UPDATE: 2/4: Bank closures and layoffs continue to grow.

Reuters reports that the Chief Executive of Commerzbank, Manfred Knof, finalized the plans yesterday to cut 10,000 jobs and closes hundreds of branches.

The bank posted a 2.9 billon Euros ($3.5 billion) loss for 2020. Commerzbank recorded a profit 585 million Euros in 2019.

Knof stated that these cuts were necessary and considered it a “bitter pill.” One labor representative called it “simply crazy.”

They will slash their 790 branches to 450 by 2024.

The report says that big shareholders such as the German government and the U.S. Private equity company Cerberus support the effort.

It is also reported that Deutsche Bank is shedding employees, and other underpaid call-center employees have gone on strike.

AUTHOR COMMENTARY

I encourage you to read the initial report and additional commentary if you have not already.

It is happening all over the world: the banks are in trouble. They are losing massive sums and will not stop in the foreseeable future. Do not rely on these places to safekeep your money.

Today it was announced that TD Banks is shutting down 81 branches across 15 states, such as Florida, Pennsylvania, and Maine.

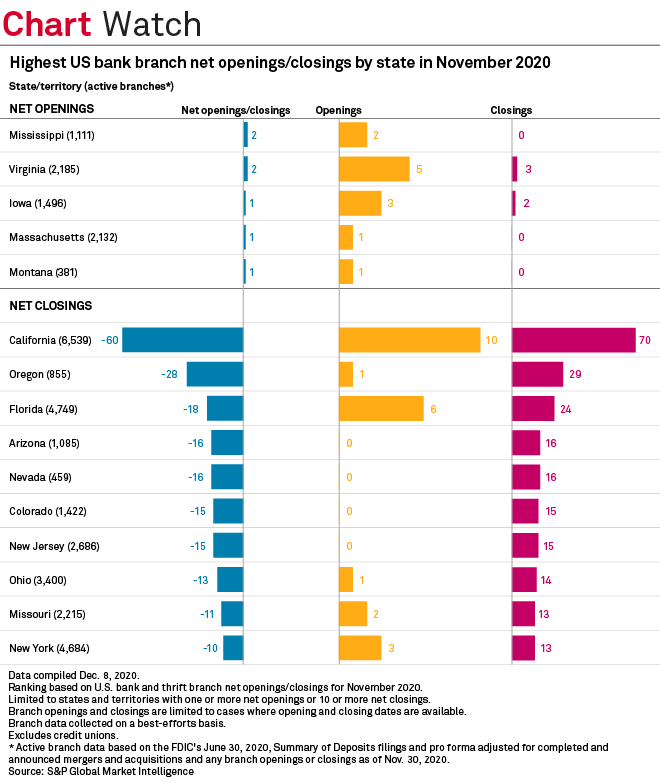

The Minneapolis/St. Paul Business Journal reports that U.S. Bancorp closed 144 branches in November. This is the most of the “big banks.”

It is also reported that Wells Fargo shutdown 91, J.P. Morgan Chase & Co. closed 32, as did PNC Financial Services Group Inc., and South State Corp. with 19. These are all within November of last year.

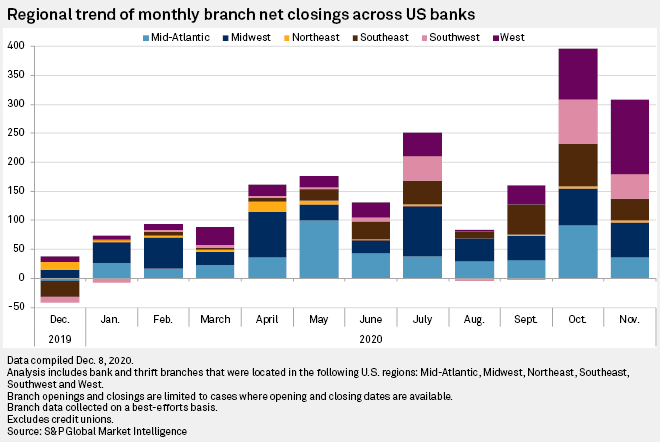

S&P Global reported in mid-December that U.S. Banks and thrifts have closed 2,993 banks over a 12 month period.

The Philadelphia Enquirer points out that many of these closures also have to do with the exponential growth in online banking on phone and computer, more so than ever before because of lockdowns and employees being forced to work remotely. This is the reported main reason why TD Banks’ branches are closing. This then leaves the issue with lot and property vacancies.

The U.K. is also seeing a large number of bank closures. According to Which?, 3,836 branches since January 2015 have closed up. This is at a rate of 55 banks a month.

But it is not just brick and mortar branches that are shutting their doors, but online banking apps too.

Several weeks ago it was announced that popular online banking service Simple will no longer be operating. Accounts will be transferred to its parent holder, BBVA. Many users were shocked and disappointed at this move.

AUTHOR COMMENTARY

If you have your money in a bank, PULL IT OUT. There are no incentives to keep it there. These banks take your money and waste it on useless investments and loans. Banks are designed to make money, and in order to make their money, they gamble with yours.

For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.

1 Timothy 6:10

[1] There is an evil which I have seen under the sun, and it is common among men: [2] A man to whom God hath given riches, wealth, and honour, so that he wanteth nothing for his soul of all that he desireth, yet God giveth him not power to eat thereof, but a stranger eateth it: this is vanity, and it is an evil disease.Ecclesiastes 6:1-2

Obviously keep the necessary amount in the bank for online purchasing and for paying bills, but do not keep a ton of it in there. All it takes is another major trigger event to cause a bank run.

Let this report be a warning sign as to keep your money out of the banks. Prior to the lockdowns in 2020, I was already skeptical of keeping my savings in the bank, but when the country went into panic mode over media hysteria, I pulled all my savings out.

I have been hearing many reports from individuals that their local banks are closing their doors left and right, or they are doing some kind of “restructuring” for a length of time. The banks in my area I use are increasing their minimum account balances; and if the account is lower than the minimum by the end of the month, a small charge is made to the account. These places are hemorrhaging cash.

And you also have to take into consideration the effects this has on landlords. The commercial real estate market was already seeing pressure prior to 2020, but once the lockdowns began, that sector has been getting lacerated. So as more banks shutdown, this means more vacant building that will rot and decay as many businesses and companies will not buy them up – unless it is private equity firms, and other mega corporations.

And on top of all that, even more job losses as more and more banks follow the digital trend – which is all by design.

What about you? What are you seeing in your area? Let us know by posting in the comments down below or email us at winepressnews@aol.com.

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Concerning this Article on Bank Closures; I have called USBank National 1800 number my Bank for 15 years and so far to my knowledge USBank is still Open for Business. However, this does not fit well with this Articles Background Wallpaper showing a USBank location! Now some remote locations such as locations in Grocery Stores have been removed closed & that happened here in Louisville KY since the February 2021 that is true. This is very concerning since USBank Main Branches have resorted to an automated system during this unfortunate plandemic. Hope this is helpful to understand possible misleading information.

[…] Warning: Banks Are Shutting Down And Closing Up … […]

What’s going on with Bank of America, the LARGEST banking firm in the United States? Many of us who work for Walmart are living paycheck to paycheck and cannot afford a disruption.