This is down from 2020 which was 41%.

38% said they would need to borrow money or use a credit care from family and friends in order to cover a $1000 emergency fund.

The precarious state of Americans’ emergency savings has been further set back by the pandemic, with nearly as many needing to borrow to cover a $1,000 unplanned expense as those that can pay for it from savings.

Greg McBride. Chief Financial Analyst of Bankrate.com

The report shows that many have had the ability to stockpile some savings because of staying at home more often, because of working from home, and limiting travel and entertainment expenses.

On the other hand, many millions are struggling just to simply survive, due to job losses and pay cuts.

The report continues by saying “Older people are more likely to be able to pay for an unexpected expense, with only a third of Millennials (aged 24-39) able to afford it. That’s compared with 46% of Gen Xers (aged 40-55) and 45% of Baby Boomers (aged 56-74).”

21% of Americans earning less than $30,000 a year can cover emergency costs with additional savings. 58% of those earning $75,000 or more per year have the available funds.

However, the report also finds that 44% are optimistic that things will get better, and that their financial slump will improve this year. 40% say it will stay relatively close to the same if not unchanged. 14% say it will get worse.

Older Americans, ages 66 and above, believe this year will be a better financial year – which shows less optimisim among elders; compared to the 53% of Millennials who believe their finances will improve in 2021.

Widespread vaccine availability brings the hope of normalcy we’ve all been craving, and optimism that this year will be better for our finances. For many households, 2021 will be a year of trying to right the financial ship.

Greg McBride

AUTHOR COMMENTARY

Some “v-shaped” recovery we got going, right? I am being sarcastic of course. If you have not come to the realization, by now, that the economy is in ruins, then you are just naïve and willingly ignorant of the truth, and are on a guaranteed path of ruination – as you are probably the 44% that think things will be getting better.

It will get better for some, and the “some” are the “haves” versus the “have-nots” of this new two-tiered, fascist system that has been allowed to come in. If these people who are optimistic of a better financial year thought 2020 was bad, they have seen nothing yet. But they will be sold an illusion by the TV screen. And as long as the government keeps printing money as if it grows on trees, and the stock market keeps hitting record highs, then people will think everything is getting better.

In the grand scheme of things, $1000 is not much money at all. And yet almost 2 out of every 5 persons does not have a small $1000 safety net.

Ask yourself, If it were not for credit cards, what would people doing right now?”

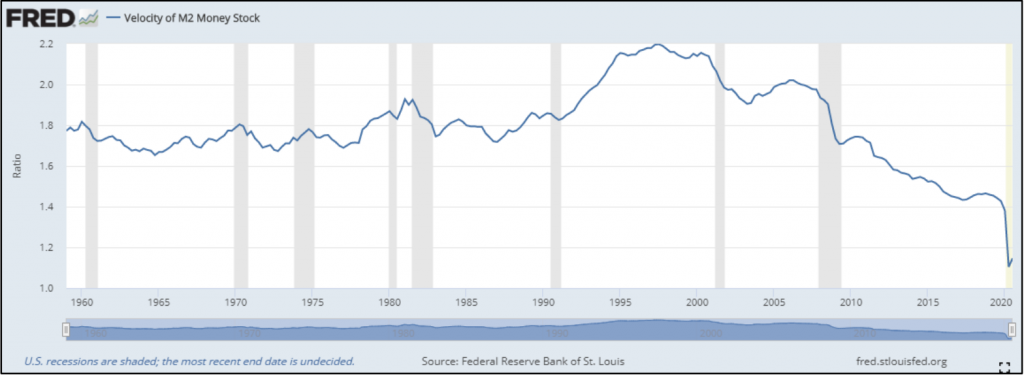

The WinePress reported in our article “Is There A V-shaped Recovery,” that money velocity continually is nose-diving. This is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money.

The graph tells the story.

The rich man’s wealth is his strong city: the destruction of the poor is their poverty.

Proverbs 10:15

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.