This article will cover two different reports that demonstrate that the masses have not learned from their mistakes that led to the financial crash in 2008-2009 known as the Great Recession.

The WinePress has expressly warned readers that a massive financial collapse is on the horizon, and these reports further prove our previous claims. To see more information on this, please check out our other economic reports.

Cash-Out Refinancings Hit Highest Level Since Financial Crisis

The following report is from ZeroHedge:

The rigging of interest rates by hapless central banks continues to do its job in distorting the market. In addition to boosting both bonds and stocks, it also has homeowners drawing on cash out refinancings at the quickest clip since the global financial crisis.

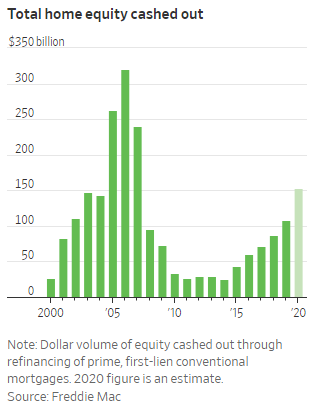

$152.7 billion was cashed out in home equity last year, up 42% from 2019 and the most since 2007, according to the Wall Street Journal. At the same time, lenders originated more mortgages than ever in 2020, helped along by $2.8 trillion in refinancings.

Some homeowners chose to use the cash to re-do their homes, since they would be spending more time in them. Others just wanted the cash as a war chest against the uncertainty of Covid.

The support coming from home equity is unparalleled in helping smooth out the degradations from Covid. For those who are in the position to refinance, it’s a major source of support.

Susan Wachter. Economist and professor at the University of Pennsylvania, told the Wall Street Journal

In 2008, cash out refis became the enemy, since they left many people owing more than what their house was ultimately worth. Today, economists believe housing prices will continue to rise and support the idea of cashing out. Low rates also make it an obvious decision; the average rate on a 30 year fixed mortgage fell below 3% for the first time last year.

There are genuinely a lot of people who want to buy homes to live in. They’re not just buying them to buy them or speculating that home prices will continue to rise. People are buying because they want them and they’re not trying to sell again the next year.

Daryl Fairweather. Chief economist at real-estate brokerage Redfin Corp

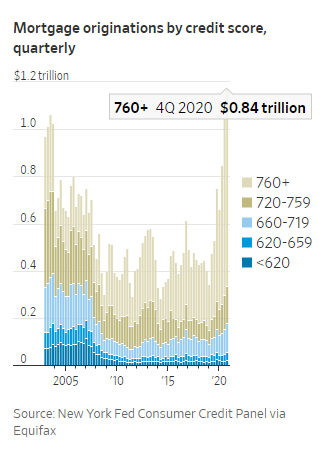

Median home prices rose to $310,000 in December, up almost 13% from December 2019. The price increases have been felt the most in suburban and rural areas, as an exodus from cities continues. Meanwhile, the median credit score for those who refinanced has approached 800.

Todd Kennedy of North Texas refinanced and lowered his rate by almost 100 bps. He cashed out $30,000 in the interim to help pay for some home improvements and said he considered a refi when it mortgage company reached out with an offer. His credit score is about 780.

They said, ‘Hey, you’ve already got equity. We can do a lower rate and get cash back.’

Todd Kennedy

St. Louis’ Wendi Comello also closed on a cash out refi. Her home, purchased at $95,000 in 2014, appraised for $150,000. She’s going to use the proceeds to pay off credit card debt and renovate her kitchen. Because she had a credit score in the 600s, she wasn’t able to lock in a lower rate.

Mortgage loan officer Eric Henning said many customers have taken out “larger than usual” sums of cash for major renovations or additions:

They can’t find a house to move into, so they’ve basically decided to make their homes work long term.

Understatement of Housing Inflation Exceeds “Bubble” Levels

The following report is from Joe Carson, former chief economist of AllianceBernstein:

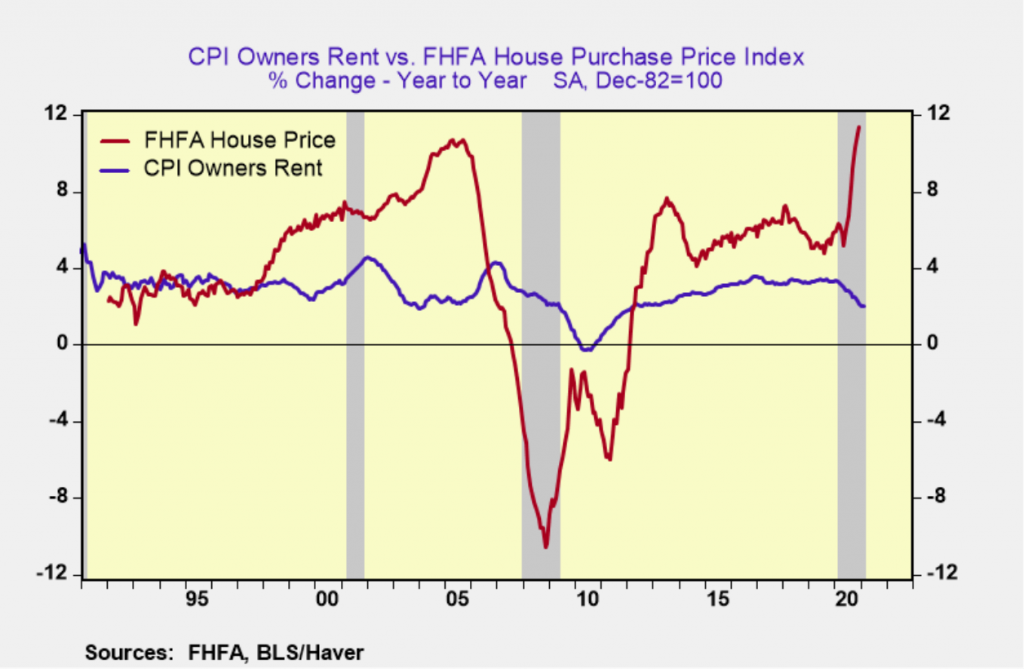

The understatement of housing inflation in the consumer price index has reached a new milestone. As reported, the gap between the actual change in house prices and owners’ rent, published by the Bureau of Labor Statistics (BLS), exceeds the “bubble” levels.

In February, BLS reported owner’s rent increased 2% over the last 12 months. House price inflation, as reported by the Federal Housing Finance Agency (FHFA), increased 11.4%. That gap over 900 basis points exceeds the 800 basis point gap recorded during the housing bubble peak.

The consumer price index was created and designed to measure prices paid for purchases of specific goods and services by consumers. The CPI was often referred to as a buyers’ index since it only measured prices “paid” by consumers.

The CPI has lost that designation. It is no longer measures actual prices. For the past two decades, BLS imputes the owners’ rent series, using data from the rental market, no longer using price data from the larger single-family market.

Imputing prices for the cost of housing services make the CPI a hybrid index or a cross between a price index and a cost of living index. A hybrid index is not appropriate as a gauge to ascertain price stability, especially when the hypothetical measure of owner’s rent accounts for 30% of the core CPI.

The CPI missed the price “bubble” of the mid-2000s, and the economic and financial fallout was historic. History sometimes repeats itself in economics and finance. Policymakers forewarned.

AUTHOR COMMENTARY

By faith Noah, being warned of God of things not seen as yet, moved with fear, prepared an ark to the saving of his house; by the which he condemned the world, and became heir of the righteousness which is by faith.

Hebrews 11:7

All I can say is what I have said before: you MUST be preparing. Get debts paid off. Stock up on useful and practical supplies and goods. Get your health in check and the best shape you can get in.

The masses never learn. They are braying donkeys that do not know or understand what is going on. These people, by the innumerable millions, are going to get crushed. If you thought it is bad now, you and I have seen nothing. We are going to see so much poverty and homelessness. The suicide rate will skyrocket. Crimes and murders will shoot into the stratosphere. The Biden administration with the aid of BOTH Democrats and Republicans will print more money than the brain can register, creating hyper-inflation. These people will be toast. It will be over for them.

Reader, do not be one of these people. I know there are naysayers reading this right now scorning and saying The WinePress is nuts and peddles doom and gloom. On behalf of The WinePress, I am doing the best that I can to warn the masses of impending doom. Get used to it, and accept it, that America is over. I am not saying I am happy about that, but it is reality, and if you are not living it right now, it’s probably already too late for you.

The way of the wicked is as darkness: they know not at what they stumble.

Proverbs 4:19

A whip for the horse, a bridle for the ass, and a rod for the fool’s back.

Proverbs 26:3

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Is it okay for lost people to donate to the WinePress? Does it violate the scriptures? What exactly does Bryan mean when he says that he doesn’t accept money from the lost world because it violates the scriptures? Is there a specific chapter and verse on that?

Here’s Bryan’s study on this issue: https://www.youtube.com/watch?v=XkQb03Z8rHY

The WinePress does not make ad-revenue from groups such as Google. Or if someone I know is a heretic and they are trolling us for whatever reason then I will refund it. But I cannot do “background checks” to see if every donation came from a truly born-again person if that makes sense.

I’m not Bryan or Jacob, but I would observe from scripture and experience that lost folks give money trying to show their own righteousness or to buy it, & without understanding or knowledge of God & his ways. Some of them do it consciously trying to corrupt & influence to ‘prove’ their righteousness & supposed superiority, and/or as the occulted corporate powers do whether they call it capitalist socialism (fascism) or socialism/communism for Mammon….like a seducing woman, a prostitute, or a thief.

–

It is wrong to mislead the unknowing lost. And it is unwise to put oneself under the influence or power of those cunning & sophisticated in their sin & manipulations who knowingly serve the god of this world & ‘nature’ rather than the transcendent Creator, Savior and King evidenced by truth, conscience & the scriptures.

–

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

–

2 Corinthians 6:14 Be ye not unequally yoked together with unbelievers: for what fellowship hath righteousness with unrighteousness? and what communion hath light with darkness?

–

1 Corinthians 6:12 All things are lawful unto me, but all things are not expedient: all things are lawful for me, but I will not be brought under the power of any.

I’m not Bryan or Jacob, but I would observe from scripture and experience that lost folks give money trying to show their own righteousness or to buy it, & without understanding or knowledge of God & his ways. Some of them do it consciously trying to corrupt & influence to ‘prove’ their righteousness & supposed superiority, and/or as the occulted corporate powers do whether they call it capitalist socialism (fascism) or socialism/communism for Mammon….like a seducing woman, a prostitute, or a thief.

–

It is wrong to mislead the unknowing lost. And it is unwise to put oneself under the influence or power of those cunning & sophisticated in their sin & manipulations who knowingly serve the god of this world & ‘nature’ rather than the transcendent Creator, Savior and King evidenced by truth, conscience & the scriptures.

–

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

–

2 Corinthians 6:14 Be ye not unequally yoked together with unbelievers: for what fellowship hath righteousness with unrighteousness? and what communion hath light with darkness?

–

1 Corinthians 6:12 All things are lawful unto me, but all things are not expedient: all things are lawful for me, but I will not be brought under the power of any.

Yes, we are seeing history repeating itself.

Concerning Bryan Denlinger’s video called Pain, Pleasure, & Punishment (I recommend that you watch it), I took note of the following (I already did prior to the video being made):

WW1 -> Spanish Flu of 1918 -> Roaring 1920’s -> Great Depression 1930’s (started after Stock Market crash) (20th Century)

“War” on terror -> COVID-19 Plandemic -> Roaring 2020’s (I call it Roaring 20’s 2.0) -> Great Depression 2030’s (I call it The Great Depression 2.0) (21st century)

I can see a pattern here. I am slowly waking up, even though I have my own struggles.