The WinePress has been reporting on what is going on in the American economy, and others too, but primarily what has been unfolding in the states. To find those reports, feel to visit the Economy tab on our site.

Mainstream media, whether it be on the left or the right, is not being honest and transparent with Americans and the rest of the world as to the current state of the economy.

In this report, I wish to explain one of the quickest ways you can know the overall shape of an economy summarized in a nutshell. I have mentioned what I am about to explain before in other reports months ago, so regular readers might already know this. But this serves as a great reminder as to where things are at, where they were, and where they are heading; additionally, to readers that are new to The WinePress and/or unaware of some key facts about the current state of the American economy.

What is known as Money Velocity, or the Velocity of Money, is a critical measurement to judging the state of an economy, though, unfortunately, this is a metric that is rarely if ever discussed in mainstream.

According to Investopedia, this is what velocity of money represents:

The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money.

The velocity of money is usually measured as a ratio of gross domestic product (GDP) to a country’s M1 or M2 money supply.

The velocity of money is important for measuring the rate at which money in circulation is being used for purchasing goods and services. It is used to help economists and investors gauge the health and vitality of an economy. High money velocity is usually associated with a healthy, expanding economy. Low money velocity is usually associated with recessions and contractions.

Velocity of money is a metric calculated by economists. It shows the rate at which money is being transacted for goods and services in an economy. While it is not necessarily a key economic indicator, it can be followed alongside other key indicators that help determine economic health like GDP, unemployment, and inflation. GDP and the money supply are the two components of the velocity of money formula.

Economies that exhibit a higher velocity of money relative to others tend to be more developed. The velocity of money is also known to fluctuate with business cycles. When an economy is in an expansion, consumers and businesses tend to more readily spend money causing the velocity of money to increase. When an economy is contracting, consumers and businesses are usually more reluctant to spend and the velocity of money is lower.

Since the velocity of money is typically correlated with business cycles, it can also be correlated with key indicators. Therefore, the velocity of money will usually rise with GDP and inflation. Alternatively, it is usually expected to fall when key economic indicators like GDP and inflation are falling in a contracting economy.

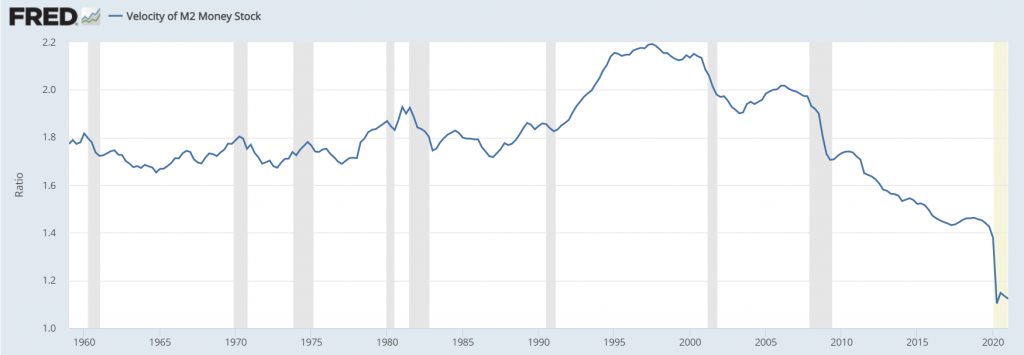

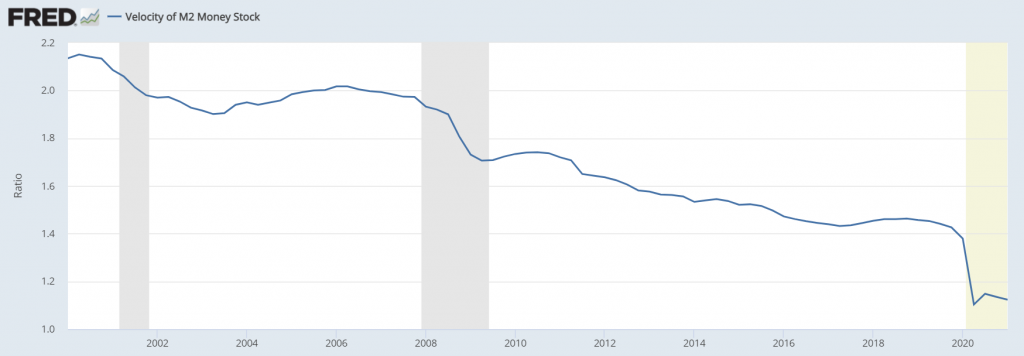

Now, knowing that definition of money velocity, take a look at a graph provided by the St. Louis Federal Reserve:

The Investopedia definition of money velocity is also connected to what is known as Money Supply. Here is what Investopedia defines as money supply:

The money supply is all the currency and other liquid instruments in a country’s economy on the date measured. The money supply roughly includes both cash and deposits that can be used almost as easily as cash.

Governments issue paper currency and coin through some combination of their central banks and treasuries. Bank regulators influence money supply available to the public through the requirements placed on banks to hold reserves, how to extend credit and other regulation.

Economists analyze the money supply and develop policies revolving around it through controlling interest rates and increasing or decreasing the amount of money flowing in the economy. Public and private sector analysis is performed because of the money supply’s possible impacts on price level, inflation, and the business cycle. In the United States, the Federal Reserve policy is the most important deciding factor in the money supply. The money supply is also known as the money stock.

An increase in the supply of money typically lowers interest rates, which in turn, generates more investment and puts more money in the hands of consumers, thereby stimulating spending. Businesses respond by ordering more raw materials and increasing production. The increased business activity raises the demand for labor. The opposite can occur if the money supply falls or when its growth rate declines.

The website goes onto explain some of the further breakdowns and subcategories of this measurement.

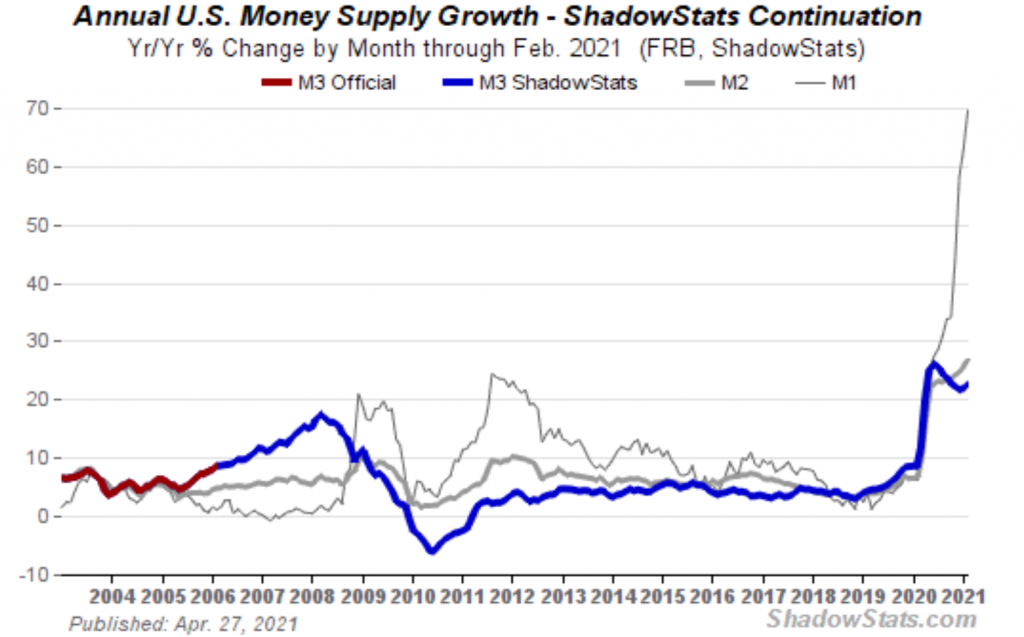

Knowing that definition, take a look at a chart of the money supply provided by ShadowStats:

These two pieces of information, as I said, are next to never discussed. Moreover, the mainstream financial and business outlets simply do not discuss these topics – such as Fox Business, CNBC, CNN Money, Bloomberg, Yahoo Finance, Forbes, and others.

AUTHOR’S NOTE: See my commentary at the end for further analysis of these statistics.

Thermal Nuclear Inflation Is Silently Approaching

The following article is by Trends Journal writer Gregory Mannarino:

Turn on the mainstream news and all the talk now is about the rising state of inflation. It’s an interesting situation, as, for years, the talk used to be “there is no inflation” – but that narrative has certainly changed in a big way.

This mainstream spin on this is: “The current spike in inflation is temporary.” Oh yes! There is inflation, but do not worry; it is just transitory.

Really? Transitory?

I have explained for years in interviews and in my blog, and, more recently, in several articles I have written for the Trends Journal, that rising inflation would become a problem. And, make no mistake about it, this is not by accident.

In my article last week, “THE FED’S DANGEROUS GAME,” I described how the Federal Reserve is using a kind of revolving door mechanism to create currency devaluation, which is massively inflationary. Through one door, the Fed is creating epic sums of debt out of thin air in the form of currency expansion. And through another door, the Fed is buying debt.

This mechanism, by design, is hyper-inflationary. Today, we are seeing the effect of this inflationary revolving door everywhere. People are getting nervous, henceforth, that is why Fed Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen are propagating the false narrative that the current state of inflation is transitory.

What you are not supposed to know is this: The current state of inflation is about to get much worse.

I would like to shed some light on the main forces that are working to assure that inflation will continue to rise.

For nearly a decade, the Federal Reserve has been on a currency creation/money-printing binge, unlike anything that has ever been seen in the history of the world. They have been able to get away with this because the economy is essentially dead and has been since the meltdown of 2008.

The dead economy has caused the velocity of money, which is the rate in which cash moves through an economy, to crater down to historic lows. By the velocity of money being at historic lows, all the extra cash created by the Fed cannot chase the existing amount of goods created, but this is changing.

There is essentially NO WAY for the Federal Reserve to prevent the epic sums of cash it has created from eventually chasing the same or existing amount of goods, which leads us back to the money velocity.

Once the money velocity begins to move higher, even fractionally, the specter of massive and even possibly hyper-inflation become very real possibilities.

The fact of the matter is this: We are currently in a currency crisis, and therefore the Fed, to prevent a complete lock-up of credit, MUST continue to create epic sums of cash out of thin air. If, for example, the Fed were to stop printing cash, in a nanosecond, we would have a global lockup of the entire financial system.

The prospect of inflation being “temporary” or transitory is a LIE. I foresee a full-blown financial crisis is on the horizon.

Here, again, this is no accident. The Federal Reserve is working to bring this about, so they can roll out a new currency system, which will be 100% digital, 100% fiat.

AUTHOR COMMENTARY

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

The rich man’s wealth is his strong city: the destruction of the poor is their poverty.

Proverbs 10:15

If you know nothing about the economy, and all the finer points, default to the two points I laid out in this report. If you know nothing else, know those and engrain them in your brain like you brand a horse.

These facts are purposely ignored in the mainstream media, left or right, because they absolutely destroy the narrative that the economy is booming or ever was in the last decades.

You and I were led to believe by Trump himself and his many cheerleaders and acolytes, that the economy was the strongest it has ever been and was booming. But as The WinePress has explained in other reports, that was not the case. There were some improvements in some areas, yes, but these were extenuated by the media and blown out of proportion, as other critical details were completely swept under the rug; and if you dared raise any kind of question, concern, and criticism, you would be chastened for not blindly joining the conga line off the cliff and into the ditch.

Let them alone: they be blind leaders of the blind. And if the blind lead the blind, both shall fall into the ditch.

Matthew 15:14

But as I have shown, just look at the charts: how in the world is that a strong economy? It isn’t, but you are not supposed to know this. Not only that, Trump and his cheerleaders like Steve Mnuchin or Larry Kudlow were telling us that we are going to see a “V-shaped recovery in the economy,” and it would come back even stronger than ever before. If you look at the money velocity chart, you can see a small ‘v’ that was formed in 2020, so perhaps this is the V-shaped recovery they were talking about.

Of course, I say that sarcastically. It is an absolute lie. There is no recovery to speak of, nor will there be.

As detailed in other reports, America is a dead corpse still on life support. Household debt has reached ridiculous highs while most Americans can barely make a small savings and emergency fund. But we are not supposed to ponder that: just as long as the stock goes up because the Federal Reserve has been juicing the markets will endless money and buying up all the debt.

Americans In Massive Debt. Setting Up ‘GoFundMe’ Accounts To Pay Bills

The list of our problems are endless, and I cannot cover them here. Again, go back and check out our economic reports for more information.

To do a bit of self-promotion, no other professing Christian outlet will even dare touch or discuss the information we are presenting right now. The WinePress is doing what we can to warn you of what is happening, what will happen, and how to prepare. These other Christian outlets, I can say with the upmost confidence, are next to useless as they are hardly discussing the real issues at hand; but rather bow down at the altar of Trump: a man that has completely and utterly lied to its people, but the masses choose not to admit to it, or any of these politicians for that matter.

America has an extreme pride and ego pandemic. If the masses were to be able to fix the financial ruin, they would have to admit to themselves that they have a problem, they were wrong, and that they were lied to and believed in lies. But since that is too hard for them to do that, they must continue to live in their fantasy world and find it easier to deny the truth, as admitting to it at this point would basically admit that there is little they can do to fix their situation.

Am I therefore become your enemy, because I tell you the truth?

Galatians 4:16

But as I was saying, The WinePress is not afraid to tackle these issues unlike most. We have people like Dave Ramsey, who is this “money guru” for the broad “professing Christian evangelicals” – are spouting off rhetoric that the dollar is never going away and that there will he no market crash. If you believe that, you must also believe in the Easter Bunny, because that is absolute lunacy. But this is why I humbly say that this is why you pray and do what you can to support The WinePress because people simply just do not know the facts like they ought to. Please, share these reports and get the word out there. Though most will ignore the warnings, it may wake someone up and help them get prepared and learn the truth.

ADDENDUM: I would also like to add some ways to prepare for the looming implosion. In my original post, I told readers to go through and read some of our other reports on the economy. I ignorantly assumed some would do that, as in many of these reports, I explained some ways to help prepare for the days ahead.

Unfortunately, there is not a good answer, especially in everyone’s situation. Most of these are things you will have to do your own due diligence on. I cannot wave a magic wave and fix all your problems, as the same applies to me. What I do recommend are some general basics:

If you have any debt, get them paid off asap. As explained by the general and biblical principle of Proverbs 22:7, you are a servant, a slave, to the lender. So to be truly free you must get to a point where you “owe no many anything” (Romans 13:8).

You must take control of your health. And that is a broad topic, but if you are overweight, work hard to lose it. Get proper nutrition and supplements, exercise, sleep, hydration, hygiene, and so on. Conjointly, greater learn and study self-defense tactics. Learn how to defend yourself. Perhaps obtain some weaponry, such as a gun (Luke 22:36-38). The only metal I endorse is brass.

This leads me to another point, and that is, I caution people to not buy into gold, silver, precious metals, and even cryptos. We have a study about this topic on The WinePress, so please check that out. It is a trap (Proverbs 11:4).

Should A Christian Invest In Gold And Silver?

Stop spending money on useless junk (Proverbs 28:16). Live well below your means. Even if you are not in debt, be frugal. Conserve your wealth. Use and reuse items, use them sparingly, and get the most out of them (Proverbs 12:27).

Consider your location. If you are in a bad area, especially a city, you should greatly consider getting out of these areas. Again, check out the future smart cities initiatives that are not conspiracy theory, but is happening right now.

Agenda Absolute Zero: You’ll Be Enslaved And Be Happy

Have some additional food, water, clothing, ways to generate heat, cold, and so on. Be your own bank. Be your own grocery store.

These all sound like lofty goals, but they are more than attainable, but you MUST be diligent and work towards them. Additionally, there are a tremendous amount of opportunities to capitalize on and make money right now. If you act accordingly and learn some good skills, you could earn plenty of money, or at least some extra money on the side.

That being said, and this is the unfortunate reality for most of the broad masses: what I said will not apply to most of them. These people, as I alluded to in my earlier commentary, are simply screwed, and it will take far too long to accomplish many of the goals I have laid out.

[7] Be not deceived; God is not mocked: for whatsoever a man soweth, that shall he also reap. [8] For he that soweth to his flesh shall of the flesh reap corruption; but he that soweth to the Spirit shall of the Spirit reap life everlasting. [9] And let us not be weary in well doing: for in due season we shall reap, if we faint not.Galatians 6:7-9

He that soweth iniquity shall reap vanity: and the rod of his anger shall fail.

Proverbs 22:8

Saved or lost, you reap what you sow. And unfortunately for most, they are going to be left holding the bag.

He that is surety for a stranger shall smart for it: and he that hateth suretiship is sure.

Proverbs 11:15 (see also Proverbs 6:1-5).

The piper must be paid, as the old folktale describes. So, as one commenter put it, many are trapped in a net and, sad to say, will not find a way out, as they have just made too many foolish mistakes and committed all kinds of iniquities. Therefore, they must pay the price for it. I know that may sound cold to many, but it is the hard but very true reality of the situation.

There is a story in the Old Testament (1 Kings 22), as Israel was falling apart and nearing total collapse (just as America), the prophet Micaiah was brought in reluctantly by the kings of Judah (Jehoshaphat) and Israel (Ahab); as the other prophets guaranteed prosperity, Micaiah spoke by the Lord and told them their fate and future failure. To which one of the kings, who knew Micaiah was “Mr. Doom and Gloom, was not going to say anything good. He was then punched and then ordered to be taken away and imprisoned. Long story short, Micaiah was right and Ahab bled out in battle.

I am by no means a prophet, but unfortunately, I have to be the messenger, a watchman, a sentinel in the watchtower of battle, to deliver the bad news. That is what I see and this reality. Do not harm the messenger.

[18] Hear, ye deaf; and look, ye blind, that ye may see. [19] Who is blind, but my servant? or deaf, as my messenger that I sent? who is blind as he that is perfect, and blind as the LORD’S servant? [20] Seeing many things, but thou observest not; opening the ears, but he heareth not. [21] The LORD is well pleased for his righteousness’ sake; he will magnify the law, and make it honourable. [22] But this is a people robbed and spoiled; they are all of them snared in holes, and they are hid in prison houses: they are for a prey, and none delivereth; for a spoil, and none saith, Restore. [23] Who among you will give ear to this? who will hearken and hear for the time to come? [24] Who gave Jacob for a spoil, and Israel to the robbers? did not the LORD, he against whom we have sinned? for they would not walk in his ways, neither were they obedient unto his law. [25] Therefore he hath poured upon him the fury of his anger, and the strength of battle: and it hath set him on fire round about, yet he knew not; and it burned him, yet he laid it not to heart.Isaiah 42:18-25

Confidence in an unfaithful man in time of trouble is like a broken tooth, and a foot out of joint.

Proverbs 25:19

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

So how do we prepare? You said you would help us know how to prepare for this- then no suggestions. If we save, our savings is likely to be confiscated -especially if they change the currency to digital. If we buy gold, it could be outlawed or taxed to the hilt as any sale has to go into the digital system. It appears to me we are all caught in this net.

I am wondering that, too! I have my money in the stock market now; mutual funds, to be exact. This is all so depressing, and I wish I knew what I should do to prepare for the upcoming times, as well! The money I have is from my grandparents and I want to be a good steward of the funds, definitely!

See the addendum in my commentary.

I just noticed this. Thank you, Jacob!

Do you mind if I quote a few of your posts as long as I provide credit and sources back to your weblog? My website is in the exact same area of interest as yours and my visitors would truly benefit from some of the information you provide here. Please let me know if this alright with you. Thanks a lot!

Thank you, I have recently been searching for info approximately this subject for ages and yours is the best I’ve came upon till now. However, what concerning the conclusion? Are you sure in regards to the supply?