American household debt has continually grown for a long time now, and 2020 is no different.

The following information comes from The Ascent, a service provided by the Motley Fool, which provides unbiased information of daily personal financial decisions.

This article will list some of the highlights of the household debt in America. This information was published on November 18, 2020.

Key Findings

| Figure | Amount |

|---|---|

| Total household debt, Q3 2020 | $14.35 trillion |

| Average (mean) household debt, Nov. 2020 | $145,000* |

| Total credit card debt, Q3 2020 | $807 billion |

| Average (mean) revolving credit card debt, 2019 | $6,271 |

| Total mortgage debt, Q3 2020 | $9.86 trillion |

| Average mortgage debt, Oct. 2020 | $215,655 |

| Average (mean) mortgage payment, 2019 | $1,487 |

| Total home equity revolving debt, Q3 2020 | $362 billion |

| Average (mean) HELOC value, 2019 | $49,929 |

| Total auto loan debt, Q3 2020 | $1.36 trillion |

| Average (mean) auto loan debt, 2019 | $17,553 |

| Average monthly new car payment, Q2 2020 | $568 |

| Average monthly used car payment, Q2 2020 | $397 |

| Average new unsecured personal loan amount, Sept. 2020 | $5,538 |

The report goes on to break down how Covid affected their personal finances. They mention the spike in unemployment that occurred this year, but report that it has gone down drastically to 6.9% at the time of that posting. However, The WinePress has documented these unemployment numbers are highly inaccurate.

In March, their survey of Americans report that at that time, 60% of Americans were “somewhat” or “very” worried about their finances.

In June, surveys showed that those hit the hardest of income loss were women, low-income earners, and and non-white workers.

One-third of Americans who had lost income said they could go less than a month without the extra $600 in unemployment provided by the CARES Act. Respondents were preparing to cut their expenses, get side jobs, file for unemployment, and borrow more money.

Nearly half of those that reported a loss in income would take at least 6 months to recover.

The data they have gathered shows increases in personal and auto loans in hardship, including deferred payments and forbearance programs. In contrast, personal bankruptcies, credit card delinquencies, and mortgage foreclosures have decreased. This suggests that Americans are using assistance programs and raises questions about what will happen when those programs expire.

Consumer Debt

In Q3 total consumer debt stands at $14.35 trillion, as reported by The New York Fed’s quarterly Household Debt and Credit Survey (HHDC). This is a record for the HHDC.

Total debt has increased since 2019. Ascent estimates household debt in 2020 to be around $145,000 and the median approximately $67,000.

Debt Payments

The St. Louis Federal Reserve tracks the nation’s household debt payments as a percentage of household income. The most recent number, from the second quarter of 2020, is 8.69%.

That means the average American spends less than 9% of their monthly income on debt payments. That’s a big drop from 9.69% in Q2 2019. This drop could be related to debt relief programs and other allowances made for coronavirus-related income loss — though it could also indicate that consumers have paid off their high-interest debts.

Credit Card Debt

Americans owe $807 billion as of Q3 in 2020, according to Household Debt and Credit surveys from the New York Fed. This is down from $881 billion in Q3 2019 and $817 billion in the second quarter of 2020.

This indicates that some Americans are holding onto their cards more so than before politicians and the media hyped up the covid fear.

However, that is not necessarily a good thing according to Melinda Opperman, president of Credit.org

Consumers tightened their belts in 2020, leading them to carry less revolving debt and focus on paying their credit card bills on time every month. Consumers tightened their belts in 2020, leading them to carry less revolving debt and focus on paying their credit card bills on time every month.

According to Experian’s Oct. 20 report, Americans have an average of $5,897 in credit card debt spread over three cards. Americans also have 2.4 store credit cards, on average, with a total balance of $2,044.

Revolving Credit Card Debt

A revolving credit card balance is one that persists between payments – in other words, it’s what people pay interest on. It’s one of the most important figures when looking at credit card debt.

The latest figures reported on revolving credit card balances come from the 2019 SCF, which took place before COVID-19 threw our finances into a tailspin. But at the end of last year, the average (mean) revolving balance for cardholders who had a revolving balance was $6,271.

As we know, outliers can skew means, so we also report medians where we can. The median amount of revolving credit card balances in 2019 was $2,700. So some cardholders out there are revolving a lot more than $6,200.

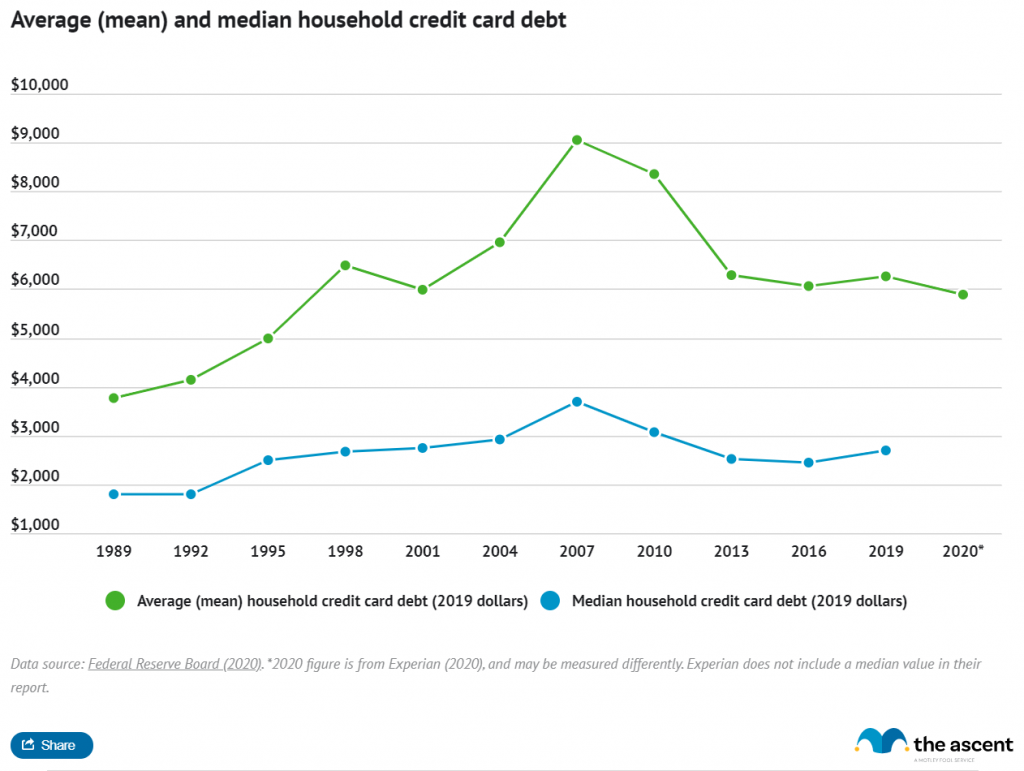

Here’s how the mean and median revolving credit card debt have changed over time:

Delinquent Credit Card Payments

The Q2, the delinquency rate of credit card loans from commercial banks was 2.42%.

Ascent notes that this is the lowest since 2017, but is more than likely do to credit card providers and banks letting borrowers postpone their payments and otherwise avoid delinquency. The number may go up, but we will not know until Q3 numbers have been released.

Average Mortgage And HELOC Debt In 2020

| Figure | Amount |

|---|---|

| Total mortgage debt, Q3 2020 | $9.86 trillion |

| Average mortgage debt, Oct. 2020 | $215,655 |

| Average (mean) mortgage payment, 2019 | $1,487 |

| Average (median) mortgage payment, 2019 | $1,200 |

| Average mortgage rate, Nov. 5, 2020 | 2.78% |

| Total home equity revolving debt, Q2 2020 | $362 billion |

| Average (mean) HELOC value, (2019) | $49,929 |

Mortgage debt makes up the bulk of the consumer debt in America at 69%.

According to Experian, in 2019 the average debt was $213,599.

2020 was a record year for mortgage rates, with the average 30-year fixed rate at 2.78% on Nov. 5. That’s the lowest it’s been since the St. Louis Fed started compiling this data in 1971.

Average Auto Loan Debt In 2020

| Figure | Amount | |

|---|---|---|

| Total auto loan debt, Q3 2020 | $1.36 trillion | |

| Average (mean) auto loan debt, 2019 | $17,553 | |

| Average (median) auto loan debt, 2019 | $13,000 | |

| Average monthly new car payment, Q2 2020 | $568 | |

| Average monthly used car payment. Q2 2020 | $397 |

Auto loan debt has been creeping up over the past several years, though we saw a slight dip in Q2 2020. Q3’s $1.36 trillion is slightly higher than the $1.34 trillion total in Q2 and the $1.32 trillion in auto loan debt than we saw in Q3 2019.

TransUnion says that a loan is in hardship if the borrower has a deferred payment, forbearance program, frozen account, or frozen past due payment.

The credit bureau’s monthly industry snapshot from September 2020 showed that 3.789% of auto loans were in financial hardship status. A year earlier, only 0.538% of auto loans were in hardship. That’s an increase of 605%.

It seems quite likely that financial difficulties caused by the coronavirus and its attendant income loss have played a part in this change.

Personal Loan Debt

In 2020 the unsecured personal loan amount was $5,538, down from $6,096 in September 2019, According to TransUnion’s September Monthly Industry Snapshot.

TransUnion says that a loan is in hardship if the borrower has a deferred payment, forbearance program, frozen account, or frozen past due payment.

In September 2020, 4.377% of unsecured personal loans were in hardship. In September 2019, 0.260% of personal loans had the same status. That’s an increase of 1,580%.

This again can more than likely be attributed to the economic instability and uncertainty brought upon by corrupt media and politicians.

Bankruptcies, Delinquencies, Charge-offs, And Foreclosures

By the end of September there were 420,048 declarations of bankruptcy, According to the American Bankruptcy Institute.

As large of a number as that is, interestingly enough, that is a 28% decrease from a similar time in 2019. Ascent does note, however, this largely due in part to organizations and government programs aiding household and businesses from going into bankruptcy and foreclosure. They remind everyone that the effects and repercussions will become far more evident in 2021 as these programs end.

The top 10 states that saw year-to-date (YTD) personal bankruptcy filings per capita at the end of September were Alabama, Delaware, Tennessee, Mississippi, Nevada, Georgia, Utah, Indiana, Kentucky, Arkansas.

As for foreclosures, they were way down this year, but that is because of eviction moratoriums.

The moratoria on evictions and foreclosures easily explain why foreclosure rates are down, and they also create some dread for 2021. Every expert expects a sharp rise in eviction rates and foreclosures next year.

Melinda Opperman. Credit.org

AUTHOR COMMENTARY

This only but a glimpse into the insane asylum that is our economy – which based off this particular data sheet, is not even the full picture because some categories have not released the statistics for 2020. But even based off what has been presented here, no way, no how, is there any semblance of a “v-shaped” recovery.

[26] Be not thou one of them that strike hands, or of them that are sureties for debts [27] If thou hast nothing to pay, why should he take away thy bed from under thee?Proverbs 22:26-27

Owe no man any thing, but to love one another: for he that loveth another hath fulfilled the law.

Romans 13:8

The current national debt of $27,546,130,000 has eclipsed the national GDP of $21,368,030,000. The U.S. total debt is currently $82,053,685,000,000.

In 2019 it was reported 40% of Americans don’t have $400 in the bank for emergency expenses according to the Federal Reserve. That is staggering! So when the politicians began to shutdown everything and prevented millions from going to work, and chained them up with ridiculous regulations afterwards, people were forcibly coerced into relying on the government to save them.

We all need to be preparing for what is coming. 2021 is not going to be getting better. I know this does not sound positive at all, but we, that includes me, must prepare ourselves. Continue to rely on the Lord and he will provide in times of need.

By faith Noah, being warned of God of things not seen as yet, moved with fear, prepared an ark to the saving of his house; by the which he condemned the world, and became heir of the righteousness which is by faith.

Hebrews 11:7

[5] Let your conversation be without covetousness; and be content with such things as ye have: for he hath said, I will never leave thee, nor forsake thee. [6] So that we may boldly say, The Lord is my helper, and I will not fear what man shall do unto me.Hebrews 13:5-6

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.