF you have been following my work here at the Trends Journal moreover, the market is going even higher.

All the talk as of late is skyrocketing inflation, in fact, the cost of living here in the US is rising at its fastest pace EVER!

Allow me to let you in on a big piece of information that you are not supposed to know. Regardless of the current pace of inflation, the Federal Reserve has no intention whatsoever of raising rates any time soon, and the worse the economic news gets, the higher the stock market will continue to go.

Here is yet another secret—the Federal Reserve has not even begun to inflate, they are still in the middle of their endgame—to hyper-inflate, and as such—own it all.

Last week the mainstream media reported that the major banks all passed their Federal Reserve Stress Tests with flying colors! Can you imagine my shock?! These institutions have a mainline directly to the Federal Reserve, and have so much cash that they do not even know what to do with it!

Ah! But we do know what they will do with it—buy back shares of their own stock and increase dividends. What will be the result? A stock market which will be propelled higher. (I have been urging people to buy energy and financial stocks for months, and it is already paying off big, with more gains to come).

Over the past several months I predicted that crude oil would be over $70 a barrel, well, now we are at $74. The higher price of crude will boost the entire energy sector of the market.

AUTHOR’S NOTE: At the time of this publication, crude oil has now surpassed $75.

The mechanism here is simple. If the energy and financial sectors of the market can be propped up, the rest of the market will follow as the Fed continues to fuel the debt market with easy money.

Forget any talk about the Fed “tapering” or “lifting off,” it is just not going to happen as the Fed is maintaining and moving closer to its end game—again, to own it all.

The Fed will not taper its asset purchasing program until it is done, and it is not done.

I fully expect that the Federal Reserve will be increasing the pace of its debt purchases, and not tapering them—even if they have to come up with some kind of new scheme, or perhaps engineer a new crisis of some kind to make it happen.

The power of a central bank resides in its ability to issue more and ever-increasing amounts of debt. Every single dollar of debt a central bank is called upon to issue, makes them exponentially stronger.

AUTHOR COMMENTARY

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

The rich man’s wealth is his strong city: the destruction of the poor is their poverty.

Proverbs 10:15

As WinePress readers know, the signs are everywhere: the economy is imploding and falling apart from every angle. But, as no surprise, the markets HABITUALLY are hitting ‘new record highs’ every. single. week. – and it will NOT stop anytime soon. As I have explained in many other reports, as has people such as Mannarino on a routine basis: the more abysmal economic news, the more markets go higher. Why? Because the markets know that the Federal Reserve will continue to print money into existence from nothing to keep the markets and economy “functioning,” creating debt while buying up the little serf’s debt, and while mega banks (including the FED), private equity firms and institutions, are tapping everyone out.

But hey, pay no attention to that: the media mainstream “experts” are telling us we are in a “boom” and “v-shaped recovery.” If you believe that, you believe in the Easter Bunny.

Speaking of characters such as the Easter Bunny, a WinePress contributor made me aware of something President Trump said recently at a press conference with Texas Governor Greg Abbott, that, under Biden’s direction, America is on the cusp of becoming a “banana republic.”

Now, most people, have no idea what that means, as most people think that is referring to the retail store, or is just Trump riffing again; but it is actually an idiom that describes a fallen and corrupt nation.

The term “banana republic” was coined in 1901 by American author O. Henry in his book “Cabbages and Kings” to describe Honduras while its economy, people, and government were being exploited by the American-owned United Fruit Company.

The societies of banana republics are typically highly stratified, consisting of a small ruling-class of business, political, and military leaders, and a larger impoverished working-class.

By exploiting the labors of the working class, the oligarchs of the ruling-class control the primary sector of the country’s economy, such as agriculture or mining. As a result, “banana republic” has become a derogatory term used to describe a corrupt, self-serving dictatorship that solicits and takes bribes from foreign corporations for the right to exploit large-scale agricultural operations—like banana plantations.

Robert Longley from ThoughtCo.

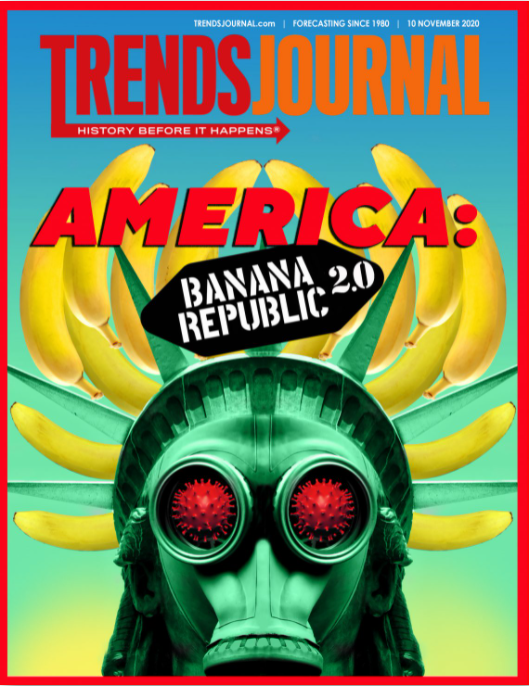

Uhh, I hate to burst your bubbles out there, but if you are not living in Candy Land and talking a stroll along the gumdrop roads, America IS a banana republic! The Trends Journal, for example, published their weekly magazine after the 2020 election declared America as “Banana Republic 2.0.”

And this is the typical operating procedure from Trump and his lackeys: they have to continually keep pushing this narrative that everything is getting better, when in reality, most of what they did, and still are, is complete white-washing of facts and reality.

Speaking of the obvious skills gap that only have been juiced because of the lockdowns (not a “pandemic”) the government imposed, Trump and his daughter Ivanka created a campaign that was literally called “Find Something New.” More like, “Let Them Eat Cake!” So, after his administration and all the state governments locked us down without our permission, decimating the economy, then they tell all the little impoverished serfs that lost their jobs to go “find something new,” and offered courses to retrain and educate these laid off employees – that would take years just to learn the basics, and does not guarantee a check or even an interview. Literally, “Let Them Eat Cake!” That campaign went belly up quickly, as Liberals attacked it and Conservatives blinded themselves even more, and then soon after we were told the economy was soaring!

Remember When Trump Spoke At The World Economic Forum With His ‘Good Friend’ Klaus Schwab?

[20] Woe unto them that call evil good, and good evil; that put darkness for light, and light for darkness; that put bitter for sweet, and sweet for bitter! [21] Woe unto them that are wise in their own eyes, and prudent in their own sight! [22] Woe unto them that are mighty to drink wine, and men of strength to mingle strong drink: [23] Which justify the wicked for reward, and take away the righteousness of the righteous from him! [24] Therefore as the fire devoureth the stubble, and the flame consumeth the chaff, so their root shall be as rottenness, and their blossom shall go up as dust: because they have cast away the law of the LORD of hosts, and despised the word of the Holy One of Israel. [25] Therefore is the anger of the LORD kindled against his people, and he hath stretched forth his hand against them, and hath smitten them: and the hills did tremble, and their carcases were torn in the midst of the streets. For all this his anger is not turned away, but his hand is stretched out still.Isaiah 5:20-25

But it’s not just Trump, it is the entirety of the presstitutes that are paid to put out to their corporate pimps, to propaganadize people into thinking things are getting better when they are not. Bryan Denlinger of King James Video Ministries had really good sermon about Satan’s favorite trick, which is to disillusion people with the idea that things are getting better, things are evolving, change is good, etc. Check it out.

[3] Knowing this first, that there shall come in the last days scoffers, walking after their own lusts, [4] And saying, Where is the promise of his coming? for since the fathers fell asleep, all things continue as they were from the beginning of the creation. [5] For this they willingly are ignorant of, that by the word of God the heavens were of old, and the earth standing out of the water and in the water: [6] Whereby the world that then was, being overflowed with water, perished:2 Peter 3:3-6

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.